Minerals produced in South East Asia play a crucial role in global manufacturing and the green energy transition, from Indonesia’s nickel to the dysprosium, terbium and other heavy rare earth elements (REEs) under threat in Myanmar. Collectively, Australian mining companies make the country the largest investor in mineral exploration across South East Asia and the Pacific.

To take advantage of their abundant untapped resources, countries across South East Asia have been actively revising policies and streamlining regulations to attract new foreign investment into their Mining Equipment, Technology and Services (METS) sector.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Add to that a revival in upstream mining across South East Asia, and it is clear that the region still holds an abundance of investment opportunities, and is likely to expand at a faster rate than traditional markets.

1. Indonesia: the “Primary Mining Market”

Indonesia’s retained status as South East Asia’s largest minerals producer has seen it designated as the “primary mining market” for Australian investment, according to Austmine’s METS Opportunities in Southeast Asia report.

The country has utilised a variety of trade policies to expand processing capacity and battery manufacturing – a strategy known as ‘downstreaming’ – to rapidly become the world’s largest supplier of nickel. Indonesian producers are targeting the electric vehicle battery market through global brands such as Tesla, Ford, LG and Hyundai.

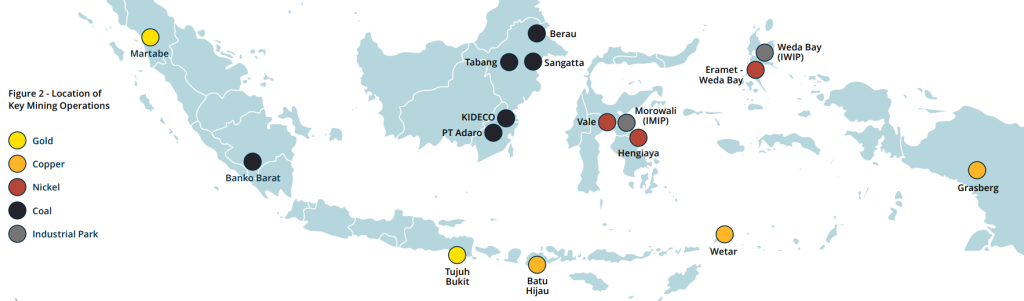

While there are also opportunities in the coal, copper and gold sectors, Indonesian nickel holds the widest array of opportunities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMore than 100 Australian METS companies are active in Indonesia – and all political and economic signs point to this number increasing.

After being re-elected in May 2025, Australian Prime Minister Anthony Albanese made the first customary visit to Indonesia just one day after swearing in his new cabinet. Albanese and Indonesian President Prabowo Subianto “recommitted to deepen bilateral and regional trade and investment ties”, which most onlookers interpreted as tit-for-tat investment in Indonesian nickel and Australian lithium, among other resources. Indonesia’s nickel sector has a well-established joint venture model, which Indonesian companies may look to emulate in Australia’s lithium projects.

Albanese and Subianto reaffirmed this partnership at an Indo-Australia summit in Canberra on 28 August 2025. Both premiers reportedly “noted the growth of the bilateral economic relationship in key areas, such as the energy transition and the strength of trade and investment, including in critical minerals and agriculture”.

This follows a previously agreed collaboration in February between the Indonesian Ministry of Energy and Mineral Resources and the Northern Territory of Australia to bolster the supply chain of critical and strategic minerals.

Specific sites of investment opportunity include the Indonesia Morowali Industrial Park and Indonesia Weda Bay Industrial Park, where much of the South East Asian nation’s nickel is processed and refined.

2. The Philippines: an untapped alternative to Indonesia?

Almost equally abundant to Indonesia in nickel, copper and gold, the Philippines has long been expected to blossom into a mining powerhouse – only for governmental policy changes and opposition by local communities to stall projects.

Australian investors with a genuine commitment to preventing mass deforestation, land degradation and water pollution may have a chance to explore the Philippines’ unknown swathes of mineral deposits, just 0.17% of which has been developed for production.

Even more promisingly, the Philippines is the fifth most mineralised country in the world. It boasts an estimated $1trn (57.18trn pesos) in untapped reserves of copper, gold, nickel, zinc and silver, according to Austmine’s report.

The Nickel Asia Corporation, Atlas Mining and other organisations primarily export Filipino nickel to China and Japan.

Meanwhile, Australian-headquartered Ten Sixty Four (formerly Medusa Mining) has made its mark in gold mining with its ownership of the Co-O Underground Mine through its subsidiary Philsaga Mining Corporation, producing an estimated 80,000oz of gold in 2024.

Since the Filipino Government removed certain restrictions around mining exploration, interest from Australia has grown in developing exploration technology such as drilling services, geochemical analysis, geographic information systems, geophysical surveys, remote sensing and satellite imagery, and 3D modelling.

“I think there is lots of room for further increase to our two-way trade [between Australia and The Philippines] and investment,” Australian Ambassador to the Philippines Hae Kyong Yu said in May, adding that the embassy had been getting more inquiries from Australian mining operators about trade and investment opportunities in the country.

3. Vietnam: a leader in bauxite and tungsten

State-owned enterprises (SOEs) still hold the keys to most of Vietnam’s major mining sites, but opportunities are widespread in a fragmented sector that also remains massively untapped.

Vietnam’s rich landscape contains more than 50 types of minerals, according to its Ministry of Natural Resources and Environment.

Notably, Vietnam ranks third in global bauxite reserves, with an estimated 3.7 billion tonnes, alongside significant deposits of coal, copper, gold, iron ore, REEs, tin and zinc.

The Dak Nong province in the central highlands region of Vietnam is set to become a major global player in the bauxite-aluminium supply chain, Austmine’s report predicts.

Vietnamese SOE Vinacomin has announced several major projects in Dak Nong, while private investors such as THACO and VPG have announced plans for integrated bauxite-alumina-aluminium operations. These developments offer great opportunities for Australian METS, especially for companies that can demonstrate a track record of working with bauxite and aluminium producers, such as Alcoa, Rio Tinto and South32.

Tungsten is another highly sought-after mineral that Vietnam holds in abundance.

Amid continued US-China trade wars, western officials have expressed concern that the Nui Phao tungsten mine and refinery in northern Vietnam may fall under Beijing’s control, Reuters reported on 29 August. Nui Phao is owned by Masan High-Tech Materials, a global leader in the production of tungsten products and a subsidiary of the Masan conglomerate, which has flagged its interest in selling the site.

Unease over allowing China to exert its influence creates a window for Australian companies to pitch themselves as a trustworthy alternative for investment.

4. The developing markets: Brunei, Cambodia, Laos, Malaysia and Thailand

By comparison, these five nations do not hold anywhere near as many significant mining opportunities for Australian companies, but they do offer a few hidden gems and a proportionate drop in competition.

Brunei is known for oil and gas exports, but with these set to dwindle over the coming years, analysts expect the small nation to turn to its deposits of limestone, sand and gravel. Australia was Brunei’s largest trading partner in 2023, accounting for 20.6% of exports. This relationship provides opportunities for Australian METS companies to develop a presence in Brunei, potentially diversifying their customer base to accommodate hydrocarbon projects.

Cambodia’s Ministry of Mines and Energy has stated that bauxite, copper, gold, iron ore, kaolin, lead, limestone, tin and zinc are amongst the country’s most prevalent resources. The first extraction of Cambodian gold began in 2021, with six companies now developing gold projects, including Australian-listed Emerald Resources NL. The company’s Okvau Gold open-pit mine is the largest project in Cambodia and is expected to produce more than 100,000oz of gold for 2024.

Mining accounts for 30% of foreign investment into Laos. However, its three major mines – Sepon, Phu Kham and PanAust – are approaching end of life in the next decade, leaving ample opportunity for prospecting into the impressive untapped reserves of bauxite, copper, gold, lead, silver and zinc.

Malaysia was a major producer of tin until the market collapsed in the 1980s. At its peak in the 1960s, Malaysia accounted for more than 30% of global tin demand. By 2023, it only accounted for 0.2% of global output.

The country’s mining industry remains fragmented and decentralised, with more than 356 quarries and 174 mines mostly operated by small-scale enterprises. Nonetheless, signs of movement include Australia’s Lynas Rare Earths recently signing a memorandum of understanding with Menteri Basar for the supply of mixed rare earth carbonate.

Thailand is the second-largest economy in South East Asia, but mining remains relatively insignificant. The Department of Mineral Resources recently reported more than 30 trillion tonnes of mineral reserves across more than 40 mineral types, and has identified several mining zones with significant development potential. These include feldspar, gold, gypsum, manganese, REEs, tin and tungsten – Thailand is the world’s sixth-largest producer of gypsum and feldspar, and the fifth-largest of REEs.

5. Singapore: the financial mining hub

Lacking the significant natural mineral reserves and resources of its South East Asian neighbours, Singapore may not represent a conventional, brick-and-mortar mining investment opportunity. However, it has positioned itself as a cornerstone of the mining investment industry due to its strategic location, powerful financial sector, tax incentives and robust legal framework.

BHP, Rio Tinto and Fortescue Metals are among the many Australian mining companies to have opened offices in Singapore, leveraging these logistically and geographically strategic benefits.

The country invests heavily in research and development for advanced materials, resource efficiency and sustainable mining technologies. It remains at the forefront of emerging digital technologies that impact the mining industry, such as blockchain and real-time emissions tracking.

Singapore also offers METS companies exposure to a plethora of venture capital firms operating in the market.