South32 has entered a binding agreement to divest its Cerro Matoso mine to a subsidiary of CoreX Holding, following a strategic review prompted by shifts in the nickel market.

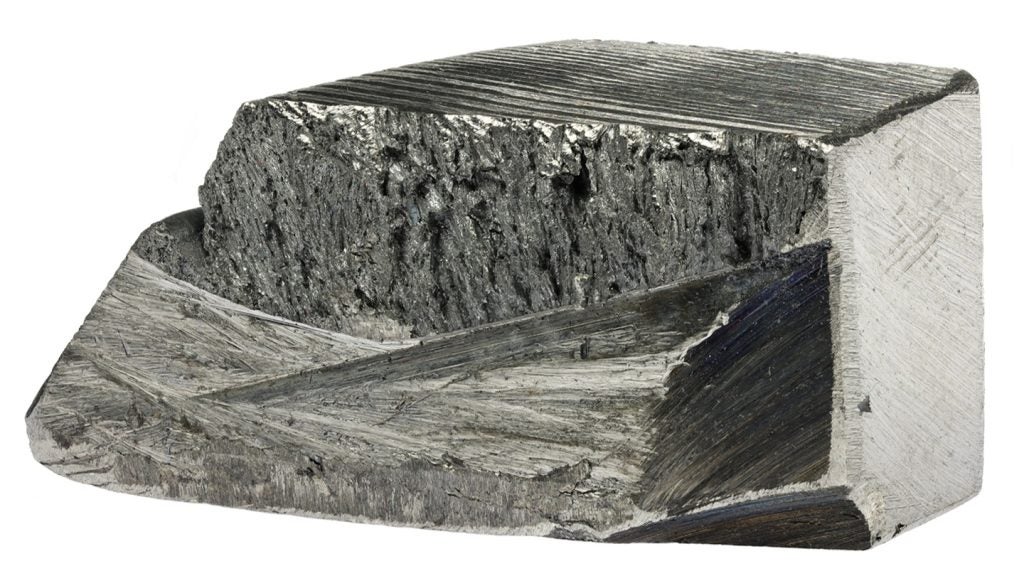

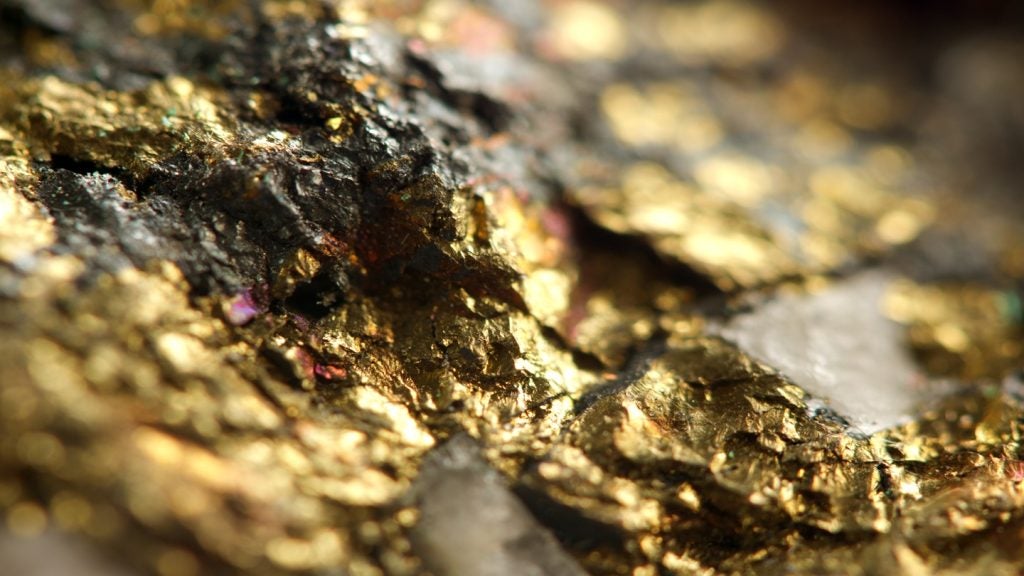

Located in Córdoba, Colombia, Cerro Matoso is an open-cut mine and smelter that produces ferronickel.

The deal includes the assumption of the mine's economic and operational control by the buyer, along with all current and future liabilities.

Upon completion of the transaction, the buyer will pay nominal consideration and make future cash payments of up to $100m, contingent on production, nickel prices, and permitting milestones for the Queresas and Porvenir North Project.

These payments include up to $80m linked to nickel production and prices, and up to $20m in four equal payments tied to permitting milestones over the next five years.

South32 CEO Graham Kerr said: “The transaction is consistent with our strategy and will further streamline our portfolio toward higher margin businesses in minerals and metals critical to the world’s energy transition.

“The transaction will deliver a clean separation of Cerro Matoso and provide additional balance sheet flexibility to support investment in our growth options in copper and zinc.

“Cerro Matoso has a long and proud history in Colombia. Over the coming months, we will work with the Buyer, our workforce, the local communities, government, customers and suppliers to support a successful transition of ownership.”

The sale is contingent on several conditions, including international merger clearances and a reorganisation of the entity holding Cerro Matoso.

The expected completion date for the transaction is late calendar year 2025, subject to these conditions being met or waived.

The transaction will result in an impairment expense of approximately $130m in the Group's FY25 financial statements, which will be excluded from FY25 underlying earnings as per the Group's accounting policies.

Goldman Sachs is serving as the financial adviser and Freshfields as legal adviser to South32.

Furthermore, the Australian Renewable Energy Agency (ARENA) has granted South32 A$4.4m ($2.8m) to investigate steam electrification at the Worsley Alumina Refinery in Western Australia.

This initiative is part of the A$400m Industrial Transformation Stream programme and aims to reduce greenhouse gas emissions from Australia's largest industrial process heat user.