Environmental, social and governance (ESG) frameworks have been described as “dying” at Europe’s biggest mining investment conference, Resourcing Tomorrow. However, the acronym is garnering new interest in the risk management sector.

Yesterday’s (3 December) ESG and risk management panel opened with the question: “ESG: is it dead? Or is the acronym dead?”

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The question was asked by Beverley Adams, head of client engagement and consulting director of strategic risk practice at Bowring Marsh. Addressing attendees, she rephrased: “Is ESG dying or is it always rebranding?”

The hype around ESG is generally agreed to have died down, but one acronym that the panel agreed was not dead is VUCA: volatile, uncertain, complex and ambiguous. As soaring critical mineral demand puts pressure on supply chains, mining operations are ever more ‘VUCA’.

“We are increasingly seeing that the world around us, the world of resourcing, the world of our jobs, the world of our homes, is increasingly uncertain,” said Adams. “Uncertainty is the new normal.”

For Gerhald Bolt, principal of climate and sustainability at consultancy dss+, ESG’s value lies in the management of VUCA risks: “How can I advise ESG to advance my brand equity? How can I use it to increase revenue? Can I use it to reduce cost and how can it significantly reduce risk?”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Risk” has emerged as a buzzword across the conference, and the VUCA problem has rumbled on.

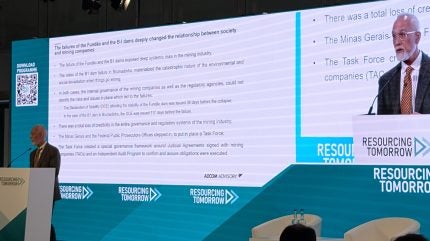

Bolt’s point on risk was illustrated during a keynote address delivered by Vicente Mello, senior vice-president and Brazil country manager at consultancy Aecom. He pointed out that, more than a decade on, the mining sector has not been able to escape the ramifications of the 2015 collapse of the Fundão tailings dam in Mariana, Brazil.

Only last month, a UK court found BHP and Vale liable (although not criminally responsible) for the collapse of the Fundão tailings dam, concluding that they were involved in the “detailed operational matters” and “strategic decisions” of operator Samarco’s activities “at every level”.

Mello also pointed to the 2019 Brumadinho dam disaster. He stated that “in both cases, there was deep failure in terms of the governance system within the companies and also within the regulators”.

At the heart of the two tragedies was a governance failing, with monumental environmental and social repercussions. The Fundão tragedy resulted in 19 deaths, while Brumadinho resulted in 272; both caused environmental devastation.

ESG can act as a risk management framework, then. According to Gemfields corporate responsibility director Edward Johnson, this point is at the crux of ESG conversation: “Until there is more due diligence done in the supply chain, down from us, ESG is meaningless.”

He offered the example of the company’s ruby mine in northern Mozambique, which he said “is most definitely VUCA”. The Montepuez mine, which sits within the Cabo Delgado province, covers 349km² and provides upwards of 50% of the world’s rubies.

Johnson told attendees that 657 illegal miners had been identified on the concession within the last 24 hours. “What you have got for ESG priorities, is a significant risk from people who are willing to risk their lives on a daily basis and attack your security forces to get access to the attractive material that you are in charge of bringing into the supply chain in a responsible manner,” he said.

ESG is unavoidable and embedded; governance is fundamental to risk management, and environmental and social ramifications are inextricable to any decisions made in response to an increasingly VUCA industry.

Speaking to this point, Adams concluded the panel, saying: “ESG isn’t dead, but the language of ESG, whether it is sustainability, whether it is social license, whether it is co-design, that is what is evolving.”