The Warintza Project is a copper-gold porphyry deposit in southeastern Ecuador. The project is entirely owned by Solaris Resources and its subsidiary Lowell Mineral Exploration Ecuador.

In November 2025, Solaris published a pre-feasibility study (PFS) for Warintza.

The study projected a mine life of 22 years and an initial capital expenditure of $3.7bn. It estimated that average annual copper equivalent production will exceed 300,000 tonnes (t) over the first five years and 240,000t over the first 15 years.

The company aims to take the final investment decision (FID) by the year-end 2026, with first production potentially beginning as early as 2030.

Warintza Project location

The Warintza Project is situated in Morona Santiago province in the south-eastern part of Ecuador. The site is around 235km south-east of the capital of Quito.

The property comprises nine metallic mineral concessions encompassing a total area of 26,773 hectares.

In April 2024, Solaris signed an option agreement to acquire up to a 100% interest in ten additional neighbouring concessions covering an area of around 40km² with porphyry copper and epithermal gold potential.

Geology and mineralisation

The Warintza Project sits in Ecuador’s south-eastern Cordillera del Cóndor mountain range in the eastern Andes, within the Jurassic Zamora Cu–Au metallogenic belt.

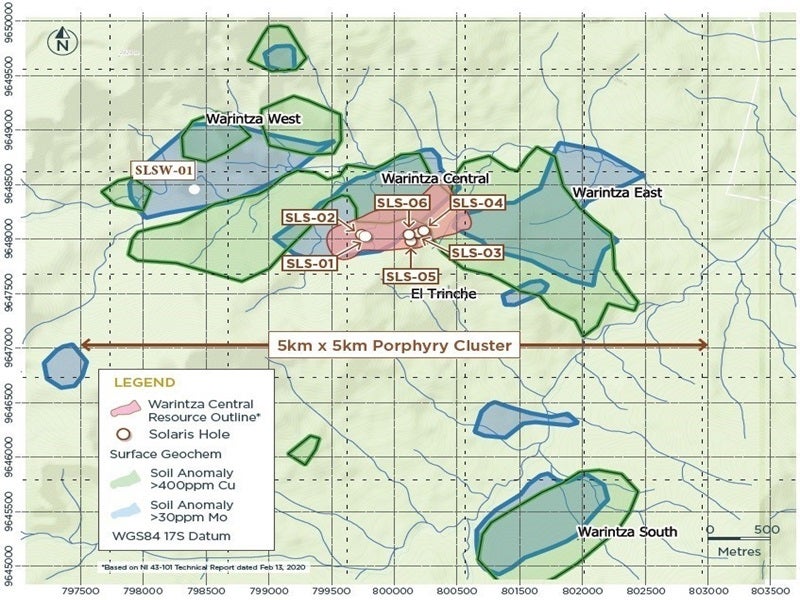

Warintza comprises a cluster of discrete-to-locally-coalescing porphyry centres spanning an estimated mineralised footprint of 30km².

Mineralisation across the region is linked to Late Jurassic subduction-related magmatism associated with the Zamora Batholith and the Misahuallí volcanic sequence.

At the central part of the property, copper mineralisation is hosted by composite quartz monzodiorite and diorite stocks cut by porphyry dykes and veinlet sets.

Warintza East is centred on a molybdenum-rich rhyodacite porphyry core with peripheral copper-molybdenum mineralisation in andesitic wall rocks, while Warintza West features stockwork-style porphyry mineralisation within tonalite-to-quartz monzodiorite intrusions.

Warintza Project reserves

As of May 2025, the Warintza Project contains proven and probable reserves of 1.3 billion tonnes (bt) at 0.41% copper equivalent, grading 0.31% copper, 0.02% molybdenum, and 0.04 grams per tonne (g/t) gold and 1.3g/t silver.

Contained metal is estimated to be 4.1 million tonnes (mt) of contained copper, 214,000t of molybdenum, 1.8 million ounces (moz) of gold and 54.1moz of silver.

Mining at Warintza Project

Mining at Warintza is planned as a conventional open-pit, truck-and-shovel operation. The project will use loaders in constrained spaces and for reclaiming material from stockpiles.

Two principal pits, Warintza Central and Warintza East, will be mined in eight phases.

Drilling and blasting will be conducted on 15m benches using 311mm-diameter holes. At peak rates, total material movement is expected to reach around 160 million tonnes per annum (mtpa), with long-term ore delivery averaging roughly 60.2mtpa.

Following an initial pre-stripping period of approximately two years, the mine will be run with an owner-operated fleet. Main units will comprise 120t-class cable shovels, 70t wheel loaders and 320t haul trucks, supported by dozers, graders and water carts.

Ore processing

At Warintza, the processing plant will handle a combination of supergene and hypogene ores, with hypogene material being the main component of the feed.

Supergene ore contains mainly secondary copper sulphides such as chalcocite and bornite, together with some primary chalcopyrite, while hypogene ore consists largely of chalcopyrite.

The plant design is based on a standard porphyry copper-molybdenum concentrator arrangement, with a planned throughout rate of 165,000t per day.

The ore will first undergo primary and secondary crushing, and then pass through semi-autogenous grinding (SAG) and ball mills, to obtain a milled product size with a P80 of 150µm.

Two parallel grinding circuits are planned. Each circuit will include one 24MW dual-pinion SAG mill and two 22MW dual-pinion ball mills.

The ground ore will be treated in a rougher flotation circuit to produce a concentrate, which will then be reground to P80 25µm and subjected to three stages of cleaner flotation to yield a bulk copper-molybdenum concentrate.

Copper and molybdenum products will be separated from this bulk concentrate, then dewatered and sent to external smelting facilities.

Flotation tailings will be dewatered using two tailings thickeners. Subsequently, the thickened slurry will be pumped either directly to the tailings management facility (TMF) or to cyclone stations to separate sand for TMF embankment construction from slimes for deposition within the TMF.

Warintza Project infrastructure

The Warintza Project can be reached from provincial capital of Macas via National Highway 45, which runs about 20km west of the site. A second option is to approach from Cuenca via the Cuenca-Gualaceo-Limón Indanza road.

The project’s total electrical demand is estimated at 236MW. It will receive power supply through a 62.1km-long overhead 230 kilovolt transmission line from the Bomboiza substation.

Raw water for operations will be obtained from rainwater collected via an intake on the North Diversion Channel.

The TMF will be designed to be contained by four dams within the Warintza stream valley. It will hold approximately 1.3bt of tailings over the expected life of the operation.

A waste rock facility is planned upstream of the tailings area, to the south of the open pit, with capacity for around 670mt of waste rock.

Financing

In May 2025, Solaris Resources arranged a $200m (C$275.05m) financing deal with RGLD Gold, a Royal Gold subsidiary. The deal included a gold streaming and net smelter return royalty arrangement.

This arrangement is intended to supply Solaris with sufficient long-term funds to carry out activities up to the FID and to settle the senior secured debt facility with Orion Mine Finance Management.

As agreed, Royal Gold paid $100m to Solaris with the signing of the deal. The remaining amount will be paid in two $50m tranches.

The first tranche will be paid after the PFS is published and technical approval from the EIA is received, and the other on the first anniversary of closing.

Contractors involved

The PFS on the Warintza Project was produced in collaboration with three consultancies – Ausenco, Knight Piésold and AMC Mining Consultants (Canada).

On the $200m financing transaction, BMO Capital Markets advised Solaris Resources on financial matters, while Blake, Cassels & Graydon provided legal counsel.

Geosystems International carried out the mineral resource estimate for the project, while Minsys Mining Systems contributed to various mine planning activities.

Additionally, Ecuadorian company ESSAM Cía was responsible for conducting the environmental and social impact studies that support the project’s Environmental Impact Assessment.