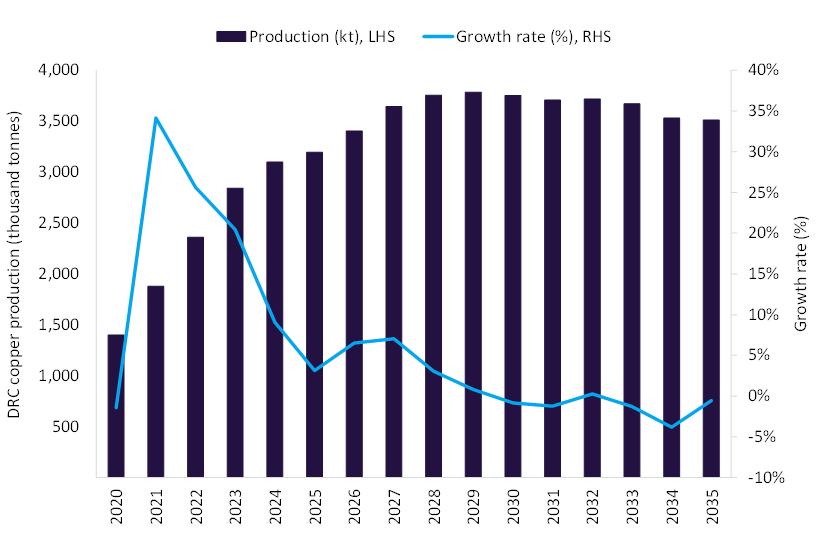

The Democratic Republic of Congo’s (DRC) copper production is expected to grow moderately in 2025, supported by efficiency gains at key operations such as the Mutanda, Tenke Fungurume Mining (TFM) and Kinsevere, although this growth will be partially offset by production disruptions at the Kamoa-Kakula complex following temporary flooding.

In 2026, output is forecast to increase strongly with an annual growth rate of 6% to reach 3,404.1kt, as operations normalise at Kamoa-Kakula, restoring volumes lost in 2025 and enabling the Phase 3 expansion to deliver its planned capacity increases, while the Mutanda, TFM and Kinsevere mines are expected to maintain steady performance, collectively driving a significant uplift in national production.

Additional upside in 2026 will come from the Mutoshi project, which commenced operations in September 2025, alongside stable output from the Kipushi mine, which entered commercial production in 2024. Medium-term growth will be further underpinned by continued process optimisation, favourable ore grades across several mid-tier asset and ongoing investments in expansions and mine-life extensions, including plans to increase Kamoa-Kakula’s capacity to 600ktpa and throughput and quality enhancements at TFM.

Chinese mining and smelting companies are expected to remain central to this growth trajectory through sustained investment, accelerated expansion timelines and deeper integration across the copper value chain, supported by government policies aimed at strengthening domestic participation and boosting copper output and exports.

However, the DRC’s copper output is expected to gradually enter a decline phase from 2029, as several large deposits are approaching depletion and high-grade zones in key mines are becoming exhausted. While ongoing ramp-ups and near-term expansions will support short-term production, output is projected to trend downwards as operations transition from peak to declining ore grades.

Overall, during the period from 2025 to 2035, copper output is forecast to increase at a modest compound annual growth rate, reaching around 3,511kt by 2035, reflecting strong medium-term recovery followed by structural supply constraints in the later years of the forecast.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData