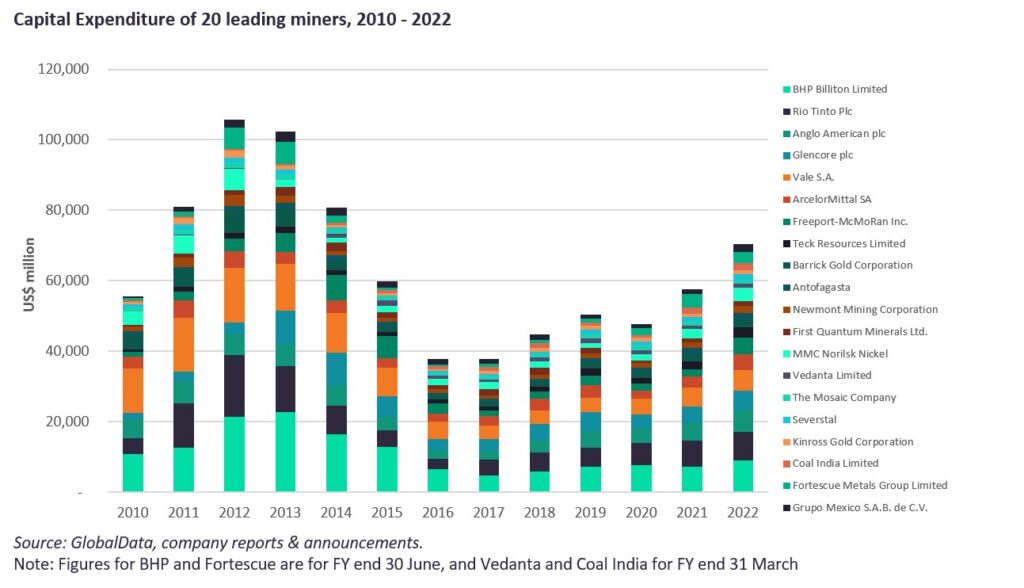

After rising by 20% in 2021, the capital expenditure (Capex) of 20 leading miners is expected to increase even further in 2022, reaching $70.4bn, a rise of 22% and the highest level since 2014. As well as investment in growth and sustaining Capex, increasing investment is being made into decarbonization efforts as companies strive to achieve short-term targets – typically around a 30% reduction in greenhouse gas (GHG) emissions by 2030 – and their long-term net-zero targets.

Amongst the leading spenders is BHP, who has an estimated spend of $9bn in the financial year to the end of June 2022. Of the total, $6.7bn is for minerals and $2.3bn for petroleum, and it includes spending on the $5.7bn (C$7.5bn) Jansen Stage 1 potash project. Construction is estimated to take six years with first ore targeted in 2027.

Rio Tinto, having previously estimated spend of $7.5bn, has increased its 2022 Capex guidance to $8bn. It has stated its ambitions are to then spend between $9bn-$10bn per year in 2023 and 2024, including sustaining capital of $3.5bn per year, with $1.5bn of this accounted for by Pilbara Iron Ore. In order to achieve its GHG emission reduction targets, it has plans for $7.5bn of direct investments to lower emissions between 2022 and 2030 and is also targeting $3bn per year in growth capital expenditure in commodities critical to energy transition.

Anglo American is predicting a spend of between $6.2bn and $6.7bn in 2022, up from $5.2bn in 2021, when the investment was impacted by Covid-19-related delays, while Vale is expecting to spend $5.8bn in 2022, up from $5.4bn in 2021.

Glencore has shifted $0.5bn from 2021 to 2022, with 2022 Capex guidance of $5.3bn, up from $4.5bn in 2021. It is then expecting a spend of $4.7bn in 2023 and $4.4bn in 2024. Its key expansionary capital projects over the period from 2022 to 2024 are at the Collahuasi desalination, Zhairem ramp-up, Raglan Phase 2 and Onaping Depth project.

A significant increase in spending is expected in 2022 by Freeport-McMoRan. Of the total spend of $2.1bn in 2021, $1.25bn was for major mining projects and $0.2bn for the Indonesia smelter projects 2021. In 2022, capital expenditures are expected to reach $4.7 bn, including $2.0bn for major mining projects and $1.4bn for the Indonesia smelter projects. Other significant spend is expected at ArcelorMittal, up from $3.0bn to $4.5bn, including $0.2bn in carry-over from 2021 and $0.3bn of decarbonization Capex, and approximately $3.1bn at Teck Resources (C$3.9bn), net of partner contributions and project financing and including capitalized stripping, an increase of approximately 33%. A sizable proportion of this will be for the Quebrada Blanca 2 project, which was 77% complete at the end of 2021 and is expected to achieve first production in the second half of 2022. Lastly, a substantial increase in spending has been indicated by Norilsk Nickel at $4bn in 2022 compared with $2.8bn in 2021. It also plans to spend between $4.0bn and $4.5bn per year from 2023 to 2025.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData