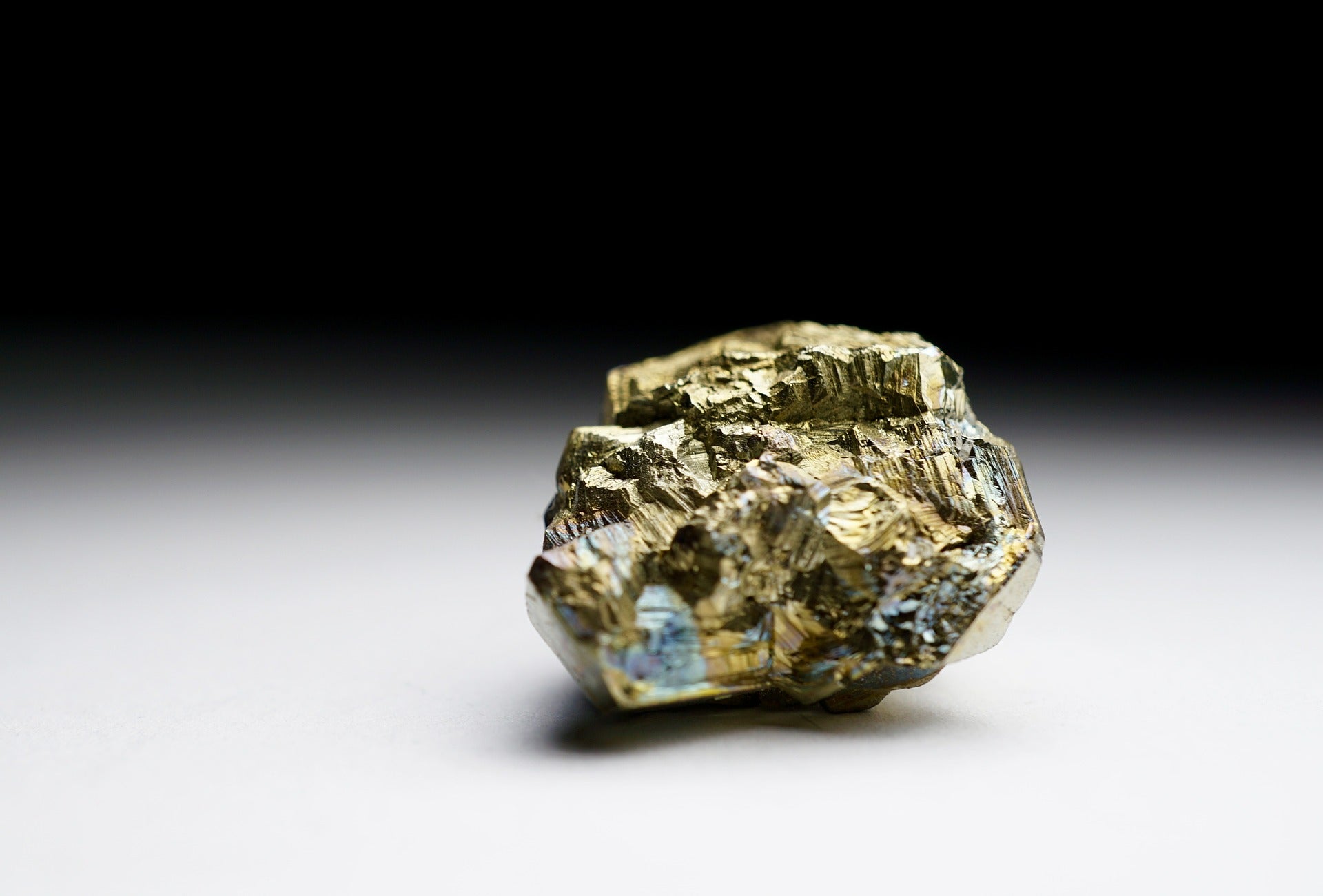

Regis Resources has agreed to acquire a 30% interest in the Tropicana gold project in Western Australia firm Independence Group (IGO) for $688.3m (A$903m) in cash.

The Tropicana open-pit and underground gold mine is located in the Albany-Fraser Orogeny, approximately 330km north-east of Kalgoorlie.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

AngloGold Ashanti operates the Tropicana Gold Mine with a 70% stake while IGO owns the remaining 30% stake.

Regis expects the acquisition to diversify its existing production base with a non-operated interest in a high margin gold asset.

The transaction is conditional on the waiver or non-exercise of a right of last refusal (ROLR) by AngloGold Ashanti for up to 60-days from the binding sale agreement.

IGO said that the sale would allow it to focus on commodities that are key to enabling clean energy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe firm plans to use the proceeds from the sale for funding its investment in the Australian lithium assets of Tianqi Lithium.

Last year, IGO agreed to acquire a 49% stake in Tianqi Lithium Australia, which owns a 51% stake in the Greenbushes lithium mine in Western Australia.

IGO managing director and CEO Peter Bradford said: “While IGO continues to believe that Tropicana is a high-quality tier-one gold asset with strong upside potential, it is no longer aligned with our focus on commodities critical to clean energy.

“This transaction, along with the recent investment in Tianqi Lithium assets in Australia, solidifies IGO’s position of becoming a globally relevant pure-play battery minerals producer and developer, uniquely exposed to tier-one nickel, copper, cobalt and lithium.”

To fund the acquisition, Regis plans to undertake an equity raising of up to $495.3m (A$650m) and an accelerated pro-rata non-renounceable entitlement offer. It will also undergo a new $228.6m (A$300) loan facility.