The mining industry is facing up to a new reality that has, for some time, been taking root: ore grades are declining, deposit complexity is increasing and becoming less economic, while competition for mineral resources such as water and energy is becoming tougher.

“How do we approach these challenges in a technological sense, is what many of us are asking,” says David Miljak, research programme director for sensing and sorting, mineral resources at the Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia’s preeminent national science agency.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

For the energy-intensive ore screening and sorting part of the mining process, Miljak and his team, along with other start-ups and academics, are looking to provide the answer to this question.

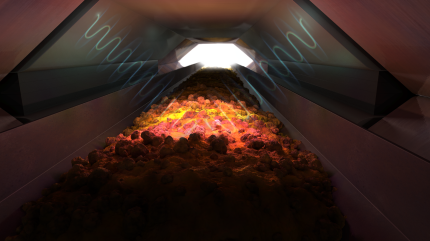

Rocks are usually sorted particle by particle using methods like X-ray transmission (XRT). However, there is significant scope for improving this process with advanced technologies that offer more informed and faster analysis and, ultimately, better data capture, according to experts like Miljak.

He and his team are advancing radio frequency, X-ray and nuclear sensing instrumentation for high-throughput conveyor belt systems used early in the mining process that can ‘interrogate’ the rocks.

“What we want to know is how much copper, for example, is in the rocks; if we know that accurately and fast enough, we can divert them for processing and reject the rocks that are low in copper and aren’t economic to mine,” he explains. “This can have enormous benefits in uplifting the ore grade, the economics and the sustainability of the operation.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn this way, low-grade rocks do not need to be crushed, meaning the overall process requires less energy and water usage. It also minimises the material entering tailings dams.

Ore screening technology

Miljak, who has almost 30 years’ experience in radio frequency-based technology, was involved in developing, over 15 years, magnetic resonance technology (MRT) that was commercialised through NextOre, a company spun out of CSIRO in 2017.

In March, NextOre announced its first solution for analysing ore transported by underground copper trucks, an adaptation of its conveyor belt application.

MRT is a form of radio frequency spectroscopy that can be used to count the atoms of a target metal in a sample. It works by subjecting ore to pulses of radio waves set to the signature frequency of the target mineral.

The resonating ore produces a radio field burst, known as a ‘spin echo’, which is quantitatively measured by the sensor. The data generated by the MRT analyser is presented as real-time weight measurements of the target metal which, combined with weightometer readings, provides real-time grade as weight per cent of the material.

The technology can do this for 50 tonnes (t) of material in under a minute, according to NextOre, providing mining operations with real-time data that informs ore routing decisions.

It has been demonstrated at several operations including First Quantum Minerals’ Kansanshi mine in Zambia, Lundin’s Candelaria mine in Chile and Capstone’s Cozamin mine in Mexico, with a trial at Cozamin reporting a 7.5% increase in copper production without additional mining.

This technology is related to magnetic resonance imaging machines used in medicine, but must be adapted to mining conditions that are harsh and dusty.

“These technologies have been around for decades, but what we are trying to do is tweak the physics to make it work in minerals, which is actually a huge undertaking; you have got to re reinvent how you transmit the radio waves onto the targets,” says Miljak.

Hyperspectral sensing technology

Another spin-out innovating in this space is Hypermine, born from VTT, a Finland-based European research organisation. Its technology combines laser illumination, hyperspectral sensing and proprietary machine-learning algorithms, to sort the valuable minerals at the earliest stage of the mining process.

The company, which in June announced a successful closure of its seed funding round, claims the technology helps cut energy use by 10% and can reduce ore flotation acids and water usage by 15%.

It does this by making stockpiling decisions 100-times more accurate, says CTO Mikhail Mekhrengin. He adds that the company is already detecting alumina contamination in its iron mines and sulphate contamination in copper mines, with four systems implemented in customer operations in Brazil, Chile and South Africa.

“Hypermine enables actionable data for each shovel or truck load, as well as the potential of a 3–10% higher mining profitability due to fewer valuable materials being lost into waste, less gangue in the process and more consistent feed to processing plants,” Mekhrengin says.

Similarly, Germany-based Steinert is providing sensor-based sorting technology to uncover ore’s composition in real time, adopted by Terra Goyana bauxite mining operation in Brazil. Successful trials at the site showed the technology could remove contaminants at an improved rate.

Multiple complementary solutions

These solutions can work in tandem with to X-ray technology, experts say. The difference, Mekhrengin explains, is that X-ray fluorescence (XRF) is based on elemental analysis to provide ore-grade information, whereas laser spectroscopy or hyperspectral sensing are optical technologies that provides molecular content of the material, including mineral content and concentrations, lithologies, rock type and chemistry.

“Why is mineralogy/rock type important? Because metals are never presented in a pure form in nature. They are enclosed in minerals. It is hard to impossible to translate elemental information to mineralogical data. In the perfect case, you need both,” he says, adding: “On top of XRF, mineralogy is crucial to understanding how to process the mined material.”

A spokesperson for NextOre adds that XRT is applied only in rock-by-rock, or ‘particle’ sorting applications, is cost intensive and can become very complex and expensive for higher throughput applications greater than 200 tonnes per hour (tph).

“Conversely, magnetic resonance is particularly well suited for bulk applications, extending currently to 6,500tph and almost certain to go higher.”

Improving processing plants

In addition to sorting, CSIRO and Miljak are applying similar techniques to measure what is in flotation plants during the extraction process.

Technology that can quantify the mineral phases changing in real time could help operators address or mitigate “upsets” in the mineral processing that spoil the entire operation, says Miljak. It could lead to mitigating actions such as changing the feedstock to blend out the bad mineral actor.

“It could be a certain mineral that makes the recovery process go off; it is a disruption. We can pick these up very quickly with the technology we have – this is a unique capability we have developed in the last 5–10 years,” he says.

“If operators are not privy to these big deviations, recoveries can drop, so stopping them earlier could lead to higher yields. Over a long period, increasing recovery by even a few per cent for a big mine can potentially provide thousands of tonnes of more products – a fortune depending on what commodity is being mined.”

CSIRO is working with some companies to pilot its “robust bits of technology” but is also looking for additional mining partners.

Innovations in screening

Further down the sorting and crushing process, Weir recently launched the ETX250, which it says is the largest double deck banana screen in the world for separating big and small rocks. The company says the screen, which is run by only two exciters, could reduce energy consumption by 40%, further supporting miners sustainability targets and reducing rising energy costs.

“Having only two exciters [rather than three] reduces the amount of inventory the customer has to keep, as well as maintenance, while giving better fine screening efficiency because we can run the exciter at a higher speed,” explains Corné Kleyn, global product manager at The Weir Group.

The company recently sold 12 to a high profile mining operation in Pakistan.

Incorporating AI into minerals screening and sorting

The next step for data-driven technologies is coupling them with AI and machine learning (ML). While this is not Miljak and his team’s focus, he says there are “big overlays”.

“There is a beautiful train of data here that can be paired with AI ML, neural nets, and so on, that can be used to improve process based on historical data and to predict problems,” he explains.

“I think part of our problem is people aren’t used to having mineral phase data in real time. So, it would be a new research endeavour to try and make the best of the data flows to improve it even further.”

Nicolaas Steenkamp, an independent consultant who is a geologist by training, says AI could be valuable for improving these processes.

“Today, X-ray transmission technologies used in the mining industry do thousands of millions of calculations for each individual grain and that data is just discarded, it doesn’t feed into production, but this could be processed in the cloud to give a much better insight into production,” he says.

“That can inform your processing plant in terms of the type of material it can expect to come through, enabling them to regulate the agents they will need to add to a specific processing cycle.”

However, this is mostly “blue sky or proof of concept” technology right now, he adds.

Vision for the future

Steenkamp says the key driver for adopting these technologies is ultimately processing less ore, so a project is using less water, power and leaching agents to get a higher grade, while reducing the tailings.

Wheaton Precious Metals president and CEO Randy Smallwood, a proponent of innovation in the mining industry, agrees these are important drivers for technology adoption.

The company’s Future of Mining Challenge awarded ReThink Milling $1m (C$1.37m) for its innovative milling technologies, which are estimated to reduce the energy use in comminution by more than half.

However, as Steenkamp notes, for the bigger players, investing in cutting-edge technology is not a high priority as most are still operating at margins that mean they don’t need to invest in high-cost equipment. For the small and medium operators, the cost often precludes them from adopting it.

Although some industries, such as the diamond sector, are more used to using different types of technology and will therefore likely have more confidence to adopt, he adds.

“At the end of the day, you have got to have someone that is willing to be a participant and then be willing to share that data into the market, which can then convince your larger players to start adopting it,” he says.

Miljak acknowledges there is general “inertia” within the industry when it comes to piloting and adopting new technologies but says there are “some really good innovation teams and individuals that are really trying to make a difference in the industry”.

“My view is it will be an important lever for the future, if we can get a whole raft of technologies and innovators into this mining space to transform mining into manufacturing-type process, where real-time data can keep people safe and productivity high. That is the longer-term vision of CSIRO,” he concludes.