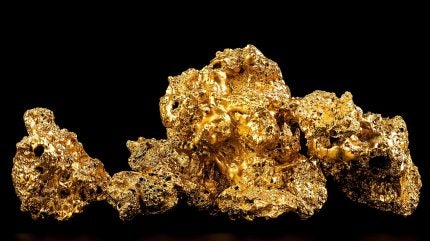

Equinox Gold has reached an agreement to divest its entire stake through Calibre USA Holdings in two Nevada-based mining projects to Minera Alamos for a total consideration of $115m.

Calibre USA Holdings owns a 100% economic interest in the producing Pan Gold Mine, Gold Rock Project and Illipah Project in Nevada, US.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The transaction includes a cash payment of $90m and equity consideration valued at $25m in Minera Alamos shares, which will not exceed a 9.99% ownership post-transaction.

If the equity portion exceeds the agreed ownership threshold, the cash component will be adjusted to maintain Equinox Gold’s ownership at or below 9.99%.

Equinox Gold CEO Darren Hall said: “The sale of our non-core Nevada Assets reflects our commitment to portfolio optimisation and disciplined capital allocation. This transaction simplifies our business and allows the team to focus our efforts and capital on core operations and key development opportunities, positioning Equinox Gold to drive greater shareholder returns.

“The $90m in cash proceeds will strengthen our balance sheet, and the significant equity ownership will provide continued exposure to the upside within the Nevada Assets as well as to Minera Alamos’ existing high-quality portfolio.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe deal is set to be completed in the fourth quarter of 2025, pending regulatory and stock exchange approvals, among other customary conditions.

Trinity Advisors and Blake, Cassels & Graydon are providing financial and legal advisory services, respectively, to Equinox Gold for this transaction.

The Pan Mine is an established gold-producing operation, while the Gold Rock Project offers higher-grade gold and significant exploration potential.

Minera Alamos has also announced a concurrent private placement financing of subscription receipts, led by Stifel Canada, to raise approximately C$110m, with an option to increase by C$25m.

This financing is intended to cover the cash portion of the acquisition cost, with any surplus funds allocated for working capital to support the Pan operation.