There were 81 deals recorded involving top mining industry operations and technologies companies in the three months to April, with a number of high profile partnership, venture financing, equity offering, asset transaction, debt offering, acquisition, and private equity deals. That’s according to GlobalData’s Financial Deals database, which tracks market activity across a variety of sectors and deal types.

The deals below only include those that have been completed – so excludes rumours or those that have been agreed but not yet executed.

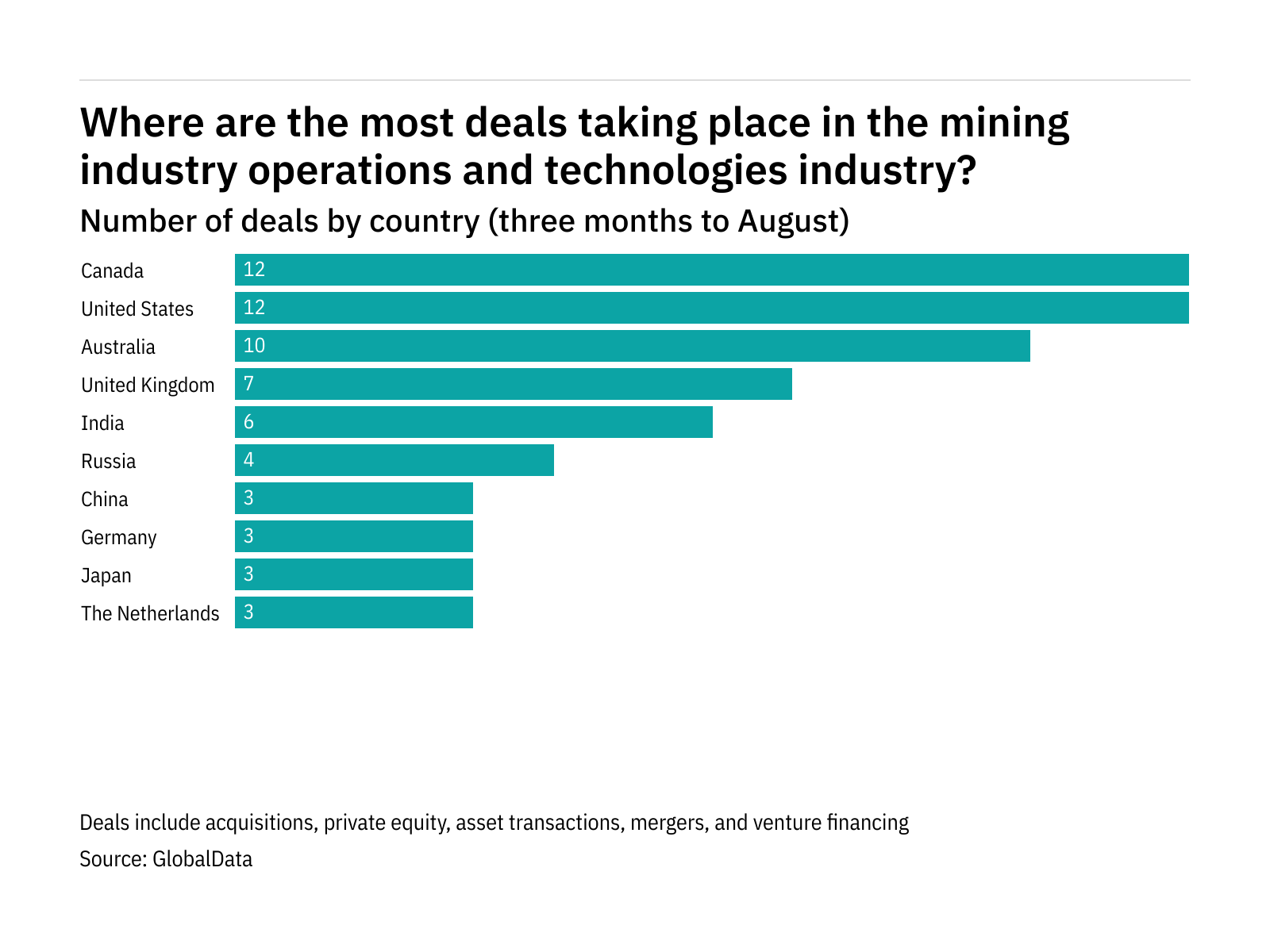

The figures, which cover the top mining industry operations and technologies companies, show the markets in the US and Canada to be the most active, with 12 deals taking place in each region over the last three months.

Below are some of the largest completed deals to have taken place in the last quarter.

Acquisitions

Rio Tinto plans to acquire 49% Stake in Turquoise Hill Resources – 14 March ($2.7bn)

Rio Tinto, a UK-based mining and metals company, has made a non-binding proposal to acquire 49% stake in Turquoise Hill Resources Ltd, a Canadian mineral exploration and development company.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUnder the terms of the proposed transaction, Turquoise Hill minority shareholders would receive C$34 in cash per Turquoise Hill share, representing a premium of 32% to Turquoise Hill's last closing share price on the Toronto Stock Exchange. This proposal would value the Turquoise Hill minority share capital at approximately $2.7bn.

The proposed transaction follows the recent comprehensive agreement reached between Rio Tinto, Turquoise Hill, and the Government of Mongolia to move the Oyu Tolgoi project forward, reset the relationship between the partners and approve commencement of underground operations.

Credit Suisse, RBC Capital Markets, and Rothschild & Co are acting as financial advisors and McCarthy Tetrault LLP and Sullivan & Cromwell LLP are acting as legal advisors to Rio Tinto.

Exxaro Resources and CNIC may acquire 60% Stake in Lekela Power from Actis – 18 February ($2bn)

Exxaro Resources, a South African miner and CNIC Inc, intends to acquire 60% stake in Lekela Power, a renewable-generation firm, from Actis LLP, a private equity company, according to people with knowledge of the matter.

76KK acquires Mitsubishi Corp.-UBS Realty from Mitsubishi Corporation and UBS Asset Management – 17 March ($1.96bn)

76KK, a Japan-based holding company and a subsidiary of KKR & Co, a US-based private equity firm, has acquired Mitsubishi Corp-UBS Realty Inc, an asset manager established as a joint venture from Mitsubishi Corporation and UBS Asset Management (Americas) Inc, for a cash consideration of ¥230 billion ($2bn).

Simpson Thacher & Bartlett LLP and Nagashima Ohno & Tsunematsu served as legal advisers to KKR and Sumitomo Mitsui Banking Corporation served as financial adviser to KKR.

Going forward, the asset manager, which was previously called MC-UBSR, will operate under the name 'KJR Management', effective immediately.

76KK will also acquire the units in JMF and IIF currently held by Mitsubishi at market price, thereby strengthening the alignment of interest between KKR and the unitholders of JMF and IIF.

UBS Investment Bank acted as exclusive financial advisor to Mitsubishi, UBS-AM and MC-UBSR.

Nishimura & Asahi served as legal advisers to Mitsubishi. Mori Hamada & Matsumoto served as legal advisers to UBS-AM. Anderson Mori & Tomotsune served as legal advisers to MC-UBSR.

Atlas Copco to acquire Lewa and Geveke from Nikkiso for $731.1m – 14 March ($731m)

Atlas Copco, a provider of industrial productivity solutions, has agreed to acquire LEWA GmbH, a manufacturer of diaphragm metering pumps, process pumps, and complete metering systems, and Geveke, a company that distributes compressors and engineers advanced and complex process pump installations, from Nikkiso, company providing specialized pumps and systems in the industrial business, for a combined purchase consideration of €670m. The company will fund the consideration from its existing funds.

LEWA is a manufacturer of diaphragm metering pumps, process pumps, and complete metering systems. LEWA offers industry-specific high-quality pump solutions for a wide range of industries. Geveke distributes compressors and engineers advanced and complex process pump installations.

Baker McKenzie is acting as legal advisor to Nikkiso in the transaction. The transaction is expected to be completed during the second quarter of 2022, subject to regulatory approvals.

Robert Hessen, CEO of Geveke, said: "Being part of the Atlas Copco family gives Geveke enormous opportunities to further grow the business, internal job opportunities for our employees, and to serve our existing and potential customers better. We are delighted to be part of the Atlas Copco group."

Mikael Andersson, president of Atlas Copco´s Power and Flow division, said, “We are happy to welcome our new colleagues from Geveke to the Atlas Copco's family. Geveke has a strong quality reputation, engineering, and application know-how, and it will be a good fit in the Atlas Copco's business strategy for industrial pumps.”

Western Mining to sell 27% stake in Qinghai Dongtai Jinel Lithium Resources – 28 February ($529m)

Western Mining has announced plans to sell 27% stake in Qinghai Dongtai Jinel Lithium Resources for consideration of CNY3,342m ($528m). Both the companies are based in China.

Venture financing

Britishvolt to raise $270.59m in Series C venture funding – 15 February ($271m)

Britishvolt, a UK-based electric vehicle battery startup, has to raise £200m in a Series C funding round from Bank of America, Citibank, Peel Hunt, and Glencore.

Under the deal, Glencore invested £40m in Britishvolt. Lazard acting as financial advisor to Britishvolt in the transaction.

Viatec secures Series B funding – 01 February

Viatec, a US-based manufacturer of plug-and-play electronic power take-off systems that support the electrification of utility fleets, has secured a series B funding round led by Terex Corporation, with participation from Duke Energy.

In conjunction with this investment, a Terex representative will fill one of five seats on Viatec's board.

Private equity

Aymium raises funds in Series B private equity financing – 01 March

Aymium, producer of renewable biocarbon products, has raised funds in Series B private equity financing. The financing was led by Sandton Capital, Nippon Steel Trading, Steel Dynamics, and Rio Tinto. With this investment, the total investment in the company is over $200m.

Proceeds from the financing will be used to advance construction of Aymium's newest production facility in Williams, California and another in the Pacific Northwest. The new facilities will employ over 125 people combined and will be operational in 2023. Production from both plants is contracted through 2037 and is projected to reduce over 1.4 million tons per year of CO2 equivalent to removing over 300,000 cars per year from the road.

Credit Suisse Securities (USA) acted as exclusive placement agent in connection with Aymium's Series B financing. Latham & Watkins acted as legal counsel to Aymium.

Asset transactions

Metals Acquisition to acquire CSA copper mine from Glencore for $1.1bn – 17 March ($1.1bn)

Metals Acquisition has entered into a definitive sale and purchase agreement with Glencore to acquire CSA for total consideration of $1.1bn (consisting of $1.05bn of cash and $50m of common equity) plus a 1.5% copper NSR.

The transaction will be effected by the acquisition by MAC's 100%-owned subsidiary, Metals Acquisition (Australia), of the issued share capital of Cobar Management Pty Limited, a 100%-owned Glencore subsidiary which owns CSA.

The transaction has been unanimously approved by the board of directors of Metals Acquisition, and is expected to be completed in 2022, subject to the approval of the company's shareholders and other customary closing conditions, including regulatory approvals.

Citi is serving as financial advisor and Squire Patton Boggs and Paul Hastings are serving as legal advisors to Metals Acquisition. Citigroup Global Markets, Canaccord Genuity, and Ashanti Capital have been engaged as placement agents in connection with an equity raise.

ArcelorMittal to acquire 80% stake in hot briquetted iron plant for $1bn – 14 April ($1bn)

ArcelorMittal, an integrated steel and mining company, has signed an agreement to acquire an 80% shareholding in a hot briquetted iron (HBI) plant located in Corpus Christi, Texas, from Voestalpine, an Austria-based global manufacturer of high-quality steel products.

The transaction values the Corpus Christi operations at $1bn and closing is subject to customary regulatory approvals.

In parallel with the transaction, ArcelorMittal has signed a long-term offtake agreement with Voestalpine to supply an annual volume of HBI commensurate to Voestalpine's equity stake to its steel mills in Donawitz, Austria and Linz, Austria.

Highland Gold Mining to acquire 100% stake in Russian assets of Kinross Gold – 05 April ($544m)

Highland Gold Mining, a UK-based mining company, has signed an agreement to acquire 100% stake in the Russian assets of Kinross Gold Corporation and and its affiliates for C$680m in cash.

Kinross is a Canada-based gold mining company.

As part of the transaction, Kinross will receive a total of C$400m in cash for the Kupol mine and the surrounding exploration licenses, which includes payment of C$100m upon closing, as well as additional payments of $150m before the end of 2023, $100m before the end of 2024, and C$50m before the end of 2025. Kinross will also receive a total of C$280m in cash for its Udinsk project, which includes payments of C$80m before the end of 2025, C$100m before the end of 2026, and C$100m before the end of 2027.

The deferred payments are secured by an extensive security package that includes share pledges, financial guarantees, and an escrow account. All payments under the agreement are payable in US dollars.

The transaction includes the acquisition of the Kupol and Dvoinnoye operating mines, exploration assets including the Chulbatkan project, as well as associated infrastructure. The transaction is subject to the approval of the Russian Government and the finalisation of certain ancillary agreements.

ArcelorMittal to invest $476m in solar and wind power projects in India - 22 March ($476m)

ArcelorMittal, a Luxembourg-based steel manufacturing company, has agreed to invest C$600m in the construction and development of solar and wind power projects in Andhra Pradesh, India. The combined installed capacity of the projects will be 975MW. The investment per megawatt will be $400,000.

The project will combine solar and wind power and be supported by Greenko's hydro pumped storage project, which helps to overcome the intermittent nature of wind and solar power generation.

The project will be owned and funded by ArcelorMittal. Greenko will design, construct, and operate the renewable energy facilities in Southern India. Project commissioning is expected by mid-2024.

ArcelorMittal's joint venture company in India, ArcelorMittal Nippon Steel India (AM/NS India), will enter into a 25 year off-take agreement with ArcelorMittal to purchase 250MW of renewable electricity annually from the project. This will result in over 20% of the electricity requirement at AM/NS India's Hazira plant coming from renewable sources, reducing carbon emissions by approximately 1.5 million tonnes per year.

The project offers AM/NS India the dual benefits of lower electricity costs and lower CO2 emissions, and it also provides an attractive return on investment for ArcelorMittal.

Asante Gold to acquire 90% interest in Chirano Gold Mine from Kinross Gold - 02 April ($225m)

Asante Gold has entered into a share purchase agreement to acquire the 90% interest in the Chirano gold mine, from Kinross Gold for a total consideration of $225m. Both the companies are based in Canada. The Ghanaian Government retains a 10% carried interest in Chirano.

The upfront consideration for the Chirano acquisition will be comprised of $115m in cash and $50m in common shares of Asante based on the 30-day volume-weighted average price of the Asante shares prior to closing of the Chirano acquisition and provided the issuance of the Asante shares will not result in Kinross exceeding a 9.9% share ownership in Asante. Kinross will also receive a total deferred payment of $60m in cash, with 50% payable on the first anniversary of closing and the balance payable on the second anniversary of closing. If the 9.9% share ownership limit is reached, the remainder of the $50m in share consideration will be paid by increasing the deferred cash payments in equal portions. Kinross has agreed that it will hold its Asante shares for at least 12 months following the closing.

The transaction is expected to be completed on or around 31 May 2022. The Government of Ghana has issued a letter of no objection to the change of control of Chirano and the transaction is not subject to a financing condition.

Canaccord Genuity and Durose Asset Management are acting as financial advisors to Asante, with Bennett Jones acting as legal advisor for the transaction.