Global manganese production remains heavily concentrated in Africa, with South Africa, Gabon, and Ghana collectively accounting for a substantial share of total output. This concentration reinforces Africa’s strategic role in the global manganese supply chain and highlights the sector’s structural dependence on a limited number of producing regions.

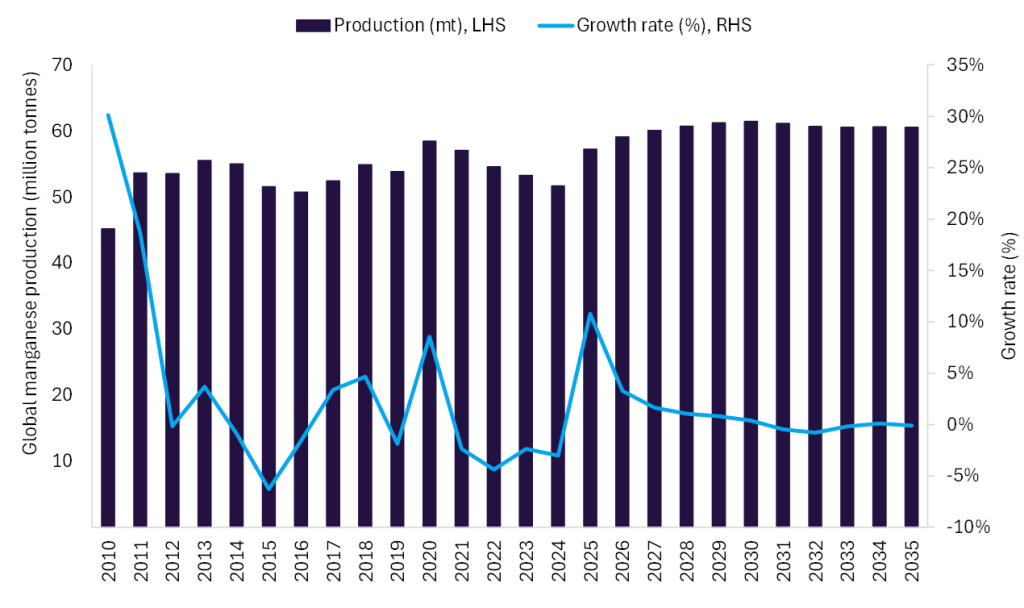

In 2025, global manganese production is estimated to have increased by 10.8% to 57.3 million tonnes (mt), primarily supported by supply growth from Ghana and Australia. Ghana’s production growth reflects the continued ramp-up of operations at the Nsuta mine, while Australia’s recovery is linked to the phased resumption of mining at the Groote Eylandt mine from May 2025. Operations at Groote Eylandt were suspended in March 2024 following disruptions caused by Tropical Cyclone Megan, and their restart is expected to materially strengthen Australia’s supply contribution in 2025.

Looking ahead to 2026, global manganese output is forecast to rise by a further 3.3% to 59.1mt, largely underpinned by Groote Eylandt reaching full production capacity following its 2025 restart. This ramp-up is expected to be a key driver of incremental global supply growth in Australia during the year.

In contrast, production from other major suppliers, including South Africa, Gabon, and Ghana, is expected to remain broadly flat, reflecting the absence of significant new capacity additions. However, this stability is particularly significant against the backdrop of supply disruptions elsewhere. The suspension of mining at Kazakhstan’s Kazmarganets mine since December 2023 due to resource depletion, combined with ongoing geopolitical disruptions affecting production in Ukraine, has tightened supply from non-African regions.

As a result, global markets are increasingly reliant on output from South Africa, Gabon and Ghana to meet sustained demand, especially from the steel and electric vehicle battery sectors. Over the forecast period (2025-2035), global manganese production is expected to grow marginally with a compound annual growth rate (CAGR) of just 0.6% to 60.6mt by 2035.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData