The mining industry is undergoing a transformative shift towards cleaner and more sustainable practices. Many of the world’s largest mining companies have now committed to a goal of net zero direct and indirect carbon emissions by 2050, according to the International Council on Mining and Metals (ICMM).

As the world grapples with the urgent need to combat climate change and reduce carbon emissions, the adoption of hydrogen fuel cell and battery-electric vehicles (BEVs) in mining operations is gaining momentum. This transition will not only help reduce the industry’s environmental footprint but also offers numerous operational advantages that benefit all stakeholders, from operators to investors.

The world’s only dedicated global mine electrification event, The Electric Mine conference, held in Tucson, Arizona in May this year was extended to three days for the first time to cater for a jam-packed agenda that saw many of the world’s biggest mining companies jostle to speak on panels and in breakout rooms and showcase their electric credentials.

As of November 2022, market intelligence firm GlobalData had identified 65 electric mining trucks and 180 electric loaders/LHDs operating globally. The combined largest population of electric LHDs and trucks was in:

Canada (96)

Russia (52)

US (33)

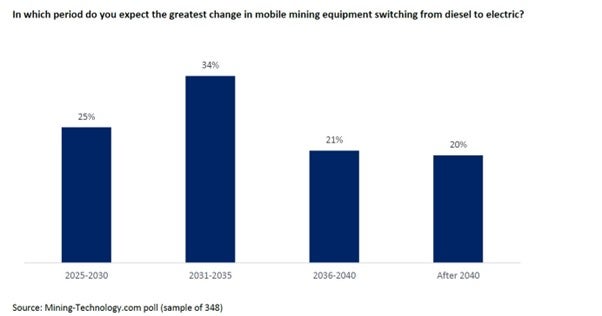

A poll conducted by Mining-Technology.com in April and May 2023 asked respondents to select a period when they expected the greatest change in mobile mining equipment switching from diesel to electric. A quarter of the 348 mining companies interviewed said they were already investing in the switch, but the largest share (34%) expected to start in 2030.

So, what are the major factors prompting a mining company to roll out electric fleets? Is it simply the fear factor over more stringent regulation?

Samu Kukkonen, technology director and chief engineer for Normet’s SmartDrive BEV technology says that of course is one aspect, but there are others.

“The main driving forces for electrification in mining depend on the market region and the customer, but there are multiple factors that speak to different stakeholders,” he says. Here are five:

Worker safety

The emissions generated by diesel vehicles pose a significant threat to the safety and well-being of workers in underground mines, producing high levels of particulate matter, nitrogen oxides (NOx), sulfur dioxide (SO2), and other harmful pollutants. These emissions, when released in the confined spaces of underground mines, can quickly accumulate, and create hazardous air quality conditions.

The fine particulate matter can penetrate deep into the respiratory system, causing serious health issues such as lung damage and respiratory diseases. By removing the need for a fuel load, BEVs also reduce the risk of fire.

BEVs operate almost silently compared to their diesel counterparts. Not only does the absence of loud engine noise reduces noise pollution, but it enhances communication and situational awareness among miners. This quieter environment can improve safety by allowing workers to better detect warning signals, communicate effectively, and hear potential hazards such as falling rocks or equipment malfunctions.

Better working conditions

The reduced noise levels contribute to a more pleasant and less stressful working environment, benefiting the overall well-being and productivity of the mining workforce.

Kukkonen adds: “For the people operating the machinery, they really like the reduced noise and the emission-free atmosphere. They don’t have to breathe in fumes, and the temperature is much cooler. If you think about hot countries like Australia, this can really contribute to a kinder working environment.

“Further up in the mining organisation, people want to take care of their workers, and then there’s the benefit of being able to design the mine differently. There is an opportunity to reduce ventilation due to lack of heat and emissions. All the way up to financial and investment areas, which is very important to make electrification happen, stakeholders are seeing the benefits of BEVs.”

Carbon-capture incentives

The mining industry has long been associated with high carbon emissions due to its heavy reliance on diesel-powered equipment, with mining vehicles accounting for an estimated 30% to 50% of the total direct greenhouse gas emissions at a mine site. The shift towards BEVs aligns with global efforts to reduce greenhouse gas emissions and combat climate change. BEVs produce zero tailpipe emissions, thereby reducing the release of pollutants such as nitrogen oxides (NOx) and particulate matter.

This is good news for the environment and good news for stakeholders. As part of the 2015 Paris Climate Agreement, multiple nations are introducing incentives for mines that reduce their carbon emissions, as well as carbon taxes to discourage reliance on diesel fuel.

Optimising global mining operations

In addition to the environmental advantages, the adoption of BEVs in mines offers several operational benefits. For example, Normet’s SmartDrive BEV technology boasts a more than 100% increase in uphill tramming speed, fast acceleration, and up to 25% faster cycles, as well as rapid charging capabilities and up to 50% energy recuperation in downhill driving.

BEVs are especially beneficial for global operations. Engine requirements in different parts of the world can mean that some diesel engine tiers are not viable in all regions, whereas BEVs can operate anywhere.

Long-term cost efficiency

While the upfront cost of BEVs may be higher than that of diesel vehicles, the long-term cost benefits make them an attractive option for mining companies. Electric vehicles have lower energy costs per mile compared to diesel, especially where carbon taxes are high, resulting in significant savings over their lifespan.

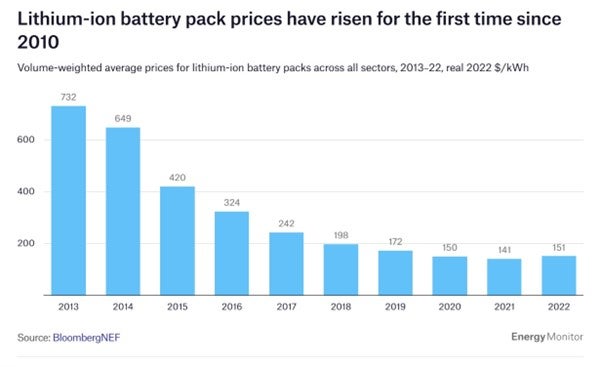

While 2022 saw a slight rise in lithium-ion battery prices, costs have reduced significantly over the past decade.

A major cost saving associated with BEVs is the reduced need for ventilation. Mines can expect to save money on infrastructure for exhaust shafts, as well as energy spent on ventilation equipment.

Overall, the transition to BEVs in the mining industry is inevitable. It is simply a matter of how and when mines incorporate electric vehicles into their fleet. Learn more about how Normet and its pioneering technology can help mining companies accelerate the switch to high-performance BEV vehicles.