The proportion of mining equipment that is autonomous, autonomous-ready and tele-remote is growing and now comprises nearly 5% of key mining equipment, a series of reports shows.

According to GlobalData’s Development of Autonomous Trucks in the Global Mining Sector, Development of Tele-remote and Autonomous Equipment in the Global Underground Mining Sector and Development of Autonomous Surface Blasthole Drills in the Global Mining Sector reports, the share of such equipment amongst the total operating population of surface and underground trucks, surface drills and load-haul-dump machines (LHDs) has risen rapidly in recent years and is now estimated at 4.2%.

David Kurtz, global head of mining research at GlobalData, commented: “While in Australia we estimate already well over 10% of haul trucks are autonomous or autonomous ready, the number identified in China has risen rapidly in the past few years, with China now accounting for more than half of all autonomous and autonomous-ready equipment in operating mines.

“Helping to drive adoption are the benefits that autonomous equipment delivers, including improved productivity – typically cited by miners to be between 10% and 30% – increased operating hours, lower fuel consumption, reduced maintenance and improved safety.”

Accelerating autonomous uptake

After initial adoption in 2008, the take up of autonomous mining equipment was relatively slow due to high capital costs, connectivity challenges, integration with legacy systems and an uncertain return on investment, particularly for smaller mines.

By 2020, less than 1% of key mobile equipment, including haul trucks, surface blasthole drills, underground mining trucks and underground LHDs, were estimated to be autonomous, autonomous-ready or tele-remote. Early adopters at that time included Australia, where Rio Tinto and Fortescue were operating fleets in excess of 160 haul trucks, principally from Caterpillar and Komatsu. As of 2020, BHP was also in the process of building up its fleet, and by 2022 the company had the largest fleet of autonomous and autonomous-ready haul trucks in Australia.

China dominates autonomous adoption

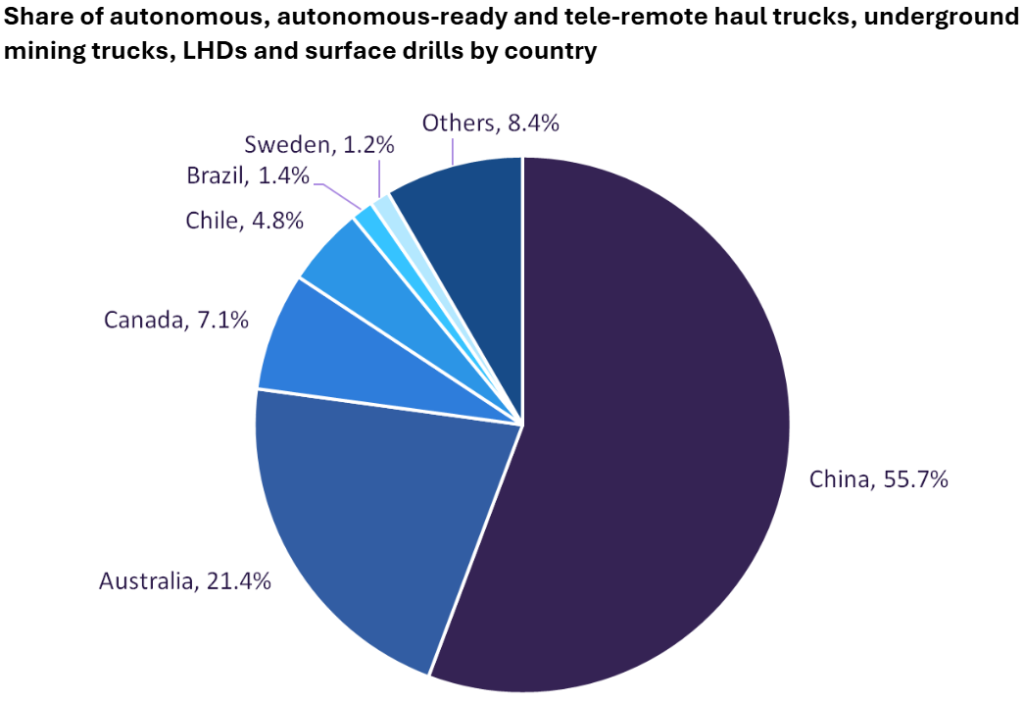

Today, five countries account for more than 90% of autonomous and tele-remote mining equipment globally, with China’s share estimated at 56%, followed by Australia with 21%, Canada (7%), Chile (5%) and Brazil (1.4%).

By mine, it is similarly concentrated. Out of almost 300 mines tracked by GlobalData with autonomous, autonomous-ready and tele-remote trucks, LHDs and surface drills, ten mines account for 30% of the total equipment count, of which seven are in China and three in Australia. The largest count is recorded at the Baishihu Coal Mine in China, owned by Guanghui Energy, with 420 autonomous haul trucks.

Looking ahead, when it comes to haul trucks specifically, which represent the largest share of autonomous machines, major additions are planned by several companies.

For example, at Yimin Coal Mine in China another 200 autonomous trucks are expected to be added over the next three years, taking the total in operation to more than 300. Meanwhile, in Australia, Fortescue has partnered with mining equipment OEM Liebherr for the supply of 360 battery-electric autonomous trucks for its Pilbara iron ore mining operations between 2025 and 2030.