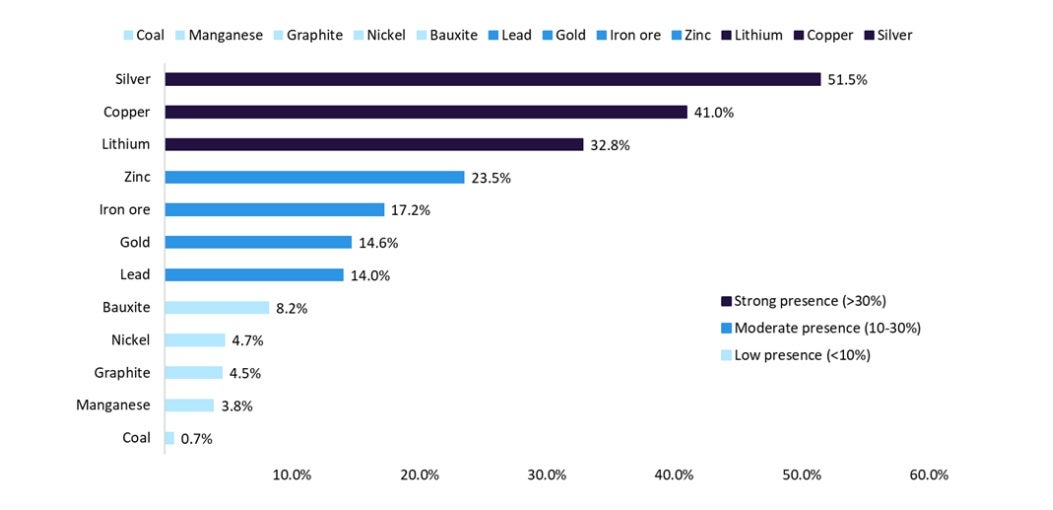

Latin America continues to play a pivotal role in the global mining landscape, underpinned by its vast resource base and growing production capabilities. In 2024, the region accounted for significant portions of global output across key

commodities, including over half of silver (51.5%), 41% of copper, nearly one-third of lithium (32.8%), and 23.5% of zinc. Countries such as Chile, Peru, Brazil, and Mexico remain industry anchors, supported by mature mining sectors, strong

foreign investment, and expansive infrastructure. However, emerging players such as Argentina, Ecuador, and Bolivia are fast evolving, driven by favourable geology and targeted investment strategies.

Copper and lithium stand out as the region’s most dynamic growth drivers. Copper production in Latin America rose by 3.5% in 2024 and is forecast to reach 40.5% of global output in 2025. Chile leads the charge, contributing nearly 59% of regional

output in 2024, followed by Peru (29.5%), Mexico (7.5%), and Brazil (4.1%). Continued investment in key projects such as Codelco’s Rajo Inca, Antofagasta’s Los Bronces/Andina expansion in Chile, and Peru’s upcoming Toromocho, Tia Maria, and

Chalcobamba mines will support regional copper production growth at a 3% compound annual growth rate (CAGR) through 2030. At the same time, Mexico’s copper output is expected to grow 4.2% annually, supported by new developments, including Media Luna and El Pilar.

The lithium sector is experiencing transformative growth, particularly in Argentina and Brazil. Latin America produced nearly 80 kilotonnes of lithium in 2024, with Chile accounting for over 68% of the regional total. However, Argentina is emerging as the fastest-growing producer, projected to grow at a 21.1% CAGR and surpass both China and Chile to become the world’s second-largest lithium producer by 2028. Key projects driving this surge include Hombre Muerto West and Sal de Vida. In Brazil, the expansion of Sigma Lithium’s Grota do Cirilo project alongside the Salinas and Barreiro mines will push the country’s regional market share from 11% in 2024 to 16.6% by 2030.

Despite growth, the region faces headwinds in other segments. Silver, lead, and zinc output are expected to decline due to widespread mine closures, notably in Mexico where silver production is forecast to shrink at a -2.9% CAGR through 2030. Gold output is similarly expected to dip before new projects come online. Yet, countries such as Brazil continue to dominate in bulk commodities such as iron ore, producing 97.5% of Latin America’s iron output and 16.7% of the global total in 2024, with output forecast to increase from 436.1 million tonnes in 2024 to 544.6 million tonnes by 2030.

Mexico is preparing to enter the lithium industry through the Sonora project, aiming for 35 kilotonnes of annual production from 2027 while also pursuing copper and rare-earth expansions. Other countries such as Ecuador and Colombia are tapping into their copper and gold potential, and Bolivia, despite holding the world’s largest lithium reserves at 23 million tonnes, faces technological and economic hurdles due to complex extraction requirements.

Policy environments remain a key determinant of investment flows. Countries such as Argentina and Guyana are moving towards investor-friendly frameworks with initiatives such as Argentina’s Incentive Regime for Major Investments

programme. In contrast, Colombia and Bolivia are shifting towards greater state oversight and stricter regulations, particularly concerning the environmental and social impact of mining. Ecuador, though legally supportive, must still address community resistance and permitting challenges.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.