The Oko West gold project, an open-pit and underground mine located in northwest Guyana, is 100% owned by G Mining Ventures Guyana, the local subsidiary of Canada-based gold mining company G Mining Ventures.

The company published the project’s Preliminary Economic Assessment (PEA) in September 2024, providing the initial economic framework and development plan.

Early works at the site commenced in March 2025, followed by the announcement of the project’s Feasibility Study (FS) in April 2025. The FS outlined total gold production of 4.3 million gold ounces (oz) over 12.3 years of life of mine (LoM).

The Oko West gold project carries an initial capital cost estimate of $973m and sustaining capital requirements of $650m over the LoM.

In September 2025, Guyana’s Environmental Protection Agency issued the final Environmental Permit, authorising construction and operations through July 2030.

Following receipt of the permit, G Mining Ventures announced a formal construction decision in October 2025, setting a target for first gold in the second half of 2027.

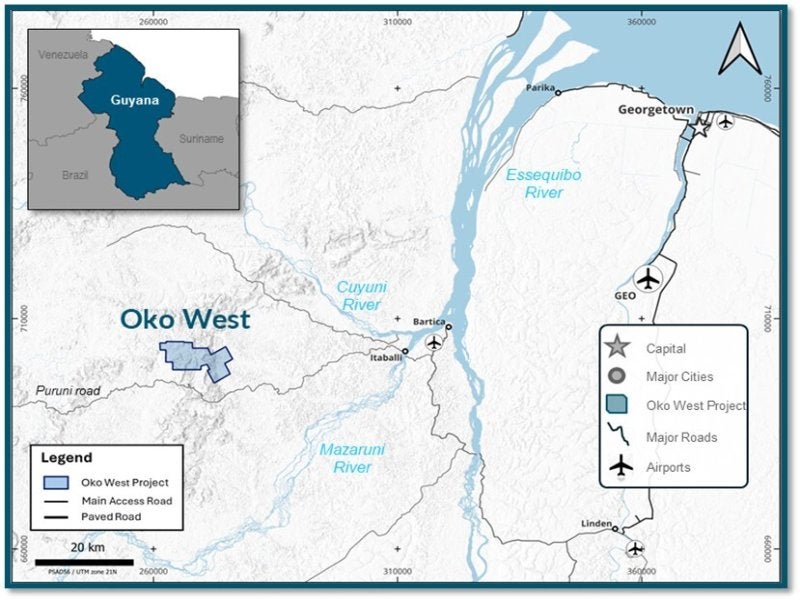

Oko West Gold Project location

The Oko West gold project lies approximately 100km southwest of Georgetown, Guyana’s capital, and about 50km from Bartica, the administrative centre of Region 7.

The project area is held under a single Prospecting Licence (PL) granted to G Mining Ventures Guyana in September 2022. The licence, covering 10,890 acres, has an initial three-year term with two possible one-year renewals.

In 2024, the project footprint expanded through the addition of medium-scale permits that the company plans to convert to a Mining Licence. The Government of Guyana retains surface rights over the PL area, while the licence authorises G Mining Ventures Guyana to occupy and explore the site.

Geology and mineralisation

The Oko West gold project sits within the Guiana Shield, a Precambrian terrane in northeast South America.

The deposit straddles the north–south oriented contact between the Barama-Mazaruni Supergroup greenstone belt to the west and the Oko granitoid pluton to the east.

Gold mineralisation is primarily hosted in volcanoclastic, siliciclastic, and carbonaceous sedimentary units with an overall tabular geometry that dips eastward.

Within the mineralised zones, the rocks exhibit silica and carbonate alteration, locally accompanied by more intense sericitization.

Multiple sulphide species, including pyrite, chalcopyrite, and sphalerite, occur as disseminations in altered host rocks, along bedding and laminations, within small fractures and veinlets, and as halos around quartz and quartz–carbonate veins.

Reserves

The Oko West project mine is estimated to hold probable mineral reserves of 76.6 million tonnes (mt) at an average gold grade of 1.89 grams per tonne (g/t) of gold (Au) for 4.64 million ounces (moz) of contained gold.

This includes 62.4mt open pit reserves at 1.57g/t Au and 14.2mt underground reserves at 3.26g/t Au.

Indicated mineral resources total 80.3mt at an average gold grade of 2.10g/t Au for 5.4moz Au.

Inferred resources total 5.1mt at an average gold grade of 2.36g/t Au for 0.4moz Au.

Mining at Oko West gold project

The Oko West gold project will use a combination of conventional open-pit mining and mechanised long-hole open stoping for the underground operation.

Open pit mining will progress in four phases and consists of a main pit centred on Block 4 zone with greater depth, along with a smaller sub-pit south of the main pit’s southern extension.

The operation will deploy diesel-powered drills, haul trucks, and hydraulic shovels. The open-pit peak mining rate is estimated at 44 million tonnes per annum (mtpa) over a 13-year life of mine.

Underground operation will comprise a single mine divided into a main zone and a satellite zone. Both zones will be accessed through a common portal in the south pit and linked by the main ramp.

The long hole open stoping mining method will use both transverse and longitudinal stoping approaches.

Underground production is planned over 12 years, including two years of initial development.

Primary underground equipment will include 21 tonne (t) load-haul-dump units and 63t haul trucks.

Ore processing and recovery

The Oko West project proposes a conventional gold processing plant using cyanidation to produce doré from a blend of fresh rock and weathered ores.

The plant will be designed for a nominal throughput of 6mtpa on fresh rock, increasing to approximately 7mtpa when blended with saprolite and transitional material.

Ore will pass through the comminution circuit that consists of a primary gyratory crusher followed by Semi-Autogenous Grinding (SAG) and ball mills to achieve a primary grind of P80 75 microns.

A gravity concentration stage will recover a portion of free gold and produce a high-grade concentrate for intensive leaching and electrowinning.

The slurry will undergo pre‑leach thickening before entering a cyanide leach and carousel carbon‑in‑pulp circuit with an approximate 36‑hour leach residence time.

Loaded carbon will be stripped in a split 10t Pressure Zadra elution system, with carbon handling and thermal regeneration for reuse.

Gold will be recovered from the solution by electrowinning and smelted on site to produce doré.

Infrastructure details

The site is accessible by a 20‑minute direct flight from Ogle Airport in Georgetown or by road and boat via Parika on the Essequibo River, with regular boat services linking Bartica and Parika.

Overland access to the project area is available via the Puruni and Aremu laterite roads from Itaballi at the confluence of the Cuyuni and Mazaruni rivers.

At full operation, the process plant, underground mine, open‑pit mine, and associated infrastructure will require an average power load of 46MW.

The base case power solution is a dedicated heavy fuel oil power plant comprising six 9.3MW engine‑generator sets, providing 55.8MW of installed capacity and 46.5MW of running capacity, assuming one unit remains on standby.

Utilities will include air and oxygen supply and multiple water systems for domestic use, raw water intake, gland seal services, and process circulation.

Financing

In October 2025, G Mining Ventures secured commitments for an initial $387.5m financing package, with an option to increase by up to $150m beginning six months after closing, subject to lender approval, for a total potential package of $537.5m.

The financing is anchored by a revolving credit facility from a syndicate of financial institutions, permitting borrowings of up to $350m, with an accordion feature for an additional $150m available post‑closing under customary conditions.

The syndicate is led by National Bank Capital Markets and Macquarie Bank as joint bookrunners and co‑lead arrangers, with participation from Bank of Montreal, ING Capital, Royal Bank of Canada, Citibank, and CIBC.

Separately, Komatsu Finance Chile, a Komatsu subsidiary, executed a Master Loan and Security Agreement with G Mining Ventures Guyana to provide up to $37.5m to finance mining and construction equipment procurement for the project.

Contractors involved

G Mining Ventures hired G Mining Services (GMS) as the lead consultant for the FS of the Oko West gold project.

Personnel from Minéralis Services-Conseils, Environmental Resources Management, Lincoln Metallurgical, Evomine Consulting, Alius Mine Consulting, and F&Z Consultoria e Projetos also supported in preparing the FS.

The PEA report for the gold project was also prepared by GMS.

The contract for power plant equipment was awarded to technology group Wärtsilä for the supply of six Wärtsilä 32 engines.

Primary open–pit and support equipment will be procured from Komatsu, while Finnish industrial machinery company Metso will supply grinding mills, gyratory crushers, apron feeders, and a pre-leach thickener.

Gravity circuit, intensive leach reactor, and gold room will be supplied by FLSmidth.