The Bayan Khundii gold project is an open-pit mine being developed in Mongolia by Erdene Resource Development, a resource exploration company based in Canada. It is one of the highest-grade open-pit gold mines in the world.

The bankable feasibility study for the project was completed in July 2020, while an updated feasibility study was completed in July 2023. The new study plans to commence open-pit mining operations on the Bayan Khundii and the Dark Horse deposits.

The project is estimated to require an investment of approximately $109m and have a mine life of eight years.

The Bayan Khundii gold project will be Mongolia’s largest primary gold producer when it commences operations in 2025.

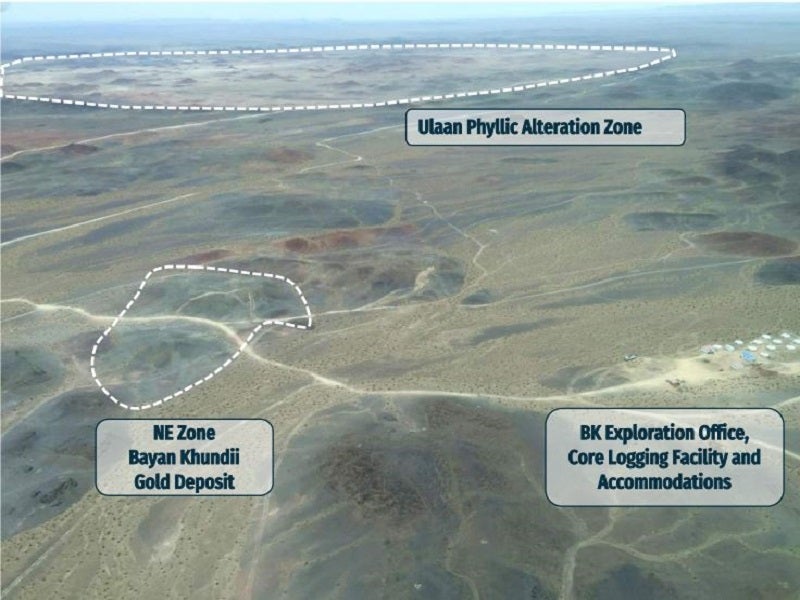

The Bayan Khundii gold project location

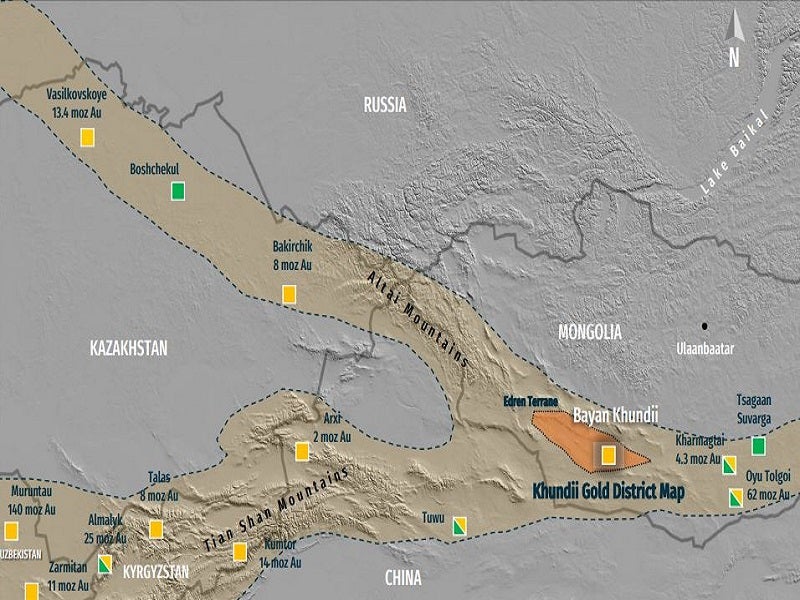

The Bayan Khundii gold project is located in southwest Mongolia, approximately 300km south of the provincial capital, Bayankhongor. The site lies within an emerging gold district referred to as the Khundii Gold District.

The project encompasses the Khundii Exploration License (XV-015569) spanning 2,205ha and the Khundii Mining License (MV-021444) spanning 2,308ha.

Geology and mineralisation

The Bayan Khundii gold project is located within the Edren island arc terrane, part of the larger composite Trans Altai Terrane.

The Trans Altai Terrane is dominated by Middle Paleozoic volcanic, sedimentary and metasedimentary rocks intruded by Middle Paleozoic calc-alkaline and alkaline plutons. The project area is mainly composed of the lower carboniferous Ulziithar formation.

Gold and silver mineralisation at Bayan Khundii occurs in massive-saccharoidal, laminar and comb-textured quartz hematite veins, multi-stage quartz-adularia-chalcedony hematite veins and quartz-hematite breccias. The veins occur along late fractures and disseminations within intensely illite-quartz-altered pyroclastic rocks, which are associated with hematite that partially or completely replaced pyrite grains.

Reserves

The proven and probable reserves at the Bayan Khundii gold project were estimated at 4Mt grading 4g/t gold and 1.7g/t silver with 513,700oz and 220,500oz in contained gold and silver respectively, as of August 2023.

The Bayan Khundii gold project mining methods

The Bayan Khundii gold project will be developed as a conventional open-pit mining operation with a strip ratio of 10.9, targeting 650,000t per year of feed material.

Open-pit mining operations are planned to commence in the southern portion of the Bayan Khundii gold deposit and expand northward. The Dark Horse deposit will be mined from year three of operations and the ore will be processed concurrently with that from Bayan Khundii.

Mining operations will be carried out using hydraulic excavators in a backhoe configuration. Ore will be loaded into haul trucks, while waste rock will be stockpiled in an engineered integrated waste facility adjacent to the pit.

The mining fleet is envisaged to comprise four excavators, including two each for ore and waste, 20 payload trucks of 55t each and three blast hole drills backed by a fleet of ancillary and support equipment.

The mining workforce is expected to peak at approximately 260 personnel including employees and contractor personnel.

Processing

The processing facility for Bayan Khundii will comprise conventional crushing and grinding, leaching and a carbon-in-pulp (CIP) plant with a processing capacity of 1,935 tonnes per day.

The run-of-mine ore will undergo crushing and grinding with a grind size of 80% passing 60 microns. The ground ore will undergo cyanide leaching with a retention time of 36 hours. The leach solution will be fed to the CIP circuit.

The CIP circuit will discharge to the elution circuit and gold room, where the product will be dewatered, filter pressed and fed to a furnace to produce the final product.

The ore-processing plant located adjacent to the Bayan Khundii open pit is designed to maximise water recovery with the most efficient pressure filters to achieve targeted 15% moisture in tailings while minimising chemical and reagent usage to reduce environmental impact.

Bayan Khundii project financing

Erdene executed a strategic alliance and investment agreement with Mongolian Mining (MMC), a coal mining company based in Mongolia, in January 2023 for the development of the Bayan Khundii gold project.

MMC will invest $40m in return for a 50% equity interest in Erdene’s Mongolian subsidiary, Erdene Mongol.

Erdene Mongol holds the Khundii and Altan Nar mining licenses and the Ulaan exploration license.

Contractors involved

O2 Mining, a Hong Kong-based engineering company, prepared the updated feasibility study and was responsible for the mine design and planning, process design, cost estimation and financial evaluation.

The mineral resource estimate for the Bayan Khundii deposit was prepared by AGP Mining Consultants, a mine engineering company, while that for Dark Horse was prepared by RPM Global, an enterprise technology, advisory and training provider. The mineral reserve estimates for the two deposits were prepared by O2 Mining.

Engineering and construction services company, 360-Global was responsible for the processing plant design.

Como Engineers, an engineering services provider, was awarded the contract to supply a gold elution plant for the project in February 2022.

Roma Group, an engineering services company, was engaged to lead the development of the final technical report for the updated feasibility study.

ATC Williams, a consulting engineering company, was responsible for the mineral waste and tailings facility design and management planning, including closure.

Metallurgical testing and interpretation for the project were provided by Blue Coast Research, a metallurgical test work and consulting services provider.

Architecture, engineering and consultancy firm Ramboll Australia was responsible for the technical review and assessment of the mine water supply and pit hydrology.

Geo-data specialist Fugro provided the geotechnical assessment of the Bayan Khundii and Dark Horse open pits.

Sustainability East Asia, Ramboll and Eco Trade delivered the environmental and social impact assessment for the project.

HCF, an independent corporate finance advisory boutique based in the UK, was engaged to act as project finance advisor in 2020, with the primary responsibility for securing debt.