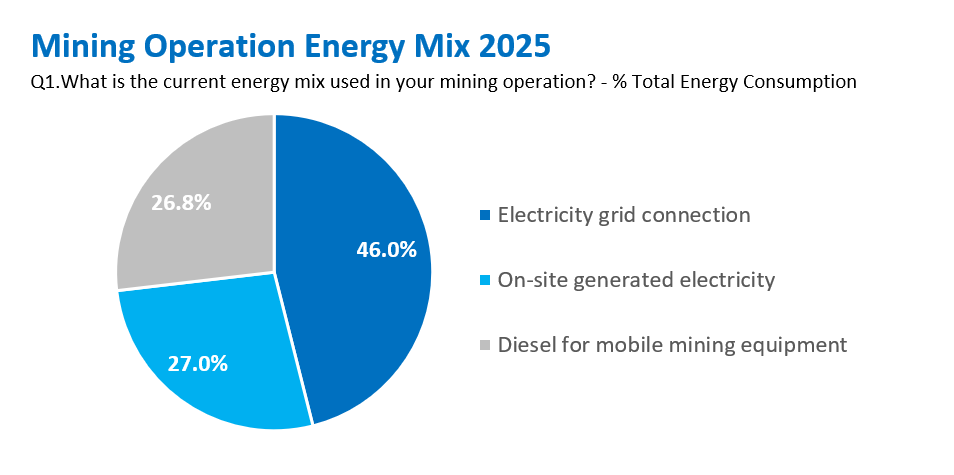

Across the world’s mines, the power mix is split. On average, about half of a site’s energy use is grid electricity – for crushers, mills and ventilation. But diesel, that drives haul trucks, loaders and ancillary kit, remains prominent.[1]

But the mining sector faces challenges that are driving change. Three-quarters of mining operators say greenhouse gas (GHG) emissions reduction is important to strategy, and a similar share have established specific carbon intensity reduction targets. Many go further, describing lowering emissions as a cornerstone of their future strategies.1

However, caution about the pace of change in the pit remains. Operators expect diesel powertrains to remain the majority (two thirds) of haul truck fleet operations by 2040.1 This expectation reflects the fundamental economics of heavy haulage, the capital life of heavy equipment and the physics of lifting hundreds of tonnes ramp after ramp, day after day. It also is encouraging a shift in diesel fuel selection in order to meet the desire to drive change with their existing diesel-powered fleet. Performance diesel with modern detergent packages, and the rising availability of bio-based drop-in fuels, are expected to have a more significant role in haul truck operations.

A tension exists: operators want to reduce their emissions, but remain reliant for now on ICE technology. In many open-pit and underground operations, mobile equipment makes up on average around 70% of diesel consumption from mining operations.[1] At deeper or more sprawling sites, for example, long, steep runs drive fuel burn; intensive fuel consumption by haul trucks is unavoidable under such circumstances. Although battery-electric powertrain technology (BEV) is receiving a lot of attention, the current BEV base is small: only a small proportion of underground haul trucks currently run on electric, and for the largest surface trucks the engineering and infrastructure challenges remain formidable.[2]

With a wholesale shift towards electric some time in the future, diesel efficiency is in the spotlight. New approaches and programmes are helping a change in approach.

Getting more from every drop: the diesel-efficiency toolkit

Diesel efficiency is an exercise in optimizing asset utilization, something mines already pay close attention to. Getting it right can be a win-win-win – improved productivity, enhanced operating efficiency and reduced emissions per tonne moved. But what does this mean in practice for operators?

The first step is the chemistry. A single ultra-class haul truck can burn nearly a million litres of diesel a year.[3] Using fully formulated diesel – fuel engineered with effective detergent technology to help keep injectors and fuel systems clean – helps engines maintain optimal combustion and stable power delivery over long duty cycles. Pair that with high-performance synthetic lubricants for engines, transmissions and final drives. Synthetics typically offer better oxidation control, film strength and low-temperature flow than conventional oils, further bolstering overall efficiency. In mining, even a small percentage improvement at the engine or drivetrain can translate into worthwhile efficiency gains when scaled across a fleet.

Second, operators can drill into the data to work out where inefficiencies are creeping in. Duty cycles are unforgiving; haul trucks often run 18 hours per day.3 Even modest idling, creeping or queuing can compound into thousands of wasted litres of fuel over a month across a typical sized fleet. Real-time data consolidation, fleet-management software and on-board telemetry can highlight idle hotspots, flag loading inefficiencies that eat into litres per tonne, reduce off-haul travel and cut bottlenecks. When used effectively, the result is fewer unproductive engine hours and a direct reduction in fuel burn per tonne moved.

Next, ramping up automation. It can be a shortcut to increasing efficiency. The proportion of autonomous haul trucks in operation has doubled from 1 to 2% between 2021 and 2023.[4] Automation can offer more consistent throttle application, disciplined braking and smoother haul cycles that can trim fuel use and reduce component wear. The anticipated benefits are cumulative: fewer abrupt events, better tyre life, and a tighter distribution of litres per tonne across shifts.

With full fleet electrification still some time in the future, miners might consider to take a targeted, modular approach to upgrades. Deploying newer-generation diesel engines and diesel-electric hybrids can deliver near-term reductions in fuel burn and tailpipe emissions. Improvements in turbocharging, after-treatment and controls raise thermal efficiency; diesel-electric drives capture some of the efficiency gains of electrification and can be rolled out today. Newer engines can deliver more consistent torque at lower specific fuel consumption – all of which adds up to better efficiency and lower emissions.

Finally, renewable diesel. Molecules matter as much as machines. Renewable diesel – often called hydrotreated vegetable oil, or HVO – has shown great promise as a drop in solution for mining operations, with the potential for lower lifecycle GHG emissions compared to conventional diesel. [5],[6]

According to ExxonMobil’s analysis of HVO for mining applications, it boasts two key advantages, First, HVO requires no engine modification – a number of haul truck OEMs now support its use[7]– and secondly it is ready to be used now as part of a mining haul fleet’s GHG emission reduction plan. Supply is expanding, which makes pilots and staged roll-outs plausible beyond early adopters. Global renewable-diesel production capacity is projected to triple from 2020 levels to over nine billion US gallons per year in 2030.[8] While this scale will not meet the mining industry’s fuel demand on its own, it points to a decade of growing opportunities for lifecycle greenhouse gas (GHG) emissions reductions. Early pilots have proved promising. At the Kearl oil sands site, operated by Imperial Oil in Canada, CAT ultra-class haul trucks were run on 100% renewable diesel. The pilot reported similar power and performance – a critical finding for high-utilisation, high-payload operations in a harsh climate.[9]

A triple dividend from taking an approach combining smart real-time data use, automation and next-generation fuels is emerging with the potential for improved productivity, efficiency and reduced emissions, contributing to a gradual step-wise approach to a new generation of lower emission mining operations.

Choosing the right diesel efficiency provider

Mines run on close coordination between maintenance, operations and procurement. That is where a single programme of diesels and lubricants, tuned for mining duty, earns its keep. Considering fully formulated performance diesel with synthetic lubricants offers the potential for a site to pursue fuel-economy gains thereby contributing to emissions reduction goals, whilst improving productivity and uptime.[10] And where supply allows and equipment is compatible, drop-in renewable diesel is a complementary option.

Working in a collaboration with an expert can make this process much simpler for operators stuck in a quagmire of day-to-day operations. ExxonMobil has a commercially-available proposition that runs from assessment to action without hampering activity.

The process offered by ExxonMobil begins with establishing a clear operational baseline for each fleet and shift. From the molecule to the mechanics, ExxonMobil then offers to develop a site lubrication plan that brings synthetics tailored for mining duty, backed by technical services that align with OEM maintenance windows. It helps operations teams on the ground turn data into practice – payload discipline, smarter routing, operator coaching and change control, so gains can flow and persist across crews. This can be paired on the fuels side with Diesel EfficientTM fuel, ExxonMobil’s performance diesel offering, along with the option to explore Renewable Diesel (HVO) trials offering the potential for lifecycle GHG emissions reductions vs conventional diesel, progressing to phased roll-outs that keep tonnes moving. The whole effort can be held to account by clear KPIs and continuous monitoring, so managers can see what worked and decide what to scale next.

In short: Offering fuels and lubricants expertise, ExxonMobil is well placed to help operators looking to optimise efficiency and productivity whilst reducing emissions. Curious to learn more? To learn more about ExxonMobil’s perspectives on the potential for lower emission mining operations, see the mining White Paper on this page.

[1] ExxonMobil-commissioned research of 91 mining operators by Frost & Sullivan in 1Q25. See ExxonMobil’s white paper, “Mining Forward”, for more details.

[2] GlobalData Analyst Briefing, “Mobile mining equipment to accelerate switch from diesel to electric in early 2030s,” 2023.

[3] Rocky Mountain Institute 2019, “Pulling the Weight of Heavy Truck Decarbonization.”

[4] GlobalData Surface Mining Equipment Market Analysis by Region, Population, Commodity and Forecast to 2030.

[5] Renewable diesel can be used in most modern diesel engines without modifying the engine or blending with conventional petroleum diesel. Suitable for use in diesel engines certified to use CAN/CGSB 3.520, ASTM D975 and EN15940 specifications fuel. Verify fuel compatibility with your vehicle owner’s manual or by contacting your vehicle manufacturer.

[6] The estimated lifecycle GHG emissions reduction potential depends on several factors, including the bio-feedstock and production method. Models recognized by policymakers vary by jurisdiction, but, for illustration, EU’s RED II (Renewable Energy Directive II) assign to renewable diesel from used cooking oil a default carbon intensity reduction of 83% and a typical reduction of 87% vs B0 diesel.

[7] See, for instance, CAT unveils new CAT C13D engine at ConExpo 2023, Cummins – Biodiesel Questions and Answers, Rental Equipment Register – Komatsu America Provides Recommendations for Biodiesel Usage.

[8] GlobalData report, “Global Renewable Diesel Production Capacity Outlook to 2030,” 2024.

[9] Imperial Oil & Finning Trial – see ExxonMobil’s “Mining Forward” White Paper for more details. Operator experience may vary from that in this trial. Actual benefits will vary depending on factors such as vehicle/engine type, driving style and diesel fuel previously used. Consult the original equipment manufacturer (OEM) for guidance on compatibility with renewable diesel.

[10] See for instance Esso Diesel EfficientTM and Mobil ServTM case studies in ExxonMobil’s “Mining Forward” white paper. Each Proof of Performance is based on the experience of a single customer. Actual results can vary depending upon the type of equipment used and its maintenance, operating conditions and environment, and any prior fuel or lubricant used.