Canadian mining company Noront Resources has signed an arrangement agreement to be acquired by Wyloo Metals, for $0.850 (C$1.10) per share.

Currently, Wyloo Metals owns a 37.25% stake of the Noront common shares.

As per the arrangement agreement, Noront shareholders may elect to sell all or a portion of their common shares to receive cash consideration from Wyloo Metals.

In case less than 10% of the outstanding common shares of Noront are not subject to a sale election, Wyloo Metals will have the option to buy all of the remaining Noront common shares.

The deal, which values Noront at $478.11m (C$616.9m), gives five business days to BHP to match the Wyloo’s offer which was made earlier this month.

However, BHP subsidiary BHP Lonsdale Investments’ announced its decision not to increase or extend its offer for Noront Resources.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBHP chief development officer Johan van Jaarsveld said: “BHP is committed to its strict capital discipline framework. While the Eagle’s Nest deposit is a promising resource, we do not see adequate long-term value for BHP shareholders to support an increase in BHP’s offer in order to match the C$1.10 per share proposal from Wyloo Metals Pty Ltd.”

Wyloo and BHP have been competing to acquire the nickel producer amid surging demand for the battery metal, which is used in electric vehicles (EVs).

In October, BHP increased its all-cash takeover offer to Noront from $0.44 (C$0.55) to $0.60 (C$0.75) per share. This surpassed Wyloo’s offer of $0.56 (C$0.70) per share made in the same month.

Noront Resources is engaged in developing Eagle’s Nest nickel, copper, platinum, palladium and chromite deposits, including Black Thor, Blackbird, and Big Daddy.

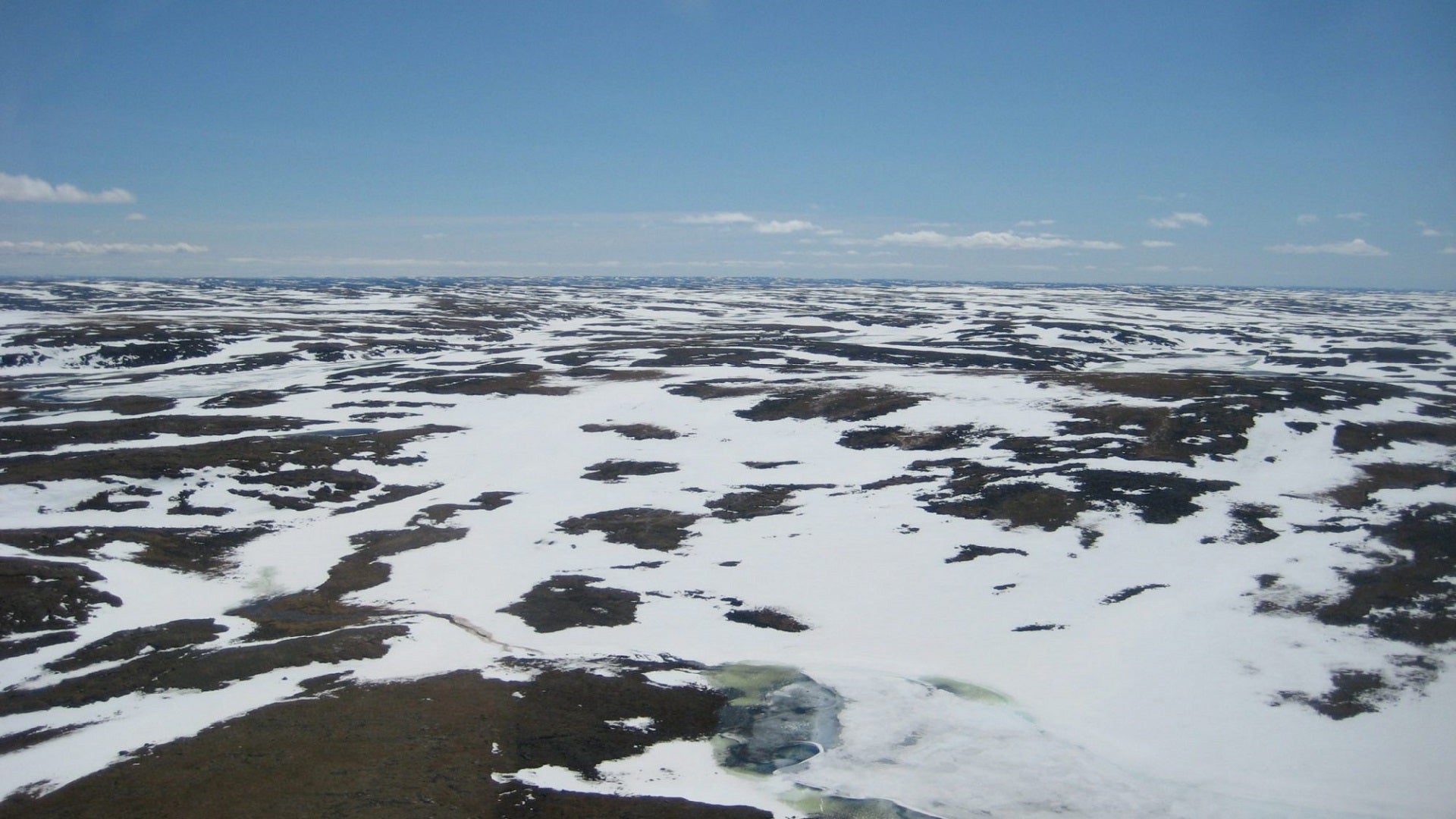

The assets are located in Ontario’s James Bay Lowlands in The Ring of Fire, an emerging metals camp.