The Maricunga lithium project is located at Salar de Maricunga in northern Chile. It is being developed by Lithium Power International (LPI), a lithium company based in Australia, through its subsidiary Minera Salar Blanco.

The project was originally developed by Salar Blanco, a joint venture of LPI (51.55%), Minera Salar Blanco (MSB, 31.31%), a stock company, and Bearing Lithium (17.14%), a mineral exploration company based in Canada. LPI gained 100% ownership of the project through two merger transactions with MSB and Bearing Lithium in December 2022. LPI is currently in the process of finalising funding pathways for the project development.

Maricunga project development details

A definitive feasibility for the project was released in January 2019, while an updated definitive feasibility study was published in January 2022 with initial development referred to as stage one. The updated study highlighted a 20-year project life with an estimated capital investment of $626.3m (509.32bn pesos).

The environmental impact assessment (EIA) report was submitted to the Chilean Environmental Assessment Service in September 2018 and approved in February 2020. MSB entered a non-binding memorandum of understanding (MoU) with Japanese conglomerate Mitsui to advance the development of the project.

The MoU incorporates potential off-take and funding rights for the stage one development of the project including potential participation, off-take and funding rights for future expansions, and new developments in Chile.

Location of Maricunga project

The Maricunga lithium project is located approximately 170km north-east of Copiapó in the III Region of northern Chile within the Lithium Triangle. The mine site encompasses an area of 2,563 hectares (ha) in Salar de Maricunga.

The project includes an additional 1,800ha site, approximately 8km north of the salt flat, for the construction of evaporation ponds, and process and plant facilities in the future.

Geology and mineralisation

The project is located in the Maricunga Basin in Salar de Maricunga within the pre-Andean depression. The Salar de Maricunga is a mixed-type salar comprising a halite unit in the central part with a thickness of up to 34m and borate and sulphate dominant facies towards the south-east. A clay-dominated lacustrine unit underlies the halite unit and is locally interbedded with silt and silty sands.

The Maricunga lithium project sits on a high-quality brine resource with high brine grades, flow rate, and drainable porosity and permeability. The Maricunga brine solutions are saturated with sodium chloride and have an average concentration of total dissolved solids of 311g/L with an average density of 1.20g/cm3.

Maricunga lithium project reserves

The proven and probable lithium reserves at the Maricunga lithium project are estimated at 479,000 tonnes (t) of lithium carbonate equivalent (LCE) containing 90,000t of lithium.

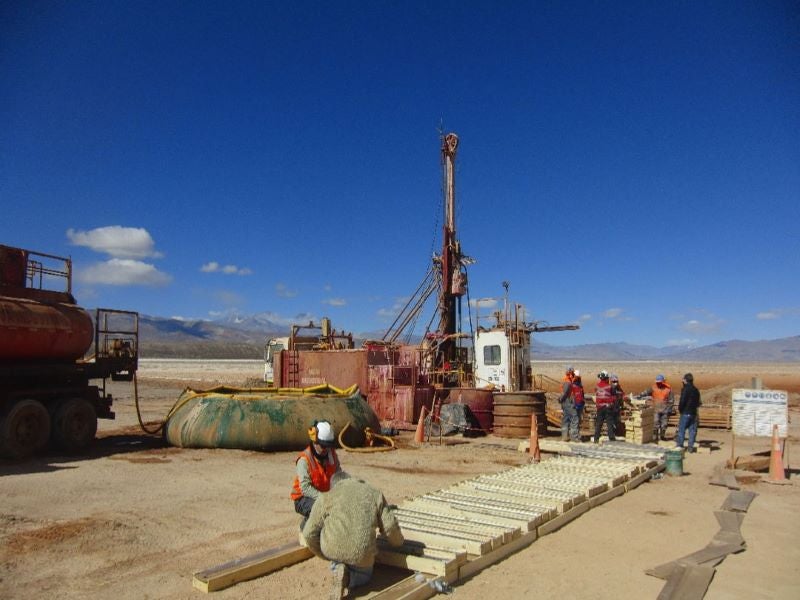

Brine extraction at Maricunga Lithium Project

Stage one of the lithium project will include the installation and operation of a brine production wellfield comprising 19 production wells, with 11 wells operating simultaneously. The brine production wells will have a 12in-diameter stainless steel production casing and be equipped with 380V submersible pumping equipment. The well depth will vary from 40m to 400m for the upper and lower brine aquifers, respectively.

The wellheads will feed 8in-diameter high-density polyethylene (HDPE) pipelines connected to two central collection/transfer ponds in the north-west of the salar. A 20in-diameter, 12km-long steel/HDPE main trunk pipeline will connect the collection/transfer ponds with the evaporation ponds.

The main trunk line adjacent to the collection ponds will feature a booster pumping station to pump the brine up to the evaporation ponds where the salts such as halite, sylvinite and carnallite will crystalise. The brine wellfield production rate will be 180l/s during the first two years of operation.

Brine processing at the Maricunga lithium project

The processing facilities at the Maricunga lithium project are designed for an average annual production rate of 15,200t of battery-grade lithium carbonate (Li2CO3).

The concentrated brine from the reservoir ponds is fed to the salt removal plant or phase one for the removal of calcium and magnesium in the form of tachyhydrite and calcium chloride salts. Solvent extraction is used to remove boron from the solution.

The brine is then fed to the second-stage crystallisers to form calcium chlorides, which will be removed in a solid-liquid separation stage. The brine is then fed to a boric acid crystalliser to facilitate the precipitation of boric acid, which is also removed using solid-liquid separation equipment.

The brine containing concentrated lithium then feeds a solvent extraction stage for the removal of boron. The boron-free brine is fed to the final crystallisers where the remaining calcium chloride salts are separated from the brine using a solid-liquid separation stage.

The concentrated brine is then sent to the lithium carbonate plant, also known as phase two. In the first stage, calcium carbonate (CaCO3) and magnesium hydroxide precipitates are removed from the concentrated lithium brine using solid-liquid separation equipment. An ion exchange stage is used to guarantee the removal of all contaminants.

The contaminant-free brine is then forwarded to the carbonation stage, in which lithium carbonate is formed using soda ash at temperatures close to 80°C. The lithium carbonate pulp obtained is processed in solid/liquid separation equipment and washed. The dewatered lithium carbonate is dried, packaged and stored for delivery to clients.

Infrastructure facilities

The project is accessible via the well-maintained route C-173, which also serves as a mining road for the area. Route C-173 can be accessed from the Chilean main highway Route 5. A modification to route C-173 will be implemented as an 8km extension to connect to the project site.

The project has an approved authorisation to connect to an existing 23kV transmission line that is connected to Chile’s 220kV power grid and crosses the property. A new substation for the project is proposed for construction, including reinforcement of the transmission line.

Water supply for the project is secured through a long-term lease agreement for the use of Can-6 water well located south of the salt flat. Water will be pumped to a water pond near the production plants, which will feed the water treatment plant that uses a reverse osmosis process. Potable water supply will be delivered by 30m³ tanker trucks during the construction phase of the project.

Accommodation for the construction phase will be facilitated using eight dorm buildings with a capacity of 1,200, which will be reduced to 232 during the operation phase.

Contractors involved in the Maricunga lithium project

The updated definitive feasibility study was prepared by Worley Parsons and Atacama Water. All reports related to geology, hydrogeology, mineral resources and reserves were prepared by Atacama Water, while Worley Parsons was responsible for the capital and operating expenditures. Boart Longyear, a mineral exploration company, was contracted to carry out sonic drilling in drilling programmes in 2011 and 2018.

The brine samples assayed from the 2011 and 2018 drilling were tested at the University of Antofagasta in northern Chile, which served as the primary laboratory.

The EIA for the project was prepared by international consulting company Stantec.

DHI, a water software development and engineering consultancy, carried out exploration, environmental permitting and feasibility studies for the project.

Ashurst, a law firm, advised LPI on the ownership consolidation of the Maricunga lithium project.

Pillsbury Winthrop Shaw Pittman, a law firm, advised LPI on the acquisition of MSB’s interest in the project.