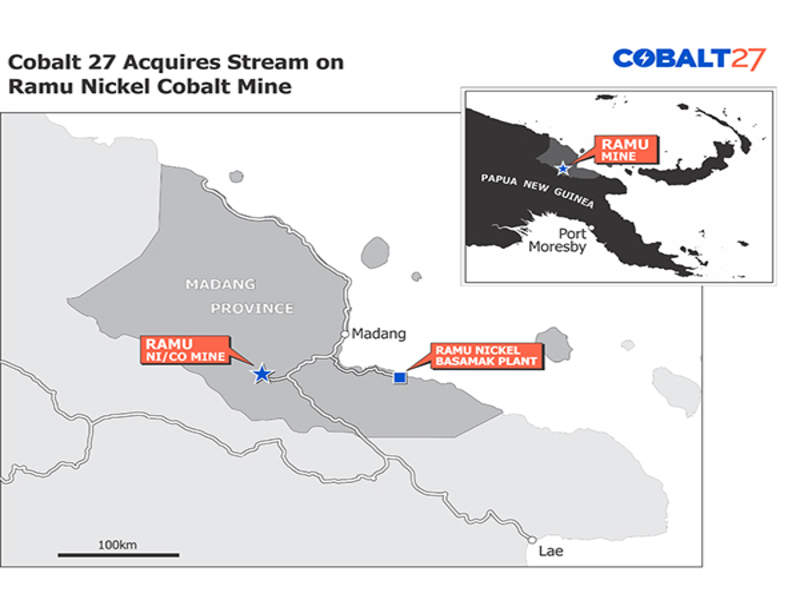

Highlands Pacific and Canadian battery metals company Cobalt 27 Capital have entered into a streaming arrangement in connection with the $2.1bn Ramu nickel cobalt mine in Papua New Guinea.

In operation for more than five years, the project comprises a nickel laterite mine at Kurumbukari, where the project has a deposit containing a JORC resource of 124 million tonnes of ore at 1% nickel and 0.1% cobalt.

Last year, the mine produced 34,666t of nickel and 3,308t of cobalt in concentrate.

Under the streaming agreement, Highlands will receive $113m upfront as payment from Cobalt 27’s subsidiary, Electric Metals Streaming, which will secure 55% of Highlands’ share of cobalt production and 27.5% of Highlands’ share of nickel production from the mine.

Additionally, Electric Metals is required to make ongoing volume-based payments of $1/lb of nickel and $4/lb of cobalt.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHighlands holds an 8.56% interest in the Ramu project, while the remaining interest is owned by a subsidiary of the Metallurgical Corporation of China (MCC), with 85%, and the PNG Mineral Resources Development Company (MRDC), with 6.44%.

The company will use the deposit received from Electric Metals to fully repay loans taken from the MCC for the construction and operation of the mine.

Once the loans are repaid, Highlands’ interest in the Ramu project will increase to 11.3%.

Highlands retains the right to acquire up to a 13.27% interest in the cobalt nickel stream from Cobalt 27 for around $15m.

Highlands Pacific managing director Craig Lennon said: “Highlands will emerge from this deal in a much stronger financial position, debt free with enhanced access to cashflows from the Ramu mine.

“The repayment of Ramu project loans allows Highlands to increase its ownership interest in the Ramu nickel cobalt mine over five years earlier than expected and will result in an immediate substantial increase in the project cashflows released to Highlands.”

Cobalt 27 will own 142.5 million shares in Highlands in exchange for an investment of A$15m ($11.37m) through a private placement, equal to 13.04% of the total shares.