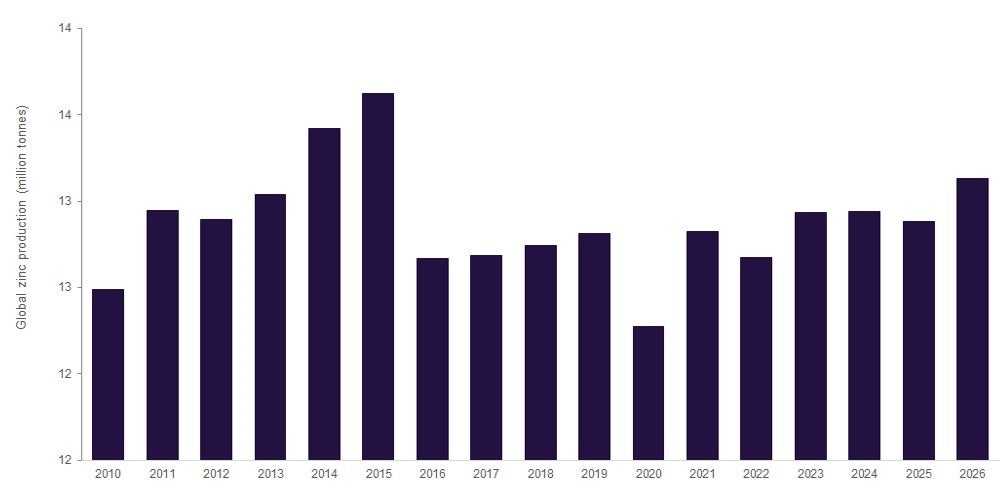

After recovering from Covid-19 in 2021, global zinc production declined by 1.2% to 12.8 million tonnes (mt) in 2022. Combined output from Peru and Australia fell from 2.8mt in 2021 to 2.7mt in 2022 while there were declines in Canada (-12.4%), Russia (-4.9%), and China (-0.3%). Increases in production from the US, Mexico, and India helped offset these declines, with total production rising from 2.2mt in 2021 to 2.3mt in 2022. Fresh Covid-19 restrictions, particularly in China, along with supply issues and a bleak economic outlook caused volatility in the zinc market for the majority of 2022.

Peru, the world’s second-largest zinc producer after China, produced 1.5mt of zinc in 2022, down by 4.8% over 2021, owing to conflicts between mining companies and the local communities that have paralysed some of the country’s key operations, including the Yauricocha, Cuajone and Atacocha mines. In addition to the road blockade, a mudslide incident at the Yauricocha mine resulted in the loss of 20 days of full production in the third quarter. Furthermore, grade reduction at Cerro Lindo, as a result of planned mining sequencing, combined with planned mining cessation at the Iscaycruz mine, as it approaches closure in 2024, further disrupted production.

In contrast, countries including Mexico, the US and India performed well during the same period, owing to higher grades and recoveries from mines such as Mexico’s San Rafael, Fresnillo, Juanicipio, and Sabinas, the US’ Red Dog mine and India’s Sindesar Khurd, Rajpura Dariba, Zawar and Kayad. Furthermore, the commissioning of Mexico’s Camino Rojo project in April 2022 aided in improved production.

Global zinc production is expected to recover in 2023, up by 2.0% over 2022. India, China, Mexico, and Brazil, among others, will contribute to this expansion. The planned commissioning of Mexico’s Buenavista Zinc project and Brazil’s Aripuana Zinc project in 2023, with a combined annual production capacity of 161.6 kilotonnes (kt), will support production growth. The former project, which is majority owned by Grupo Mexico, has completed its engineering study and is currently under construction. The project will cost $413m and is expected to double the company’s zinc production capacity, once commenced.

Looking ahead, over the forecast period (2023–2026), global zinc production is expected to remain relatively flat at a compound annual growth rate (CAGR) of 0.5%, to reach 13.1mt by 2026. The limited growth is primarily due to declining production from China, followed by Kazakhstan, Peru and Bolivia.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData