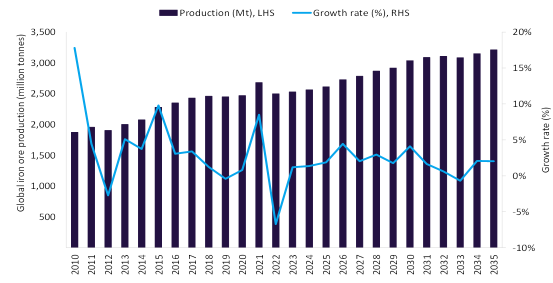

Global iron ore output is projected to increase by 1.9% in 2025 to reach 2,612.7 million tonnes (mt), up from 2,564.4mt in 2024. The modest growth is despite a softening of production in China due to weak domestic steel demand and a prolonged slowdown in construction and infrastructure activity. This shortfall has been largely offset by a rise in production from India, Australia, Brazil and emerging producers such as the Republic of Guinea, Iran and Liberia.

Looking ahead, the global iron ore output is projected to grow by 4.5% in 2026 to 2,728.9mt. This will be largely supported by ongoing project ramp-ups in the Republic of Guinea and Australia, as well as expansions in Brazil. This will be followed by the ongoing expansions in India, Liberia, and Iran, which will further supports growth trajectory. Meanwhile, China’s output is expected to remain flat at 2025 levels with just 0.5% marginal growth.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The Republic of Guinea is an emerging player, with first commercial output from the Simandou (Blocks 1 and 2) and (Blocks 3 and 4) projects in Q4 2025, supporting a growing role through 2035. The country’s iron ore output is expected to reach 35.4mt in 2026, up from an anticipated 2.9mt in 2025, supported by the ongoing ramp-ups at the Simandou projects.

In Australia, the world’s largest producer, output is anticipated to grow by 2.6% in 2026, fuelled by the ongoing ramp-ups at MRL’s Onslow, Rio Tinto’s Western Range, and Fortescue’s Iron Bridge projects. Looking ahead, Australia’s production is expected to climb to 1.1 billion tonnes by 2035, enabling the country to maintain its position as the world leader in iron ore production.

In Brazil, growth in 2026 will be primarily driven by Vale, the country’s largest producer, which is targeting 340mt-360mt by 2026. Expansions at other major mines, including Gerdau Mining’s Miguel Burnier and CSN Mineracao’s Casa de Pedra, will further boost the country’s output. India, which accounted for 11.3% of global iron ore production in 2024, is expected to be the largest driver of global supply growth in 2026, with output anticipated to rise by 3.6% to 318.5mt. This surge will be underpinned by strong domestic steel demand, significant investment momentum, and a stable policy environment.

India’s push to scale its steelmaking capacity to 300mt by FY2030–31 underscores the need for reliable iron ore availability, further solidifying its strategic role. Additionally, the adoption of green steel technologies, including DRI and hydrogen-based routes, positions iron ore as a key commodity in the country’s long-term decarbonization agenda.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Iron Ore Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2035

Liberia’s production is poised to reach 18.0mt in 2026 from just 5.2mt in 2024, supported by ArcelorMittal’s Nimba mine expansion, which will raise concentrate production from 5mt of direct shipping ore to 20mt. In Iran, production growth will be driven by development at the Sangan mine and capacity expansions at Choghart and Chadormalu mines.

Global iron ore production is expected to grow steadily at a compound annual growth rate (CAGR) of 2.1% over the forecast period (2025-2035) to reach 3,213.2mt in 2035, as these new projects reach full production capacity.