Estimated demand for copper shows no signs of slowing down and Latin America (LatAm) is leading the charge in terms of production.

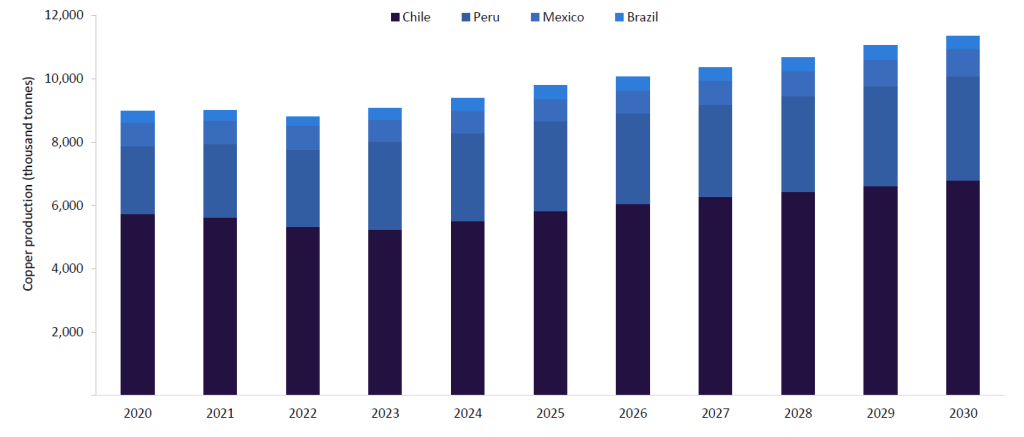

Mining Technology’s parent company, GlobalData, forecasts that LatAm will account for 40.5% of global copper production in 2025, with Chile at the forefront. In 2024, the country produced 58.8% of the region’s total output and 24.2% of global copper production.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Chile alone contains three of the world’s biggest copper mines, with BHP and Rio Tinto’s Escondida greenfield site in Antofagasta at the helm. In the first half of the 2025 financial year, the mine’s copper output increased 22%, contributing to BHP’s group copper production rising 10% year-on-year to 987,000 tonnes (t). BHP is set to invest $2bn (A$3.07bn) in Escondida as part of a broader $10.8bn investment plan in Chile.

Other significant LatAm countries involved in copper mining include Peru, which produced 29.5% of the region’s output in 2024, as well as Mexico and Brazil, which contributed 7.5% and 4.1%, respectively.

LatAm’s copper mining market is dominated by major companies such as Chile’s state-owned Codelco, and private operators including Glencore, which owns significant copper projects in Chile and Peru, and Freeport McMoRan, which operates the world’s third-biggest copper mine in Peru.

Blue Lagoon Resources mining committee chair Ioannis Tsitos explains the reasons behind this configuration. “Copper mines typically need a big footprint and high capital expenditure, and exploration efforts have been densified in LatAm countries. This means that agile junior companies cannot find and explore deposits as easily as the majors but there are still opportunities for them.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Juniors are increasingly taking a larger share of the copper market by becoming indispensable partners in the discovery and early development stages,” elaborates Gayathri Siripurapu, senior analyst at GlobalData. Active junior miners in LatAm copper include Latin Metals and Hot Chili.

While LatAm’s dominance in copper mining is long-established, global competition is fierce across the value chain.

Staying ahead of competitors

LatAm’s closest challengers in copper production are China and the Democratic Republic of Congo (DRC).

While the DRC is home to 8% of the world’s known copper reserves, compared with Chile and Peru’s combined 31%, its ore quality is notably higher. Some of the DRC’s copper mines are estimated to contain grades above 3%, whereas Chile’s copper core grades have hovered around 0.6–0.7% in the past decade.

“The bulk of the copper that is produced and exported out of LatAm from mature mines has declining ore grades and this is one of the biggest challenges in the business,” states Tsitos, who has 35 years of international exploration and mining experience, including with BHP. “A key example is BHP’s Escondida mine as the average mined copper grade has now gone under 1% and could go as low as 0.5% in the future.”

Meanwhile, China is the world’s biggest importer of copper from Latin America, buying $20.8bn (149.35bn yuan) and $16.8bn from Chile and Peru, respectively, in 2024. These volumes are used to feed China’s extensive refineries, enabling the country to account for 44% of global refined copper production in 2024. By 2027, China is planning to increase its copper smelting capacity by 45%, which will further strengthen its hold over LatAm copper.

Conversely, LatAm’s processing capability is limited. Chile constructed its last copper smelter in the 1990s and Peru currently only has one copper refinery in operation.

Inter-American Development Bank lead mining specialist Natascha Nunes da Cunha tells Mining Technology: “Downstream copper processing and manufacturing offer higher margins, generate skilled jobs, foster industrial innovation and strengthen geopolitical relevance. Yet in much of LatAm, these activities are still treated as peripheral rather than central to national development strategies.”

China is also set to scale up its domestic mining capacity. In 2024, a $2.4bn plan to expand the Julong copper mine in the Qinghai-Tibet Plateau was approved. If the project remains on track to begin operations by the close of 2025 and gain approvals for expansion, it will become the largest stand-alone copper mine in the world in terms of mining and processing scale.

Siripurapu confirms that these developments are “gradually reducing LatAm’s dominance in global copper”.

“The interesting question for LatAm countries is whether they want to take on more processing and smelting,” says Scot Anderson, mining expert and lawyer at transatlantic company Womble Bond Dickinson.

“I think there is opportunity there given the demand for copper,” he adds. “For any country trying to break free of Chinese dominance on the mineral processing side, it is economically appealing to build more capacity.”

Expanding Latin American copper activities

The LatAm region is advancing its downstream activities, albeit gradually. In late 2024, it was announced that Chilean state-owned companies Codelco and Enami were exploring a joint venture (JV) to revamp the Paipote smelter and construct a new facility.

Siripurapu explains that progress is driven in part by the acceleration of global electric vehicle (EV) adoption, which requires approximately 83kg of copper per EV.

Chile is also working on strengthening its partnerships beyond China. At the EIT Raw Materials Summit in Brussels on 15 May, Chile’s Minister of Mining, Aurora Williams, stated that the “energy transition has created huge opportunities for Chile and we can contribute to critical minerals supply [but] projects take time to be developed”.

The country has a trade agreement with the EU for raw materials, which includes copper.

Argentina is another LatAm country that is taking significant steps to revitalise its dormant copper industry. The country’s Incentive Regime for Major Investments (RIGI), which came into effect in 2024, provides tax and customs incentives and foreign exchange exemptions to large-scale mining projects with a minimum investment of $200m (236.43m pesos).

Research from LatAm and Iberia-focused forum Canning House confirms that: “Argentina’s mining sector is known for its relatively liberal legal and regulatory environment compared to the rest of Latin America.”

“RIGI is designed to attract mining investment and will position Argentina to become more competitive within the copper market to the benefit of the whole region,” asserts Anderson.

What is on the horizon for Latin American copper?

By 2030, LatAm’s copper industry will have grown to nearly 11.4 million tonnes (mt), at a compound annual growth rate of 3%, according to GlobalData.

While much of this depends on global market conditions, the investment outlook in the region appears strong. “I see more and more shareholders and investors asking the question, ‘why not copper exploration?’ as the demand is there,” says Tsitos.

He attributes the strength of LatAm’s copper mining landscape to “common language, which allows for movement between countries, and similar geology, as there are copper porphyries that are important areas for high tonnage, high grade discoveries”.

Indeed, in May, Lundin Mining and BHP JV Vicuña made a landmark 13mt copper discovery at the Filo del Sol project in Chile, believed to be the largest copper find in the past three decades.

Chile will retain its position as the region’s leading national producer. The country’s overall copper output is projected by GlobalData to reach 5.8mt by the close of 2025 (a 5.8% increase), supported by Codelco’s targeted 1.4mt production and Antofagasta’s goal of 700,000t.

Following Chile’s upward trajectory is Peru, where copper output is set to rise strongly after 2027. Siripurapu states that this is driven by expansions and the start of operations at major sites such as the Toromocho mine owned by the Aluminum Corporation of China and Southern Copper’s Tia Maria mine.

“There is a lot of upside in LatAm copper,” confirms Anderson. “The demand is not going to go away, even aside from the energy transition, as we have data centres and AI which require a lot of minerals, especially copper.”

Nunes da Cunha asserts that beyond 2035, Latin America’s copper sector will “face growing competition” from Africa and Central Asia.

She concludes: “To maintain its competitive edge, the region must innovate across the value chain, both upstream and downstream, improving productivity, reducing carbon intensity, and advancing local processing and manufacturing capabilities.”

Frequently asked questions

-

What are the main challenges facing copper mining in Latin America?

One of the most pressing issues in copper mining in Latin America is the declining ore grades in many of the region's mature mines. This not only affects the profitability of mining operations but also increases the costs associated with extraction and processing. Additionally, the region's infrastructure, particularly in remote mining areas, often requires substantial investment to improve transport and logistics, which can hinder operational efficiency.

-

How does Latin America plan to enhance its copper processing capabilities?

Latin America is recognising the need to enhance its copper processing capabilities to maintain its competitive edge in the global market. The growing demand for copper, particularly driven by the electric vehicle (EV) market, is prompting Latin American countries to reconsider their positions in the value chain. By investing in processing facilities, Latin America can not only meet domestic demand but also position itself as a key player in the global supply chain.

-

What role do junior mining companies play in Latin America's copper sector?

Junior mining companies are increasingly becoming vital players in Latin America's copper sector, particularly in the discovery and early development stages of mining projects. As major mining companies focus on maximising output from existing operations, juniors can fill the gap by identifying and developing new copper deposits. This dynamic is particularly important in a region where exploration efforts have become concentrated among a few large players, making it challenging for them to discover new resources.

-

How is the demand for copper evolving in the context of global energy transitions?

The rise of electric vehicles and renewable energy technologies is increasing demand for copper. As countries around the world commit to reducing carbon emissions and transitioning to greener energy sources, the demand for copper is expected to surge. Latin America, with its vast copper reserves and established mining operations, is well-positioned to capitalise on this growing demand. Countries like Chile and Peru are already significant players in the global copper market, and as the energy transition accelerates, their roles are likely to expand.

-

What investment opportunities exist in Latin America's copper mining sector?

Latin America's copper mining sector presents a range of investment opportunities, driven by the region's rich mineral resources and the increasing global demand for copper. One of the most promising areas for investment is in exploration and development of new mining projects. Additionally, there is significant potential for investment in processing facilities. As Latin America seeks to enhance its copper processing capabilities, opportunities exist for companies that can provide the technology and expertise needed to build and operate smelting and refining plants. This is particularly relevant given the increasing demand for refined copper driven by the electric vehicle market and renewable energy technologies.