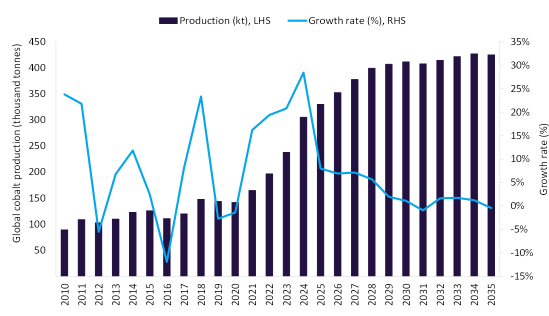

Cobalt production has seen significant growth in recent years, driven by increasing demand and substantial investments from both the government and private sectors. Global cobalt production is estimated to have grown rapidly in 2025 to reach 330 kilotonnes –a notable 8.0% growth, driven by the strong output from Indonesia and the DRC. The DRC remains the dominant player in the global cobalt market and is estimated to account for around 72% of the global output in 2025, followed by Indonesia with 14.9%.

Looking ahead, global cobalt output is anticipated to grow further by 6.9% to reach 352.8 kilotonnes in 2026, supported by the rising supply from the two largest players, the DRC and Indonesia.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The DRC continues to dominate global cobalt supply, with its leading position underpinned by the country’s vast cobalt resources and long-standing strategic partnerships with Chinese mining companies, which have enabled large-scale mine development and sustained output growth.

Cobalt mine output in the DRC is projected to grow by 4.4% to reach 247.7 kilotonnes in 2026. Supply growth will be driven primarily by higher-grade feed from Glencore’s Mutanda and the ramp-up of the Musonoi underground project, which started production in September 2025. The Musonoi project, jointly owned by Jinchuan Group (75%) and Gecamines (25%), has a production capacity of around 7.4 kilotonnes of cobalt and an estimated mine life of up to 14 years, strengthening the country’s medium-term supply outlook. The production trajectory is further supported by consistent, stable output from China Molybdenum’s (CMOC) major operating assets in the DRC, particularly the Kisanfu (KFM) and Tenke Fungurume Mining (TFM) operations, which remain key contributors to national cobalt production. Despite short-term market headwinds, these operational developments are expected to sustain positive production momentum.

Meanwhile, Indonesia, once a minor player in the global cobalt market, has emerged as a significant force, largely driven by investment in high-pressure acid leach (HPAL) facilities. In 2026, the country is expected to produce 59.8 kilotonnes of cobalt, a 21.2% increase over the previous year, primarily driven by the planned commencement of new projects such as the Pomalaa and Morowali in 2026. In addition, the ongoing ramp-up of Zhejiang Huayou’s Huafei Cobalt-Nickel Project, which started production in Q1 2024, along with the ongoing expansion and commissioning of additional HPAL production lines at Ningbo Lygend Mining’s PT Halmahera Persada Lygend Project, will also further support the country’s growth trajectory in 2026.

Among others, Australia and Canada are expected to contribute larger shares of production. They accounted for only 2.6% of the global share in 2024, but this figure is projected to increase to 8.1% by 2035. These countries, with their vast mineral resources and strong mining industries, are well-positioned to capitalise on this growing demand and are expected to contribute to global production, albeit on a smaller scale. Their output is primarily as a byproduct of nickel or copper mining, with scheduled commencement of several new projects through to 2035. In addition, government policies that supports critical minerals are also favouring the countries’ cobalt industries.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Cobalt Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2035

Canada’s government and its provincial partners have allocated more than $46bn toward creating a domestic EV battery supply chain, including dedicated funding for cobalt-related initiatives. Canada also provides a 30% tax credit on the production of cobalt as part of its critical minerals strategy.

Meanwhile, the Australian government is actively attracting investments in the critical minerals industry through the Critical Minerals Strategy 2023–2030 and the “Future Made in Australia” plan. These include significant funding and tax incentives (a 10% production tax incentive for processing and refining costs) to encourage private investment in the critical minerals sector.

Russia, despite its substantial cobalt reserves and position as the third-largest producer currently, is poised to lose its global prominence due to escalating geopolitical tensions. Consequently, cobalt production in Russia is projected to stagnate at current levels until the end of this decade. This will be due to the absence of new projects with high chances of coming online.

Over the forecast period, global cobalt production is expected to grow at a CAGR of 2.6% to reach 425.2 kilotonnes in 2035.