Miferma (Mines de Fer de Mauritanie) was created in 1952 to exploit iron ore deposits in the Kedia d’Idjil area of northern Mauritania. A mining centre was constructed at Zouerate together with port facilities at Nouadhibou on the Atlantic coast, both with power plants and linked by a 700km railway.

Nationalisation of the Miferma consortium in 1974-1975 created SNIM (Société Nationale Industrielle et Minière). The Mauritanian government owns 78% of SNIM and Arab financial and mining organisations own the balance. Production rapidly grew to 11-12 million tonnes per annum (Mtpa), a level that has generally been maintained by serial upgrading of the facilities.

In 2001, SNIM formed a joint venture with Australia’s Sphere Investments to study options for open-pit mining and beneficiation of the separate magnetite deposit at Guelb El Aouj and building a 5-7Mtpa plant yielding 70% Fe pellets for direct reduction. Sphere aims to complete a bankable feasibility study by early 2007.

SNIM open-pit iron ore mining geology and reserves

The deposits occur within the Archaean and Birrimian Regueïbat Shield. Those at Kedia d’Idjil comprise largely haematite mineralisation in ridges known as Guelbs. The massive Guelb Rhein and Oum Arwagen magnetite orebodies are much-folded sedimentary deposits. The 14km-long M’Haoudat ridge contains four steeply dipping, lens-shaped deposits, mostly haematite. TO14, discovered in 1991 in the Kedia area, is also a deep orebody of direct-shipping grade.

Typically, richer ores grade 65% iron while siliceous ore contains 55% Fe. Proven and probable reserves of direct-shipping ore total 300Mt, and those requiring beneficiation 3,000Mt while resources total 2,400Mt. Guelb El Aouj is estimated to contain 500Mt of ore grading 37.5% Fe.

Operations development

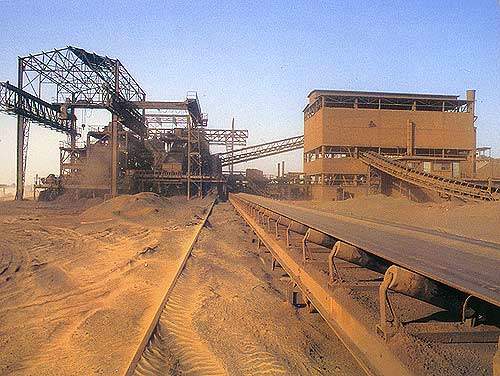

Open-pit mining of direct shipping hematite ore, using rotary drills, small shovels and trucks, commenced in 1963 at F’Derik, Rouessa and Tazadit. Primary and secondary crushing is done at Tazadit and the ore is railed to Nouadhibou in trains of up to 220 cars, each carrying 84t. The ore is stockpiled then reclaimed, crushed and screened for loading into vessels of up to 150,000dwt. SNIM scheduled the start of work on a second loading facility for 180,000dwt ships during 2005.

As the high-grade direct-shipping ore was being depleted, a crushing plant for lower grades was installed at Rouessa in 1973. Thereafter, the Guelb Rhein magnetite resource was developed, north-northeast of Zouerate. Economics dictated that this ore should be upgraded for rail haulage and a 6Mt/y plant was built at Guelb. Primary crushing and autogenous grinding are followed by magnetic and gravity separation.

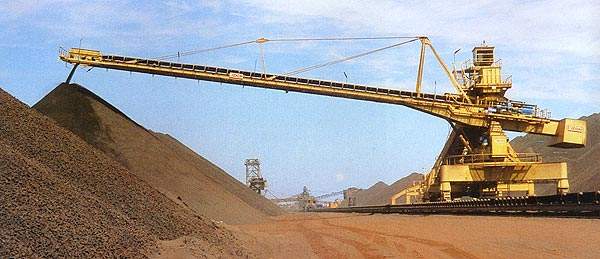

The exploitation of a new, direct-shipping-grade ore discovery at M’Haoudat, 50km further east, began in 1991. The infrastructure was again extended and new equipment purchased, including three P&H 2800XPA shovels. This fleet went to the tough Guelb magnetite and the units there were moved to M’Haoudat. The new mine has primary/secondary crushing, a stacker and a reclaimer. TO14 was discovered close to Tazadit in 1991 and was developed immediately using equipment from the Guelb and Kedia mines.

In the later 1990s, SNIM upgraded the terminal handling facilities at Nouadhibou, commissioning new tertiary and quaternary crushing and screening at the Point Central plant to maintain production at 12Mtpa. A 960tph regrinding circuit at the Guelb Rhein plant was opened in November 2000.

Additional investment further upgraded Guelb Rhein and modernised the railway. In April 2006, the SNIM board announced plans to increase output to permit the export of 14Mtpa ore by 2010, primarily by adding new equipment at the Rhein and TO14 mines.

The project was the first stage of a progressive capacity increase to 25Mtpa. In March 2007, SNIM and Sphere signed a memorandum of understanding with Saudi Basic Industries and Qatar Steel covering the joint development of the El Aouj project, subject to a satisfactory bankable feasibility study.

In November 2015, SNIM inaugurated the new Guelbs processing plant in Zouerate, as part of the Guelb II project. The new mining complex adds 4Mtpa of concentrates and represents a 30% increase in production capacity.

The Guelb II project is a major investment that included the expansion of the Guelb El Rhein mine, construction of a complete ore beneficiation plant, and expansion of the capacity of the Guelbs power plant by 20MW.

Guelb II project financing

The finance partners for the Guelb II project include the African Development Bank, BNP Paribas, the European Investment Bank, the French Development Agency, the Islamic Development Bank, KFW IPEX, Société Générale, and BHF-Bank.

Production of Guelb II

The three mining areas shift around 75Mtpa of material. Approximately 50% of the 10Mtpa–12Mtpa ore produced is processed at the mining area plants and the remainder at Point Central. SNIM markets several grades: 0mm to 90mm and 8mm to 30mm lump ores, sinter fines and high-phosphorus concentrates.

In 2004, SNIM mined 10.7Mt of ore and shipped 11Mt of product, 14.3% more than in 2003. SNIM reported exports at 10.64Mt in 2005. Approximately 60% of deliveries comprise direct-shipping grades, with 40% made up of concentrates, and more than 90% of the tonnage goes to European markets.

SNIM produced 12.501Mt of iron ore in 2020, which is an increase of 4% from its previous year sales, and the company plans to sell up to 13.5Mt in 2021.