The Grängesberg mine in Dalarna County, Sweden, was closed in December 1989 due to prevailing market conditions after producing more than 150Mt of iron ore. The mineral deposit at Grängesberg is one of northern Europe’s largest homogenous iron ore bodies.

Anglesey Mining, a UK-based mining company, entered an agreement to acquire a controlling interest in the project in May 2014, including a direct 6% interest in Grängesberg Iron AB (GIAB), a Swedish mining company and the owner of the mine. Anglesey plans to restart mining operations at the project.

The company made a small investment in late 2019 and other investments over the years, enabling it to acquire a direct interest of 20% and management rights to the project with a right of first refusal to increase its interest to 70.2%.

A pre-feasibility study (PFS) on the Grängesberg mine was completed in April 2012. A 25-year mining concession was awarded for the project by the Swedish Mining Inspectorate in May 2013.

An updated PFS was announced in July 2022, which proposed a life of mine (LOM) of 16 years and an estimated investment of $559.6m.

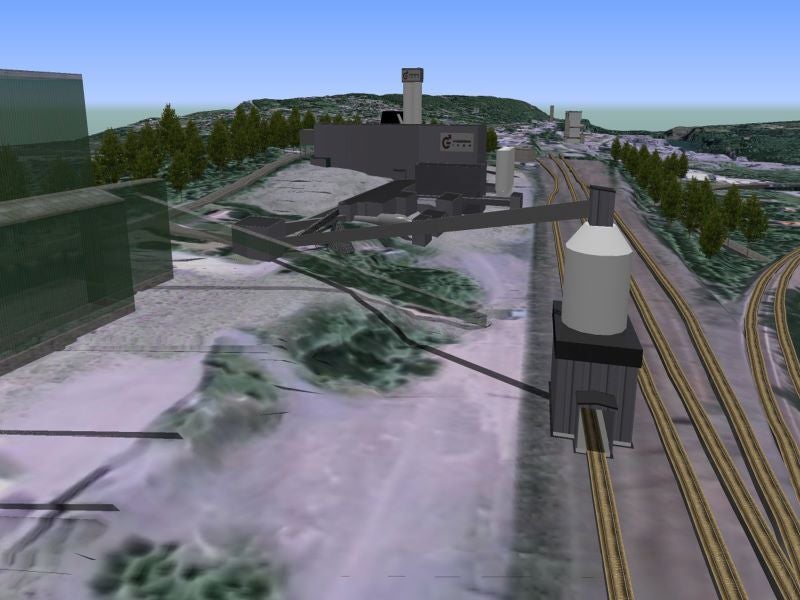

Project location of the Grängesberg mine

The project is located within the Bergslagen mining district, 10km to the southwest of Ludvika in Dalarna County, central Sweden. The site is situated approximately 200km north-west from the capital city of Stockholm.

Mineralisation and reserves of the underground iron ore mine

The mineralisation at Grängesberg occurs in apatite-iron oxide ore containing magnetite (Fe₃O₄) ore with approximately 20% haematite (Fe₂O₃) ore and apatite (Ca₅(PO₄)₃(F,Cl,OH)) ore.

The northern end of the deposit hosts richer haematite mineralisation related to the oxidisation of barren pegmatite sills and dykes. The haematite content decreases with depth, transitioning to pure magnetite.

The probable mineral reserves at the Grängesberg iron ore project are estimated at 82.4Mt grading 37.2% iron (Fe) containing total iron content of 30.7Mt as of July 2022.

Mining methods

The continuation of historic sublevel caving was assumed for the 2012 PFS while the 2022 updated PFS recommended sublevel open stoping with backfilling of mined stopes for future designs.

The run of mine (ROM) ore will be transported to the underground crusher station consisting of an 80m³ feed hopper with a bypass channel, a grizzly feeder to separate oversize material at 900mm and a single toggle jaw crusher. A vibrating feeder will transfer the crushed ore to a conveyor connected to the skip hoist, for further transfer to surface stockpiles.

Processing of the Grängesberg mine

The project will include a concentrator with a processing capacity of 5.3Mtpa of ore at a nominal processing rate of 666tph and 333 days (91%) availability per year. The concentrator building is 150m-long and 40m-wide. It contains various units for grinding, separation, flotation and filtration, in addition to a plant control room, utilities, reagent makeup, and electrical switchgear.

The processing units will comprise a primary crusher, primary autogenous grinding (AG), classification and secondary semi-autogenous grinding (SAG). The crushed ore will undergo magnetic separation, froth flotation and solid/liquid separation. The unthickened tailings will be directly stored in the tailings management facility.

Vibrating feeders will discharge the stockpiled ore to a conveyor belt, which will feed the AG primary grinding mill. A trommel screen will capture pebbles from the AG mill for use as grinding media in the secondary SAG mill. The screen oversize will be recycled back to the AG mill while the undersize will be transferred to the primary wet low-intensity magnetic separators (LIMS).

The primary LIMS stage will upgrade the magnetite iron ore prior to secondary grinding. The non-magnetic slurry containing haematite will be thickened and dewatered. The thickener underflow will be transferred to a primary high-gradient magnetic separation comprising SLon Vertical ring and Pulsating High-Gradient Magnetic Separators (SLon VPHGMS) to upgrade the haematite.

The secondary SAG mill operating in a closed circuit with a hydrocyclone cluster will provide fine magnetite and haematite with a p80 size of 40µm. The hydrocyclone overflow will undergo a second stage of LIMS separators and the non-magnetic slurry containing haematite will be thickened and dewatered. The thickener underflow will be processed in a secondary high-gradient magnetic separation utilising SLon VPHGMS.

Sulphur and phosphate content from the magnetic separation concentrates will be lowered in a reverse flotation circuit. The flotation tailings containing iron ore concentrate will be thickened and dewatered. The thickened underflow will be dewatered in pressure filters to produce filter cake, which will be sent for further processing to a pellet plant to produce iron ore pellets.

Infrastructure at Grängesberg iron ore project

The existing surface infrastructure at the project site includes roads, administrative buildings, workshops, and processing buildings.

Regional power lines and switchgear are located near the Grängesberg mine site and the project envisages to utilise municipal power supply sourced from wind power. Water supply is proposed to be sourced predominantly from recycled mine water through the dewatering process.

The site also includes a main line railway that provides direct access to the Oxelösund port located 250km to the south of the mine.

Contractors involved

Mining consultant Micon International was engaged to prepare the 2022 PFS for the project.

The PFS completed in April 2012 was undertaken by the independent global engineering firm URS Corporation.

AECOM, an infrastructure consulting firm, was involved in preparing the 2012 PFS and conducting geotechnical assessment to determine the mine’s stability, profitability, and economic and financial appraisals.