Haib is a large-scale, advanced-stage copper and molybdenum porphyry deposit located in southern Namibia.

The project is 100% owned by Koryx Copper, a Canadian copper development company formerly known as Deep-South Resources.

According to a preliminary economic assessment (PEA) released in September 2025, the asset is expected to have a 23-year mine life, with average annual payable copper production of 92 kilotonnes per annum over the first ten years.

The study estimates that the upfront construction costs will total $1.56bn, which includes a 10% contingency.

The project’s Environmental and Social Impact Assessment (ESIA) and Environmental and Social Management Plan, along with public consultations, are underway as of October 2025.

The ESIA process aims to support the application for an Environmental Clearance Certificate, which Koryx Copper plans to submit in early 2026 after integrating prefeasibility study-level project details.

Haib copper project location and background

The Haib copper project is situated in the Karas Region of southern Namibia, approximately 6km north of the South African border. Its southern boundary lies within about 2km of the Orange River, which serves as the international boundary in this area.

Haib Minerals, a subsidiary of Koryx Copper’s Deep South Mining Company, holds the exploration rights for the project under Exclusive Prospecting Licence 3140.

The licence area covers 36,589 hectares designated for mineral exploration activities.

The Haib deposit was first identified in the late 19th or early 20th century. Since then, multiple exploration programmes have been carried out at the site by several companies, including Rio Tinto Zinc, Revere Resources, Great Fitzroy Mines, and Teck.

Following Teck’s exit from a joint venture in 2017, Koryx Copper assumed full ownership and initiated a series of technical and economic studies, which led to a PEA in 2018 and an updated version in 2021.

Geology and mineralisation

Haib is hosted within coeval Palaeoproterozoic Orange River Group volcanic rocks and Vioolsdrif Intrusive Suite plutonic rocks, in the Richtersveld Subprovince of the Namaqua–Natal Province.

The Vioolsdrif Intrusive Suite, which cuts through the Orange River Group, comprises felsic to mafic batholiths, primarily granodioritic in composition. At Haib, this intrusive suite occurs in several phases of porphyritic intrusive rocks, including the main mineralised host units, described as Quartz Feldspar Porphyry and Feldspar Porphyry.

Most of the rock mass shows alteration patterns characteristic of porphyry copper systems and associated copper mineralisation. Higher-grade copper zones are controlled by a fracture and vein system that follows a regional structural trend.

Broad mineralised corridors extend over a strike length of about 2km and are frequently several hundred metres wide.

Copper is primarily found as chalcopyrite, both disseminated within the host rock and within veins, alongside other sulphide minerals such as pyrite, minor bornite, chalcocite, and molybdenite.

Mineral resource estimate

The Haib mineral resource comprises 511 million tonnes (t) of indicated resources at an average copper grade of 0.33% and a molybdenum grade of 51 parts per million (ppm), containing approximately 3,678 million pounds (mlb) of copper and about 57.1mlb of molybdenum.

The inferred mineral resources comprise 308.9 million tonnes at a grade of 0.31% copper and a 40ppm molybdenum, containing approximately 2,093mlb of copper and about 27.4mlb of molybdenum.

Mining at Haib Copper Project

Mining at the Haib copper project will use a conventional open-pit, shovel-and-truck operation with drilling and blasting on 15m-high benches, while operators will selectively mine mineralised zones in two 7.5m flitches using face shovels to minimise ore loss and dilution.

To maximise project value, a pit optimisation process was conducted using Whittle Four-X software, which identified the optimal pit shell. This shell was then transformed into a practical mine design that includes ramps, as well as bench and berm configurations.

While only the final pit was fully designed, the selected interim Whittle shells were utilised for production scheduling pushbacks.

The pit and its interim pushbacks are designed to defer waste stripping as much as possible while providing early access to shallower portions of the orebody. Scheduling of waste and mineralised material within these pushbacks is focused on optimising plant feed grade and maintaining run of mine stockpile capacity.

The production schedule allows for total material movement of approximately 70.3 million tonnes per annum (mtpa) to 120.5mtpa, providing mineralised material for an estimated 23-year mine life.

The primary loading fleet will comprise 400t hydraulic face shovels working with 240t off-highway rigid haul trucks. Additionally, the supporting fleet will include graders, track and wheel dozers, front-end loaders, rock breakers and utility excavators.

Processing details

The 2025 PEA outlines a mining and processing plan for the Haib copper project based on a total ore throughput of 35mtpa. The strategy combines a 28mtpa crushing and milling/flotation concentrator circuit with a 7mtpa hydrometallurgical (heap leach) facility.

Higher-grade sulphide ore with a copper grade of at least 0.225% copper will feed the concentrator, which processes run-of-mine material through a flowsheet incorporating crushing, wet grinding and flotation.

Lower-grade sulphide ore grading between 0.150% copper and 0.225% copper, along with transitional and oxide material above 0.150% copper, will be directed to the hydrometallurgical circuit. This heap leach route includes three stages of crushing and screening, conveying of crushed ore, agglomeration and stacking on a dedicated leach pad.

The project schedule plans a phased plant start-up, with the crushing, agglomeration and heap leach operations targeted for commissioning in the first year of operations, followed by the solvent extraction and electrowinning circuits in the subsequent year.

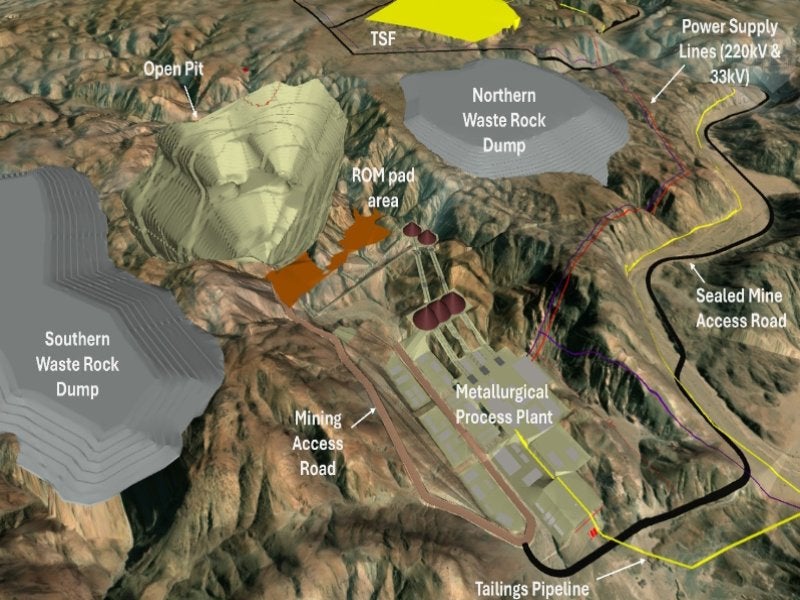

Haib copper project infrastructure

The Haib copper project lies between 12km and 15km east of the B1 highway, the main north–south route linking South Africa and Namibia. It can be accessed from Windhoek or Noordoewer via the B1, with farm roads and existing exploration tracks providing final access to the site.

The site plan includes standard process plant support infrastructure, such as a change house, administration offices, workshop facilities, warehouses, reagent storage, and sewage and water treatment plants. Additionally, the design accommodates potential expansion by reserving space for a third 14mtpa flotation circuit within the concentrator footprint.

For power supply, a hybrid model is being adopted that combines a solar photovoltaic plant with a connection to the local service provider, NamPower’s regional grid. This system is designed to meet an estimated peak demand of 152MVA and an annual energy consumption of approximately 1,131GWh, covering both mine operations and ancillary loads.

The recommended grid solution involves a double-circuit 220kV overhead transmission line providing redundancy, linking the Harib substation, located roughly 60km from the project, to a dedicated Haib mine substation.

The PEA determined raw water supply from the Orange River, supported by off-channel storage to manage seasonal variability and dry-year conditions, as the most feasible option to meet the project’s forecast demand of approximately 20 million cubic metres per year. In parallel, an alternative supply option from the Neckartal Dam remains under evaluation.

Contractors involved

All studies and technical work related to the PEA were carried out by Koryx Copper, supported by a team led by DRA Global.

The majority of the test work programme for the Haib Copper Project was conducted at Maelgwyn Mineral Services Africa in Johannesburg, South Africa, with support from several partners.

Geolabs in Johannesburg and Metso in Pennsylvania contributed to the comminution test work, while Eriez in Johannesburg handled the CPF scope.

Additionally, SGS in Johannesburg provided mineralogical characterisation and conducted Jameson cell flotation tests, and NextOre in Australia was involved in the bulk sorting test work.

Furthermore, a consortium of companies, including Maelgwyn, Rados International Technologies, TOMRA, and Eriez, has been jointly appointed to conduct a comprehensive suite of advanced tests. These include mineral sorting, dense medium separation, and various flotation tests.

Mintek conducted foundational hydrometallurgical leach tests and initial sighter amenability test work. Ceibo in Chile is conducting further, detailed heap leach column test work. The Australian firm METS Engineering was contracted to determine mining process costs and conduct specific test work.

The team also included Knight Piésold, Qubeka Mining Consultants, the MSA Group, SRK Consulting, and MJO Ingeniería y Consultores en Metalurgia.

Under a contract awarded in October 2023, Knight Piésold Consulting also conducted the ESIA for the Haib Copper Project. Ferrodrill Namibia provided diamond drilling services at the site.