The Democratic Republic of Congo (DRC) and Rwanda have been at odds for close to three decades. Stemmed by divisions between the Tutsi and Hutu ethnic groups, the 1994 Rwandan Genocide, where between 500,000 and 800,000 Tutsis were killed, remains at the forefront for international leaders. In an attempt both to cool the escalating conflict and to profit from war, the Trump administration has suggested a peace proposal centring on a US-backed critical minerals deal, similar in scope to that seen in Ukraine.

The critical mineral situation in the DRC

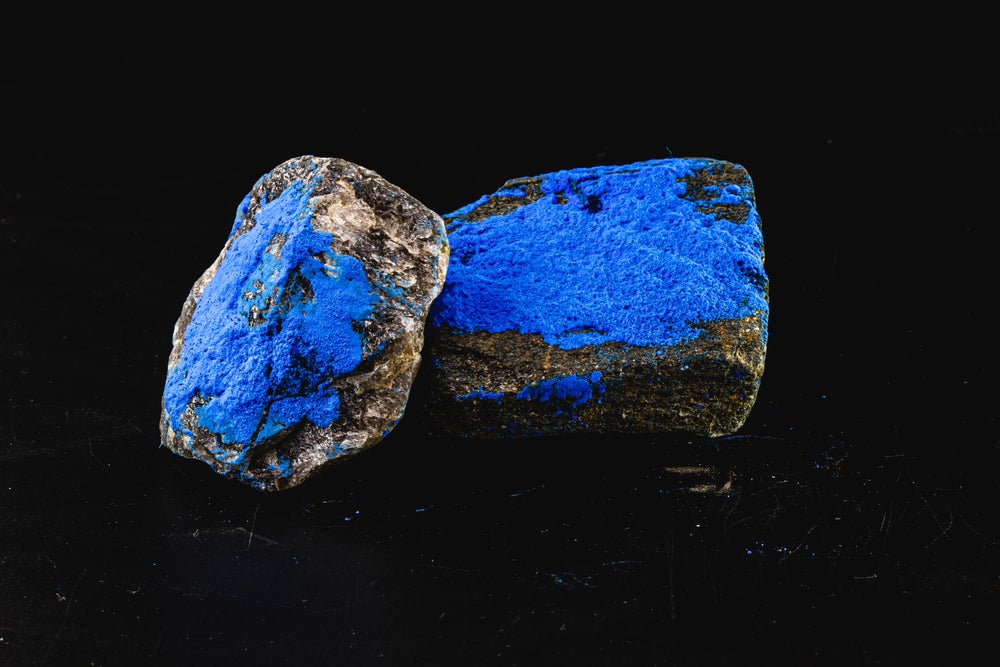

Cobalt production is dominated by the DRC, as the country produces 76% of the world’s cobalt and is forecasted to produce 73% of the world’s cobalt in 2030. Used in electric vehicle batteries and many electronics, the DRC has a monopoly on cobalt production despite controversial mining practices and labour conditions. The DRC also produces 11% of the world’s copper, and the area has reserves of tantalum, niobium, tin, and tungsten.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The DRC sits on $24trn in mineral resources, although most of it is controlled by Chinese investors. Can a minerals-for-security and a minerals-for-infrastructure deal (similar to the one signed between China and the DRC in 2007) between the US and the DRC work to extract these goods? Any deal would have to come with security guarantees, something that the Trump administration has been hesitant to dish out.

The region has always been tense

Central Sub-Saharan Africa has always been plagued by conflict, colonialism, and needless slaughter. After the Rwandan Genocide in 1994, the First Congo War began, and since then, between 200,000 and six million people have died in the region, depending on which source you use. Reprisals for the genocide were carried out in Rwanda shortly after the war, leading to over two million Hutus becoming refugees in neighbouring countries. Both the Rwandan Genocide and subsequent Tutsi reprisals led to the formulation of militias on both sides. Nowadays, more than 100 militias terrorise the region, resulting in a state of unaccountable conflict between non-state actors. Given the Trump administration’s interest in the region, a critical mineral deal may be a way of reducing said tensions, following economic deepening.

Donald Trump: the Art of the Deal

Representatives from Rwanda and the DRC flew to Washington in April 2025 to try and hash out a peace agreement. The talks came with promises of a US critical minerals deal following peace and economic agreements. Any peace agreement would be predicated on respect for the sovereignty of both nations and a refrain in support of non-state groups. Rwanda has historically been accused of supporting the rebel group M23, whereas the Congolese Government has been accused of supporting ideologically aligned militias.

The DRC made the journey to the US after the US and UN called Rwanda out for its support of M23 and illegal mineral mining, allowing the DRC to gain political capital on the international stage. Any deal between the three countries would have to be preceded by bilateral economic agreements between the two sub-Saharan African nations to pave the way for a US mineral or security deal with the DRC.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA point of contention would be the division of funds and minerals from the deal, as one of the likely reasons Rwanda intervened in the DRC was to gain mineral access and control. DRC president Felix Tshisekedi is unlikely to give away such access amid an unpopular spell democratically. A draft peace agreement was sent to the Americans in early May of 2025, although the two countries have yet to finalise anything.

It is also worth noting China’s position in the conflict. The country has loaned hundreds of billions of dollars to the DRC, Zambia, Ghana, and Zimbabwe in an attempt to secure favourable mineral-related concessions. China already controls 80% of Congolese cobalt production because of these loans and its minerals-for-infrastructure deal with the DRC, with most of its mines situated in the relatively peaceful southeastern corner.

From the US and Trump’s perspective, a DRC critical minerals deal is a no-brainer. Trump has always had a transactional view of international relations, and a deal between the DRC, Rwanda, and the US would tick all of his geopolitical boxes. A mineral deal with the DRC would limit Chinese influence in both the region and the critical minerals market, where China currently dominates the processing of rare earth elements (REEs), cobalt, and lithium. A deal would also be a political bragging point for Trump as the US nears the 2026 midterms, due to his need to be the peacemaker.

What will come of this?

On a practical basis, the development of a safe and ethical mineral extraction industry in the DRC will rely on some kind of security guarantee from the US. The two sides have been fighting for three decades, and mines take between ten and 20 years in some cases to go online. A peace agreement based on security guarantees would also only be a starting point, as robust extractive infrastructure would have to be developed in a country where 74% of people live below the poverty line, according to the World Bank.

A long-lasting, secure deal will be incredibly hard to realise in central Africa. While a less deadly conflict, the conflict between Rwanda and the DRC started around the same time as the Ukraine conflict and has exacted a heavy toll. A minerals deal in the Rwanda-DRC area would be as hard, if not harder, to realise than one in Ukraine, considering DRC infrastructure. In addition, considering Chinese control over Congolese cobalt production in the peaceful regions of the country, US investment in the DRC would be in the conflict-riddled east. The deal would also have to traverse complex land access and identity problems that have plagued the area for decades, while not increasing any non-state militia activity. Corporate America is also wary of areas of conflict, as it carries a litany of challenges. Any deal with the US would have to involve significant security guarantees, the kind of which is likely politically unacceptable for Trump.