Follow the latest updates of the outbreak on our timeline.

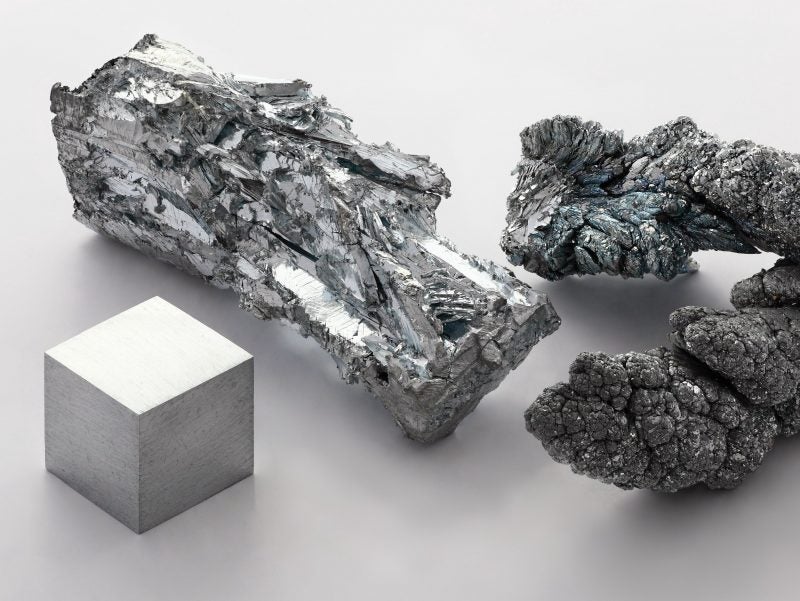

Zinc prices have fallen to their lowest levels since June 2016 due to increasing concerns over the economic impact of the coronavirus outbreak, now known as Covid-19, in China, the world’s top consumer of metals.

The decline in prices comes amid growing worries over the economic impact of the Covid-19 outbreak in China, as well as fears over its spread into other nations which may reduce demand outlook for the metal.

As of 26 February 2020, the number of deaths related to Covid-19 has increased to more than 2,750. Mainland China recorded 52 new deaths in Hubei Province yesterday.

Following reports of Covid-19 outbreak in China, the complete pack of base metals is said to have come under pressure, of which zinc noted the biggest fall.

Zinc prices have proven turbulent in stock exchanges since the disease outbreak. At London Metal Exchange (LME), zinc stocks rebounded more than 50% from a near two-decade low of 49,625t hit earlier this month. Meanwhile, stocks at Shanghai Futures Exchange (SHFE) this year have jumped more than 400% and at 143,164t as of 21 February.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReuters reported that zinc stocks in LME-certified warehouses hit their lowest in nearly three decades last week.

Last month, major metals and mining firms witnessed share price drops due to uncertainty around the Covid-19 outbreak.

Global firms such as Rio Tinto, Rusal, Vale and Glencore saw share price reductions of between 3% and 4% due to the Covid-19 outbreak, The Economic Times reported.