The creditors of Brazilian mining joint venture (JV) Samarco Mineracao have dismissed the debt restructuring proposal by the firm, reported Reuters.

Even though the proposal was supported by smaller creditors in various classes, it was turned down by representatives of 99.3% of unsecured credits.

Creditors said that the proposal underestimated the production capacity of Samarco and they also came up with the proposal of having mining executive Tito Martins spearhead the firm and drive it ‘back to growth’.

According to the country’s legislation, creditors will now have to come up with an alternative plan.

Samarco is jointly owned by Vale and BHP Billiton, both of whom have urged for being allowed to participate in voting on the creditors’ proposal.

See Also:

The bankruptcy court is still undecided on the issue.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to the news agency, Samarco also said creditors must weigh the interests of all stakeholders and ‘should not look only for financial return that cannot be supported by the company’.

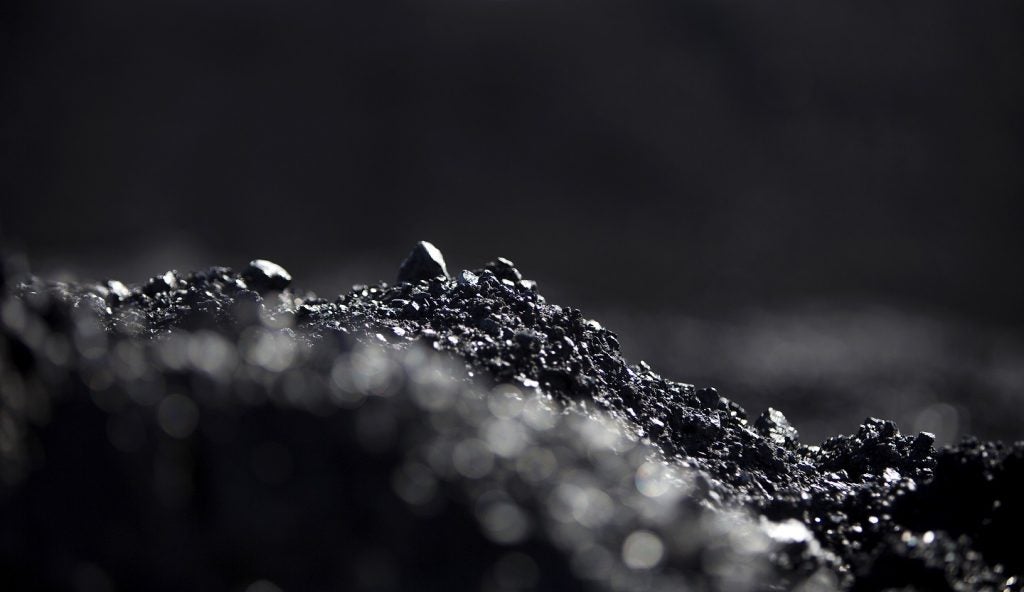

The bankrupt miner was weighed down with borrowings after a 2015 dam collapse at the Samarco mine in Minas Gerais, in what is said to be Brazil’s worst-ever environmental disaster.

The incident claimed the lives of 19 people and released toxic waste into the Doce River, which flowed into the Atlantic Ocean. Thousands were left homeless as a result, with the livelihoods of people focused on the river destroyed.

Samarco filed for bankruptcy protection in April last year.

In February, the company offered a new debt restructuring proposal that called for an inflation-linked bond with a debt-for-equity swap or a 75% haircut, maturing in 2041.