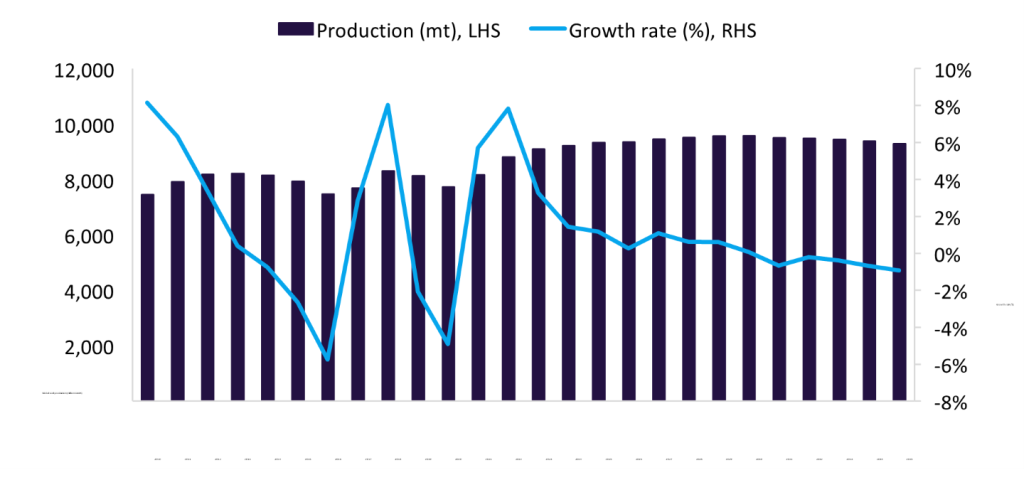

Global coal production in 2026 is expected to remain flat with an annual growth of 0.2% to 9,355.8 million tonnes (mt), marking a slower pace of growth compared with 2025, as structural pressures intensify across major producing regions. The outlook reflects continued weakness in China, persistent oversupply conditions in Indonesia and the US, and sustained price softness across the value chain, which together limit incentives for large-scale production expansion.

China’s coal output is projected to decline by 0.8% in 2026, the first fall since 2016, driven by excess supply, stagnant downstream demand, and elevated inventory levels throughout the domestic market. Despite coal’s strategic role in ensuring energy security, weaker electricity demand growth and improved renewable generation capacity are expected to reduce coal burn. Elevated stockpiles at power plants and ports are likely to keep production disciplined, even as prices remain under pressure.

This marks a structural shift rather than a cyclical slowdown, signalling a more constrained production environment going forward. Indonesia’s coal production is also expected to decline, falling by 3.9% in 2026 as inventory pressures, softer export demand, and weaker international prices continue to weigh on producers. Persistent oversupply in key Asian markets, particularly China and India, is likely to limit export volumes, while lower benchmark prices reduce margins and discourage output growth. Although domestic demand provides some support, it is insufficient to offset declining exports, especially for higher-cost producers operating under price caps.

In the US, coal production is forecast to contract by 5.1% in 2026 as utilities accelerate their transition away from coal-fired generation. Coal’s share in the national power mix, which fell below 20% in 2024, is expected to continue declining as renewable capacity expands and natural gas remains cost-competitive. The structural retirement of coal-fired power plants, combined with limited export growth, is expected to outweigh any short-term supply-side support, leading to continued production declines.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData