Tex-Mining, a mineral resource consulting firm, won the Innovation award in the 2025 Mining Technology Excellence Awards for its artificial intelligence (AI)-enabled, economics-focused mineral exploration target ranking platform minexTRM.

minexTRM integrates geological, engineering, and financial inputs into a single, probability-based decision-support platform that helps identify and prioritize higher-value opportunities and accelerate economic discovery. Developed by Samuel Addo-Frempong in 2015 and upgraded in 2020 to incorporate AI for large geoscience dataset analysis, the model has been used across gold and critical minerals projects in Africa, Europe, and the Americas, supporting faster discoveries, lower costs, and improved conversion of resources to reserves.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

This AI-enabled, economics-focused mineral exploration target ranking model was adjudged the winner as it streamlines exploration decisions, reduces bias, and improves cost and time efficiency across diverse projects.

AI-powered exploration target ranking that links geology to economics

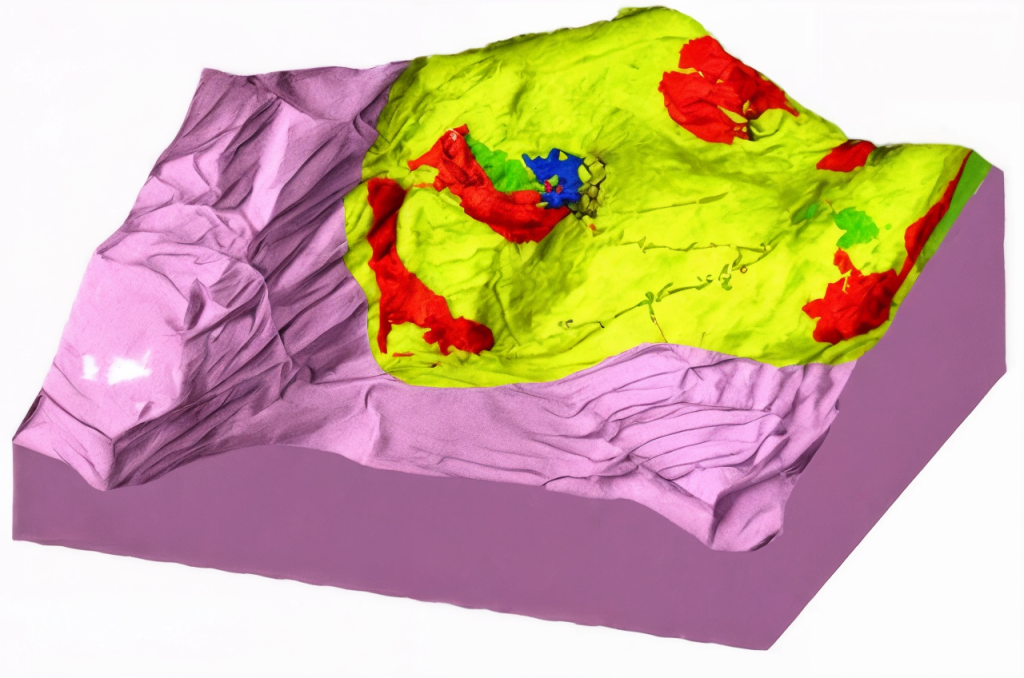

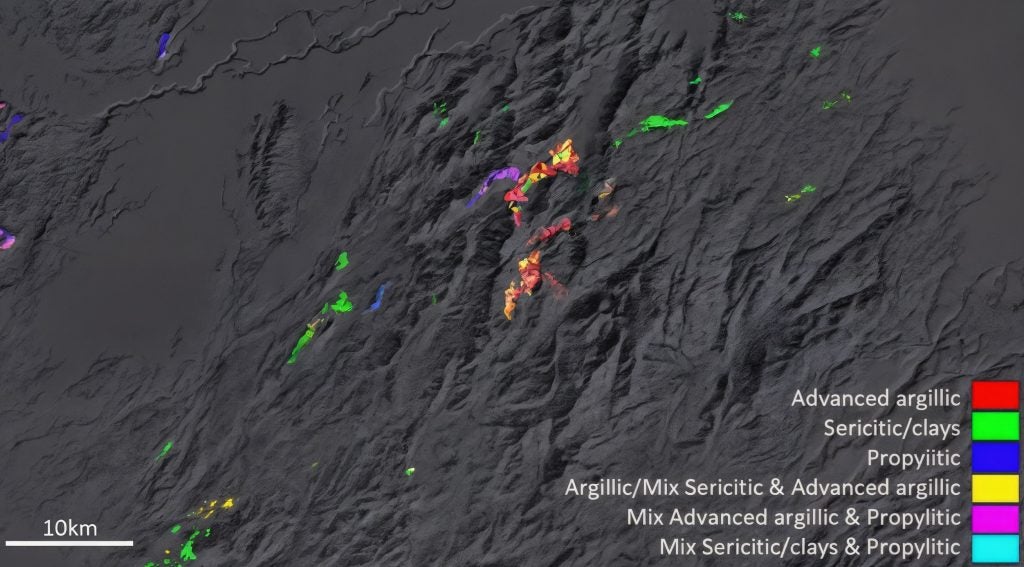

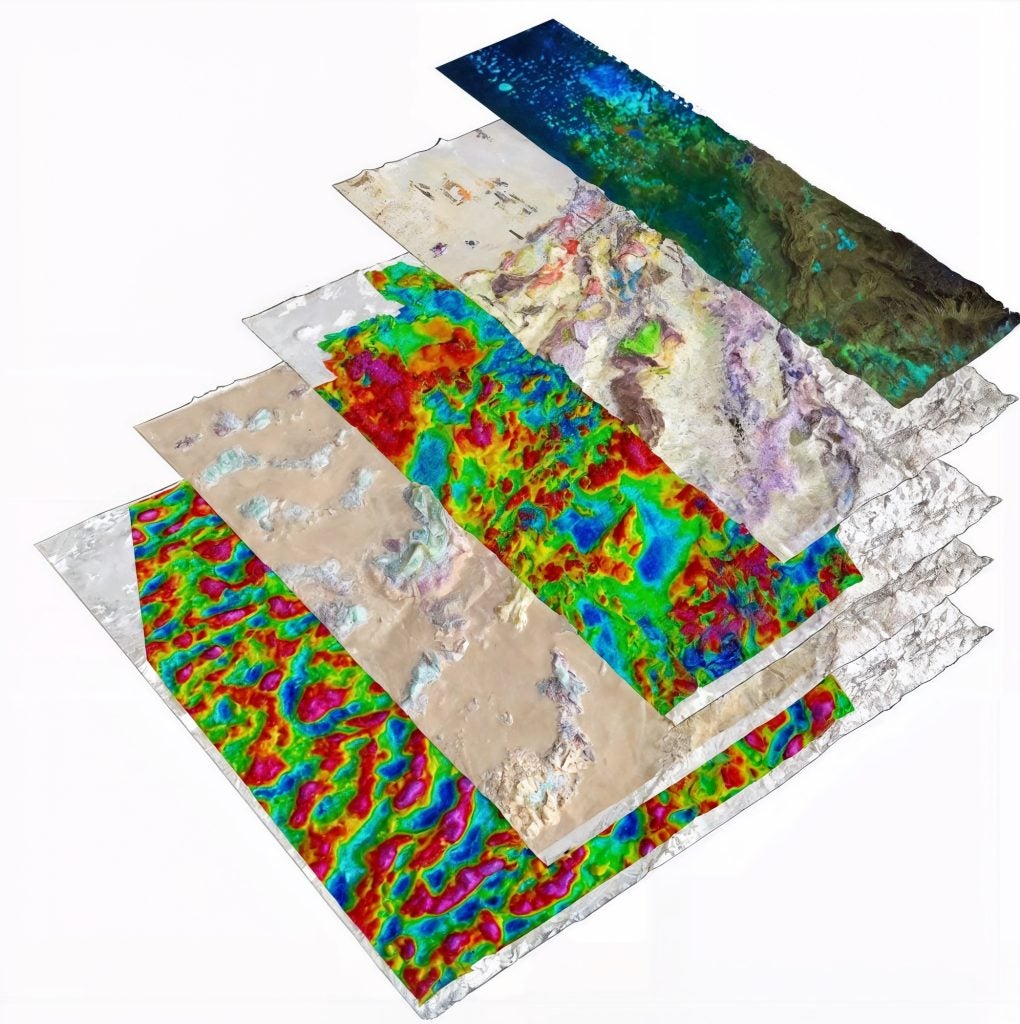

What distinguishes minexTRM is the breadth of information it brings together and how it connects geological signals to practical mine design and economics. On the geological side, the model accepts inputs from UAV and conventional airborne magnetics, electromagnetics, and gamma-ray spectrometry, alongside infrared satellite and ASTER imagery. It incorporates ground geophysics and subsurface characterization, then layers in multi-media geochemistry—lithogeochemical, soil, stream sediment, hydrogeochemical, and biogeochemical datasets. Rather than treating these datasets in isolation, the system analyzes them with proprietary AI methods, including neural networks (with convolutional architectures where appropriate), Support Vector Machines, and Deep Autoencoders, to detect patterns in noisy or sparse data.

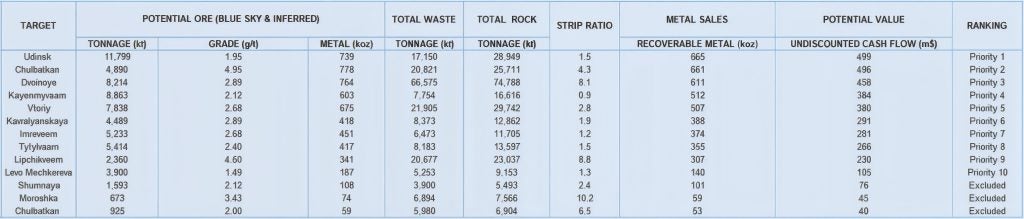

Those outputs are translated into structural, lithological, and grade–tonnage models, which frame how mineralization occurs in the subsurface and what grades and tonnages could be expected. Crucially, the platform does not stop at geological prospectivity. It links these models to probabilistic mining shapes—open pit, underground, or a combination—and factors in engineering and financial parameters such as advance drilling and assay programs, study and FEED costs, plant and equipment costs, land and construction costs, operating costs, metallurgical recovery, slope angles, production rates, commodity prices, and discount rates. The result is an economic-first, probability-based ranking in which a target advances not just because it looks geologically promising, but because it also shows potential to meet economic thresholds under realistic assumptions.

To support disciplined decisions, the model applies stochastic simulation to quantify uncertainty and test alternative scenarios. It identifies the inputs that influence target rankings, reports the correlation between original and modified rankings, and measures the average change in ranking positions across scenarios, together with statistical significance. The transparency helps teams understand why a target is prioritized, what data would most likely reduce uncertainty, and how rankings might shift as new information comes in.

Measured results: Lower discovery costs and faster resource conversion

The practical effects of this innovative AI-driven tool are reflected in reported outcomes from multiple operators. At Banro’s Namoya project, applying the ranking model reduced discovery cost by approximately 70%, while reported mineral reserves increased by about 27%. At Nordgold, company-wide adoption across nine operating and exploration sites nearly halved the discovery cost. Executives also noted shorter discovery timelines because drilling programs were directed toward higher-ranked prospects at the outset, rather than being spread across a wider field of lower-probability anomalies.

Elsewhere, Hummingbird Resources integrated the model across Kouroussa in Guinea, Dugbe in Liberia, and Yanfolila in Mali. The value-ranked outputs informed target definition and budget allocation, aligning early-stage programs with assets that could move into development sooner. In Kazakhstan, KAZ Resources used the framework to prioritize targets across more than 50 exploration blocks (roughly 180 square kilometers) focused on critical minerals such as lithium, tantalum, niobium, rubidium, and rare earth elements. In Russia’s Far East, Nornickel applied the model to initial target generation in Zabaykalsky Krai; Eldorado Gold has moved to integrate the tool into exploration processes, citing its scenario sensitivity analytics and ability to convert standard exploration inputs into value-ranked shortlists, demonstrating applicability in a different geological and regulatory context.

Across these examples, a common thread emerges: the pathway from anomaly to investable opportunity becomes clearer when geological prospectivity is evaluated alongside costs, recovery factors, and production assumptions. Users report tighter alignment between drilling meters and value creation, fewer detours on low-yield targets, and a more efficient progression from target generation through study phases. The breadth of mineralization styles supported—magmatic systems such as layered intrusions, pegmatites, and porphyries; hydrothermal systems including epithermal deposits; sedimentary systems such as SEDEX, banded iron formations, and placers; and metamorphic systems including skarns—allows portfolios spanning gold and critical minerals to be compared on a common, economics-aware basis.

Bias reduction and scenario planning in mineral exploration decisions

Exploration decisions have traditionally relied on expert interpretation and manual compilation of disparate datasets. That approach can be time-consuming and susceptible to cognitive and organizational biases. By automating large-scale data integration and applying consistent AI methods, minexTRM reduces reliance on subjective judgments and speeds up early targeting. The aim is not to replace expertise but to provide a systematic backbone that makes decisions more repeatable and better grounded in the totality of available evidence.

The model’s scenario and sensitivity capabilities also support governance. By clarifying which assumptions matter most and how robust rankings are under different cases, teams can prepare more substantive discussions for investment committees and stage-gate reviews. Because commodity prices, costs, and metallurgical recoveries are parameterized, new data can be incorporated quickly, and targets can be re-ranked without rebuilding the evaluation from scratch. That, in turn, supports disciplined capital allocation and adaptive planning—qualities that matter when exploration environments and market conditions evolve.

“We are using AI as a gamechanger to discover and revolutionize the way we predict the location of the next massive deposits. This AI-driven mineral exploration target ranking model allows for quick synthesis of massive datasets, uncovering patterns that would be nearly impossible for humans to identify. The tool combines more layers of data and reduces biases and human errors by relying on data rather than historical assumptions. The model outcome highlights the strength of leveraging artificial intelligence as an exploration tool, demonstrating how AI-assisted analysis of geoscientific datasets can systematically identify targets that were previously overlooked by conventional methods. The tool helps to minimize resource usage; saving time and money while fostering more efficient drill targeting so there’s less land disturbance.“

– Samuel Addo-Frempong, Developer of minexTRM and Mining Director at TEX

Company Profile

Tex-Mining is a mineral resources consulting firm headquartered in Dubai, United Arab Emirates, and offers:

- Mining consulting services: mineral resources and reserves estimation, mine operational management, geotechnical and metallurgical studies.

- Mineral exploration services: mineral project evaluation, geospatial analysis, mineral exploration target generation, mineral exploration potential assessment.

- Investment advisory: mineral commodity market trends and analysis, investment strategy development, portfolio management.

- Mine operational efficiency: process optimization, supply chain management, cost reduction strategies, equipment reliability, and control.

- Innovation and digitalization: process automation, AI & ML for mineral exploration, renewable energy solutions, predictive maintenance strategies.

The company works in multi-commodity environments, including lithium, REE, copper, gold, zinc, and uranium.

Globally, Tex-Mining is present in the Middle East, Africa, Eastern Europe, and Latin America.

Contact Details

E-mail: samuel.addofrempong@tex-mining.com

Links

Website: https://tex-mining.com