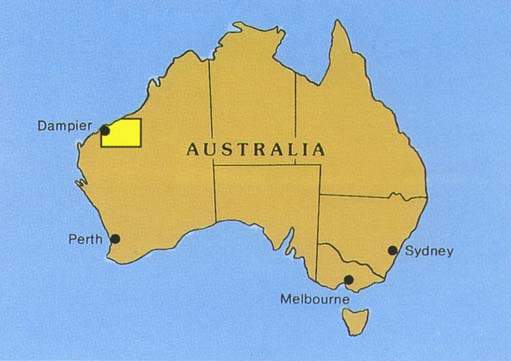

The Hamersley Basin mining area lies in the Pilbara region of north-west Western Australia, 1,100km north of Perth. Through its wholly owned subsidiary, Hamersley Iron Pty, Rio Tinto operates five major producing mines in this area: Mount Tom Price, Marandoo, Brockman, Paraburdoo and Yandicoogina, while the company is in a 60/40% joint venture with the Chinese company, CMIEC, at the Channar mine and with Shanghai Baosteel at Eastern Ranges. The Yandicoogina mine came on stream in 1999.

Production during 2006 totalled 97.2Mt of iron ore, of which 79.2Mt was sourced from Paraburdoo, Mount Tom Price, Marandoo, Brockman and Yandicoogina, 8.2Mt came from the Eastern Range operation, and 9.8Mt came from the Channar joint venture.

Total shipments from the company’s ports were 98.1Mt, an all-time record, driven largely by further increases in demand for iron ore from China. Rio Tinto also has a 53% holding in the Robe River iron ore properties (Pannawonica and West Angelas), also in the Pilbara, which produced a further 52.9Mt of ore during 2006.

In early 2008 Rio Tinto further strengthened its leading position in the region with the discovery of a major, new resource at Caliwingina (875Mt at 56.9% Fe).

The Caliwingina resource is within the Mt Pyrton Project area which lies 100km northwest of Tom Price. It is situated within the Late Archaean to Early Proterozoic (2,765–2,470Ma) Hamersley Basin.

Geology and reserves

The Hamersley iron resources, contained in banded iron formations of precambrian age, cover extensive areas of the Pilbara region. Haematite is the principal iron mineral.

In the first quarter of 2010 proven and probable reserves at Hamersley’s Pilbara operations yielded 3,344Mt of saleable ore. The Robe River operations had a further 696Mt of proven and probable ore, grading between 57.2% and 62.2% iron. Rio Tinto also has substantial undeveloped resources in the Pilbara, as well as a 50% interest in the Hope Downs joint venture that was completed in 2008.

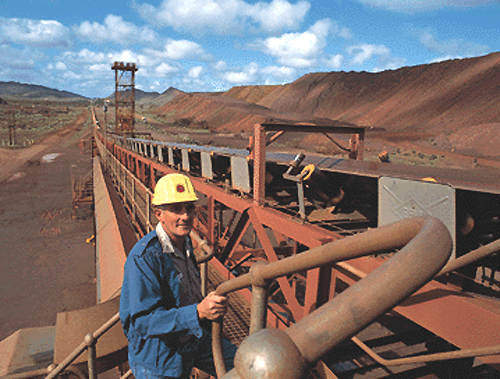

Mining

All of Hamersley Iron’s mines are conventional open pits. Material is drilled and blasted in benches, blast holes being charged with an ammonium nitrate/fuel oil (ANFO) mixture and heavy ANFO dispensed by bulk explosive trucks. Ore is loaded into haul trucks by shovels, hydraulic excavators or front-end-loaders, and transported to the primary crusher. It is then processed in a crushing and screening plant to produce fine ore and lump ore.

At Marandoo, four pits are operational and others will be brought into operation in the future.

The low bench height (10m), compared with Mount Tom Price (15m) and Paraburdoo (14m), facilitates selective mining and minimises dilution, but equipment is smaller than at Hamersley’s other operations.

Brockman enhances the stability and flexibility of Hamersley operations and raises the proportion of lump in Hamersley’s product mix. It is a contractor operation with management and grade control coming under Hamersley’s direction. The deposit consists of detrital and conglomerate haematite.

At Channar, crusher feed comes from Channar Main Pit and Channar East, with Paraburdoo’s contribution to total production having been reduced accordingly to maintain constant output as Channar’s has built up to over 10Mt/y.

Ore processing

At Mount Tom Price, a high-grade plant produces lump product, fines and oversize. The oversize is returned for tertiary crushing after which it becomes part of the feed to the product screens.

Low-grade ore is treated in a concentrator where waste shale is removed by heavy-medium separation (HMS). The low-grade ore, a mixture of well-liberated haematite and shale, feeds the concentrator and undergoes HMS and wet high-intensity magnetic separation (WHIMS) to produce saleable lump and fines products. The WHIMS plant contains three modules, each with one Jones DP317 separator.

At Paraburdoo, the fine ore stream from crushing and screening is wet screened and hydrocycloned to remove slimes. The Paraburdoo fines processing plant (PFPP) improves the quality of fines by reducing gangue impurities, particularly alumina. The PFPP treats all fines produced from Paraburdoo and Channar. The ultra-fines are removed by wet screens and hydrocyclones. The plant is designed to process approximately 12Mt/y of feed and achieve a 91% recovery on a dry basis.

The Marandoo plant is designed to process up to 12Mt/y of ore into lump and fines products. The Marandoo flowsheet excludes a primary stockpile, facilitating the integration of mine/plant operations, especially product quality control.

All output from the screening plants and concentrators is transported from the mines by Hamersley’s own rail system to the port of Dampier for export.

Expansion

All of Rio Tinto’s Western Australian iron-ore operations are currently being expanded, mainly with the aim of meeting surging Chinese demand for iron ore. Thus capacity at the port of Dampier was recently expanded to 116Mt/y, while the expansion of the Yandicoogina mine to 36Mt/y was completed in late 2005.

In 2005, the company committed $290m for further capacity expansions at Mount Tom Price, Marandoo and Nammuldi, then an additional $1.35bn for higher capacity at the Dampier port and at Yandicoogina. The Dampier project is complete and now accounts for a combined output of 140Mt/y while Yandicoogina’s output will rise to 52Mt/y.

At Robe River, expansion of West Angelas was completed in late 2005 at a cost of $105m, increasing its capacity to 25Mt/y. $200m was spent on upgrading the Robe River rail link to the coast, with $860m budgeted for an expansion of the Cape Lambert port fromm 55Mt/y to 80Mt/y.

Future expansion

Rio Tinto has also started several projects in line with its plans to boost annual production capacity beyond 220 million tonnes. The company is investing $500m in regional power development in the Pilbara, which calls for setting up a gas-powered power plant next to the 7 Mile rail operations centre.