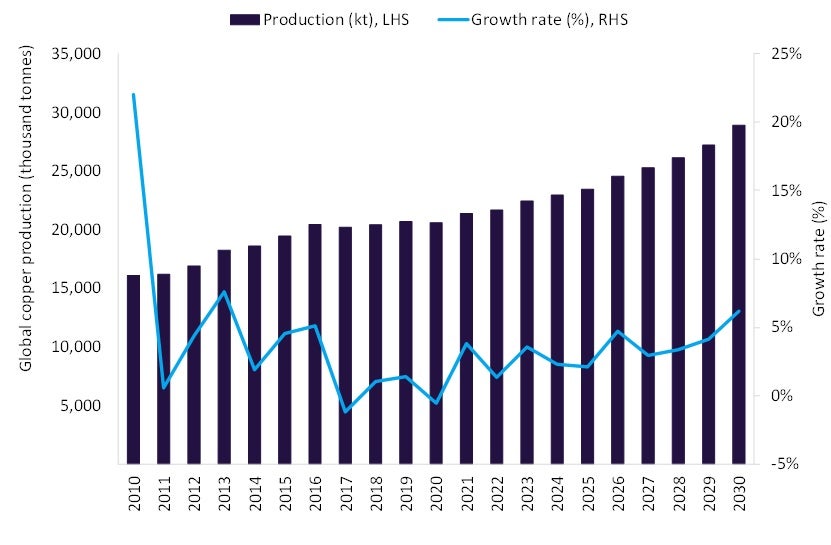

Global copper mine output is projected to grow by 2.1% in 2025 to 23.4 million tonnes, up from 22.9 million tonnes in 2024. The modest growth is primarily due to output declines in Australia and Indonesia, which will constrain global expansion. However, these shortfalls will be partly offset by production gains in Zambia, Chile, Mongolia, the Democratic Republic of the Congo (DRC), and Peru.

Zambia, which accounted for 4.2% of global copper output in 2024, is set to deliver the largest contribution to growth in 2025. Output is projected to rise by 19.2% to 937.5 kilotonnes, driven by the turnaround of ZCCM Investment Holdings’ Mopani mine. Investments are boosting underground development, modernising infrastructure, and improving financial health. Additional supply will come from Vedanta’s investment in the Konkola Copper Mine, signalling a new phase for Zambia’s mining sector.

In Mongolia, the ramp-up of the Oyu Tolgoi underground mine, one of the world’s largest copper mines, will underpin growth and provide a significant medium-term contribution.

In Peru, higher output from China Minmetals’ Las Bambas complex and the commissioning of the Chalcobamba pit in late 2024 are expected to lift production to 360-400 kilotonnes in 2025, up from 322.9 kilotonnes in 2024. Sustained performance at the Ferrobamba pit will also bolster growth.

The DRC’s output will rise with capacity expansions at CMOC’s Tenke Fungurume and Kisanfu projects, along with progress in the Heshima Hydropower Project that supports reliable energy supply.

Chile, holding a 23% share of global copper output in 2024, will see a modest 2% increase in output in 2025 as key operations recover. However, this will be offset by production declines at the Collahuasi and Los Bronces mines due to lower-grade ore and delayed infrastructure projects.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCanada will benefit from improved grades at Teck Resources’ Highland Valley Copper (HVC) mine and the approved HVC Mine Life Extension project, extending operations to 2046 and sustaining an average annual output of 132 kilotonnes.

However, this growth will be partially offset by planned lower production Indonesia and Australia, where combined output is expected to fall from 1.8 million tonnes in 2024 to 1.5 million tonnes in 2025.

In Indonesia, output at PT Freeport Indonesia’s (PTFI) Grasberg Block Cave mine, one of the world’s largest copper-gold deposits, is set to decline due to lower ore grades and reduced operating rates. Production was further disrupted in September 2025, when a large flow of wet material at one production block restricted access and temporarily suspended mining activities. Additionally, the Indonesian government’s ban on copper concentrate and anode sludge exports from 1 January 2025, has limited external shipments, though PTFI received a temporary six-month waiver due to delays in its new smelter caused by a fire. Meanwhile, Indonesia’s landmark free trade agreement with the EU, concluded on 23 September 2025, eliminates duties on over 90% of goods and is expected to enhance access to critical minerals such as nickel and copper. This may shape longer-term trade flows, even as near-term production remains constrained.

In Australia, output will be curbed by lower production at Newmont’s Cadia and Boddington mines. At Cadia, grades from the current panel cave are expected to decline in the second half of 2025 as the transition to the new PC2-3 cave progresses. At Boddington, production will be constrained by ongoing stripping in the North and South pits through 2026.

Looking ahead, global copper supply is expected to grow at a compound annual growth rate of 4.3% to reach 28.9 million tonnes by 2030.