Robotics is a fast-growing industry. According to GlobalData forecasts, it was worth $45bn in 2020, and by 2030, it will have grown at a compound annual growth rate (CAGR) of 29% to $568bn.

In a recent report on robotics, GlobalData researchers expect every segment of the robotics market to grow over the next decade. Industrial robots will function as a growth driver and innovation in the segment will spill over to other areas.

Today’s robots exist to fill the same role that automata have filled for the last 5,000 years: That is, for entertainment or to replace humans in repetitive or strenuous tasks. Industrial robots fall into the latter category. Service robots include machines built to help humans with work or chores at home and robots designed to entertain.

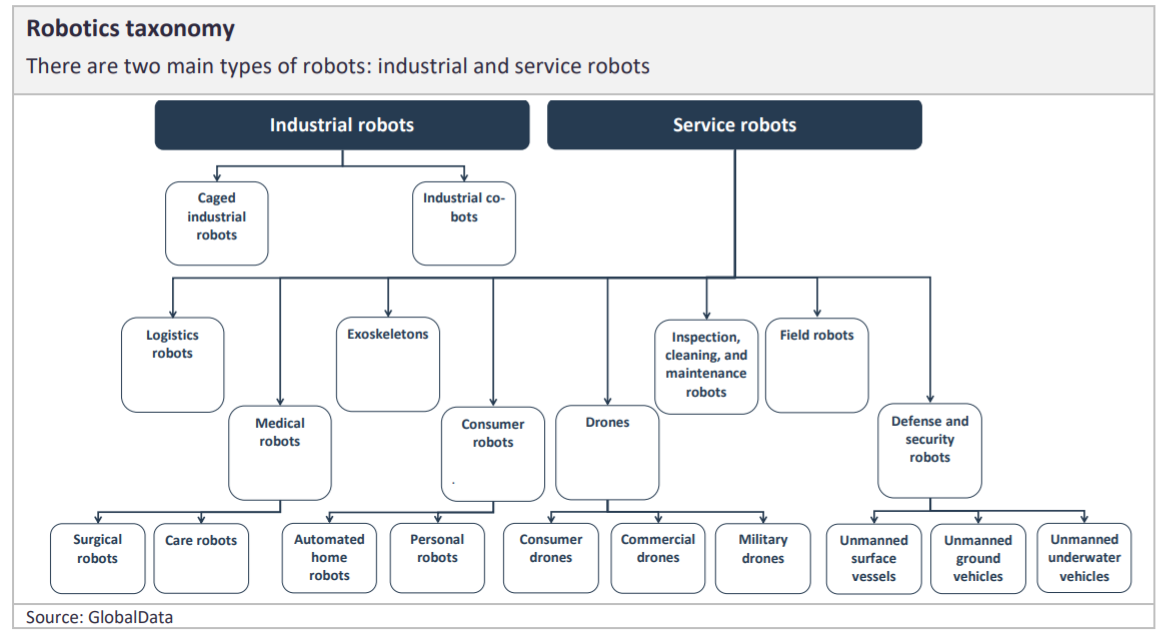

Industrial and service robots are the two main categories within robotics. The former kind are typically used in factories to automate parts of the manufacturing process and can be split into two sub-categories, caged industrial robots and cobots.

Service robots meanwhile assist humans at work in non-industrial settings or in the home. They can be split into eight main subcategories: logistics, medical, consumer, field, defense and security, inspection, cleaning and maintenance robots, exoskeletons and drones.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe robotics industry value chain

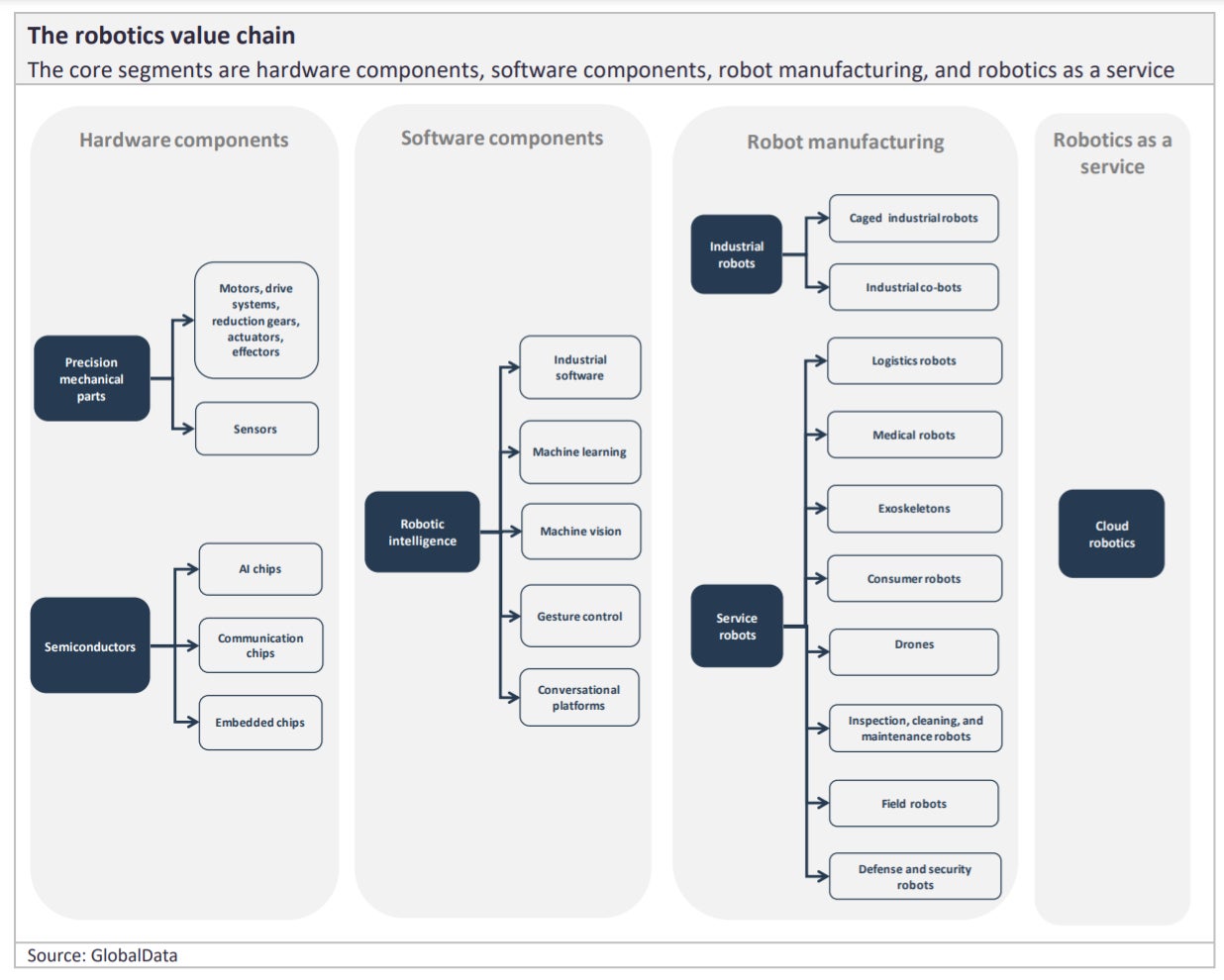

Building a robot is a highly complex task that involves an extensive supply chain. The core segments are hardware components, software components, robot manufacturing and robotics as a service.

Robotics orders from electronics, machinery, plastic, chemical products, and food processing companies have increased. The widening of the robotics market will favour all stakeholders as it is likely to lead to more innovation.

Diversification also makes all players involved in the robotics value chain more resilient, as they become less dependent on a single industry. Find out more in the full Robotics report from GlobalData here