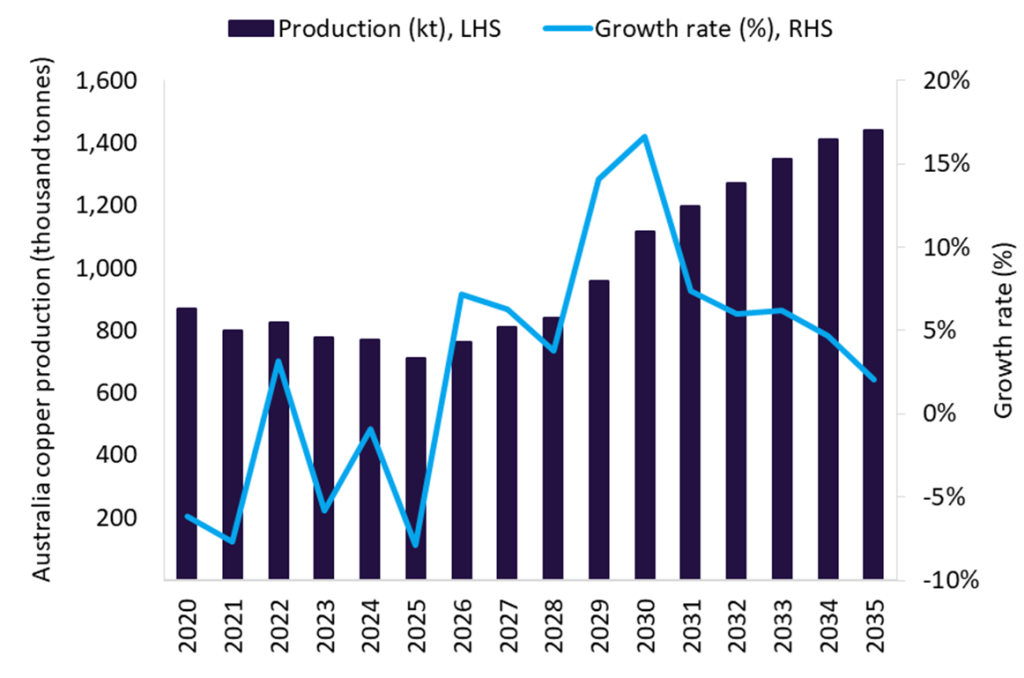

Australia’s copper production is forecast to decline in 2025, falling to 710 kilotonnes (kt), primarily due to operational disruptions at key mines. The permanent closure of the Mount Isa mine, ongoing panel cave development at Cadia, waste-stripping activities at Boddington, and scheduled maintenance shutdowns at Ernest Henry are expected to constrain output. These challenges are compounded by ore depletion at mature mines such as Nova Bollinger, Osborne, and Deflector, which will collectively weigh on the country’s copper production.

In 2026, copper output is projected to recover as operating conditions normalise and major mines return to steady-state production. Cadia and Boddington are expected to resume regular output following the completion of development and maintenance activities while the Whim Creek project is scheduled to commence operations in late 2026, providing incremental support to national supply. The recovery will also be underpinned by improving operational efficiency across existing assets, as capital programmes implemented during 2024–2025 begin to deliver productivity gains. Beyond 2026, Australia’s copper production outlook remains positive, supported by a robust pipeline of brownfield expansions and greenfield developments. Through to 2035, output growth will be driven by projects backed by significant capital commitments from major producers, including BHP, with expansions at the Olympic Dam and other mines supporting sustained medium- to long-term supply growth.

Overall, Australia’s copper production is forecast to grow at a CAGR of 7.3% between 2025 and 2035, reaching 1,432.7kt by the end of the period. Growth through the forecast period will be supported by the commissioning of projects such as the Nifty open pit, Jervois Copper, Cadia Expansion 2, Elizabeth Creek, and the large-scale Eva Copper project, reinforcing Australia’s position as a key global copper supplier amid rising energy-transition-driven demand.