The Buriticá Gold Project is located 4km north of the town of Buriticá and approximately 91km northwest of Medellín, the second-largest city in Colombia.

The project covers an area of approximately 75,583ha, comprising a total of 80 tenements, including 23 registered concessions and 60 pending registration concessions.

The project is 100% owned by Continental Gold through its wholly owned subsidiary CGL Buritica.

The preliminary economic assessment (PEA) report was completed in November 2014, the independent technical report and resource estimate was published in May 2015, and the feasibility study for the project was completed in February 2016. First production from the mine is anticipated in 2020.

The overall cost for the development of the project is estimated to be between $475m to $515m. The project was designated as a Project of National Strategic Interest (PINES) to Colombia in November 2015, helping clear all the permitting processes by early-2016.

Buriticá gold project geology, reserves and production

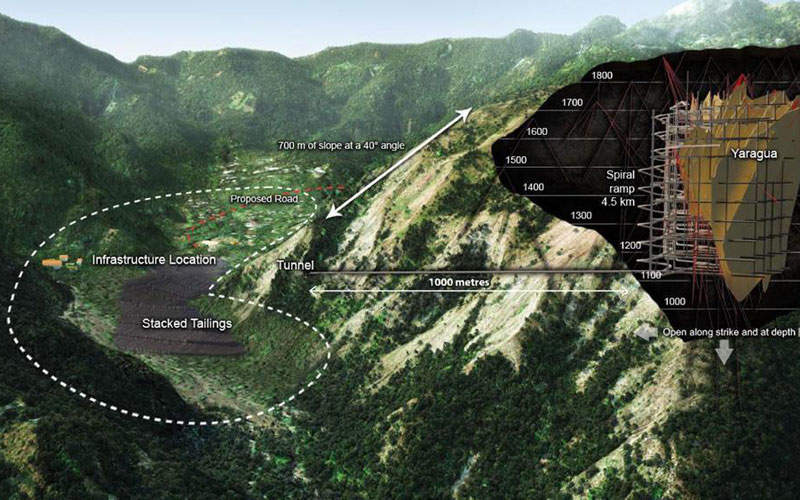

The project will involve the development of the Yaraguá and Veta Sur vein systems located within Licence 7495. The project site is located in mountainous terrain with the majority of the mineral resource located above the Higabra valley floor, the future infrastructure site.

The mineralisation at the Colombian mine is contained in a high-grade, carbonate-base metal (CBM) gold / silver vein and breccia system, hosted in Miocene andesitic intrusions and Cretaceous basement rocks.

As of May 2015, the project is estimated to hold combined measured and indicated (M&I) resources of 16.02 million tonnes (Mt), containing 5.32 million ounces (Moz) of gold grading 10.32g/t and 21Moz of silver grading 40.8g/t.

The project is expected to produce an average of 314,000oz of gold a year for the first five years, and average 265,000oz over the life of mine (LOM), which is estimated to be 14 years.

Mining and processing at Continental Gold’s flagship project

The mining method selected for the project is the bench and fill (longitudinal long-hole stoping) method, with drifts measuring 4m x 4m and the 8m-high benches, using waste as backfill.

There will be three working areas, namely Higabra valley, Yaraguá and Veta sur, which will be provided with independent ramps.

The proposed processing plant will be equipped with a primary jaw crusher, crushed mineralised material reclaim facilities, a semi-autogenous (SAG) mill, intensive cyanidation leaching system, counter-current decantation (CCD) thickeners, a Merrill Crowe plant, refinery, cyanide recovery thickener, and tailings thickener.

The proposed processing plant will have a throughput capacity of 2,000 tonnes a day (t/d), which will increase to 3,500t/d in the third year. The produced gold / silver doré bar is expected to be sold to a precious metal refinery.

Existing and new infrastructure for the Colombian gold project

The project will benefit from the presence of existing infrastructure, such as a paved access road linked to the Higabra Valley, a transformer at the site fed by the local power grid, water sourced from the Higabra tunnel and stored in a holding tank at the site, and mine offices, and a laboratory.

A 30t/d bulk-sampling facility at the Yaraguá site has been operating for more than two decades, and approximately 10km of underground development has been completed at the mine by means of the construction of the Higabra Valley tunnel, the Veta Sur ramp and the Yaraguá ramp. The construction of the Yaraguá ramp was restarted in 2014.

The tunnels provided drill access during the project’s infill drilling programme, which was completed in March 2015. They are further expected to provide access to the two vein systems at different elevations.

The project will further involve the installation of a 33km, 110kV overhead transmission line, connecting the mine to the existing Chorodó electrical substation, and two 13.2kV surface substations, which will transfer the electricity to underground substations via 4.16kV lines.

Other major infrastructure at the site will include a 5.9km access road from the existing paved road to the mine site, a stockpile, a tailings storage facility (TSF), ventilation systems, communications and control systems, and ancillary mine site buildings.

Key players involved

The project’s independent technical report and resource estimate were compiled by Mining Associates, based on the PEA prepared by M3. The latest resource modelling was audited by Resource & Exploration Mapping.

The feasibility study including the mine plan and project construction planning are being performed by JDS Energy in collaboration with Mining whereas the process engineering and infrastructure design works are being performed by M3 Engineering & Technology.

ALS Group of laboratories and SGS supported the laboratory assay works for drilling sample. Major earthwork contract was awarded to Gisaico.

Tierra Group was contracted to design the dry stack tailings storage facility and review plans related to environmental permits, water management, and water balance.

Empresas Públicas de Medellín has been assigned construction of the transmission line and power substation.

Ivor Jones prepared the updated mineral resource estimation for the project.