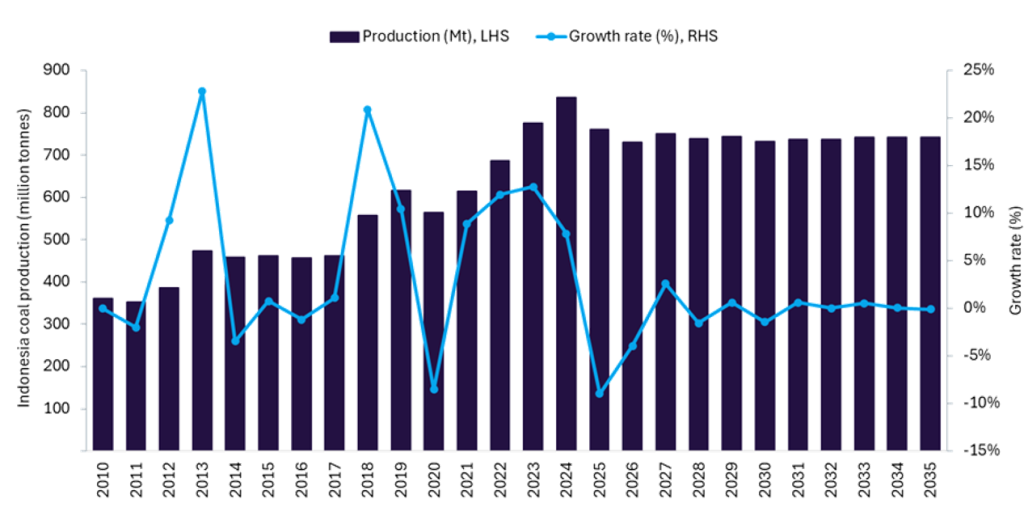

Indonesia’s coal production is expected to decline by 9% in 2025, falling to around 761 million tonnes, primarily due to weak international prices, inventory overhangs, and operational disruptions across several major mines. Production at PT Arutmin Indonesia (AGM) declined as efficiency measures and logistics optimisation temporarily reduced mining volumes, while the absence of output from PT Firman Ketaun Perkasa (FKP) following its RKAB quota limited the national supply. These mine-level constraints collectively outweighed incremental gains from selected ramp-up projects.

In 2026, Indonesia’s coal output is forecast to remain under pressure, as structural challenges continue to dominate the supply outlook. Several mature operations are approaching the end of their mine life and operating under tighter regulatory and environmental constraints, limiting their ability to recover volumes. While stronger RKAB allocations and incremental support from the power sector are expected to provide some relief, they are insufficient to fully offset declining production from depleted assets. Additionally, persistently soft export demand and price-sensitive buying from key Asian markets are likely to keep producers cautious on output expansion.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Operationally, mines such as AGM, PT Sungai Danau Jaya, and PT Tanah Bumbu Resources are expected to maintain disciplined production strategies focused on margin preservation rather than volume growth. At the same time, the phased closure of several mature mines will continue to cap any near-term upside, reinforcing a broadly subdued production environment in 2026.

Looking ahead, Indonesia’s coal production is forecast to continue its gradual downward trend through 2035, driven by ongoing mine depletion, tightening environmental regulations and structural shift towards renewable energy domestically and across key export markets. While selective projects such as Bunyu (2025), PT Samantaka Batubara and PT Karya Usaha Pertiwi (2026) and the Indominco-Mandiri mine (2029) will provide localised support, these additions are unlikely to fully offset broader declines, anchoring Indonesia’s coal output on a structurally lower trajectory over the forecast period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData