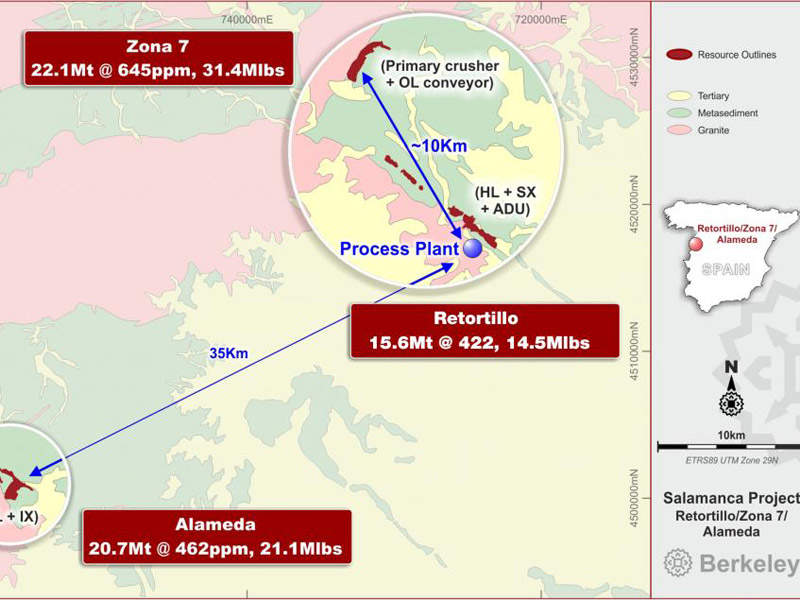

Berkeley Energia’s wholly owned Salamanca Uranium Project is located near Madrid, approximately 70km from the Spanish city of Salamanca. The project involves the development of the Retortillo, Zona 7 and Alameda near-surface uranium deposits.

The pre-feasibility study (PFS) for the project was completed in September 2013 and further updated in November 2015 by including the resources from the Zona 7 deposit. The definitive feasibility study (DFS) was completed in July 2016 and the initial construction works commenced in July 2017.

The overall investment to bring the project into production is estimated at $81.4m. The mine is expected to have a production life of 14 years and will support the creation of 450 jobs.

The annual ore processing rate from the project is estimated to be 5.2 million tonnes per year (Mtpa), whereas the triuranium octoxide (U3O8) production rate is estimated to be 4.3 million pounds (Mlb) per year.

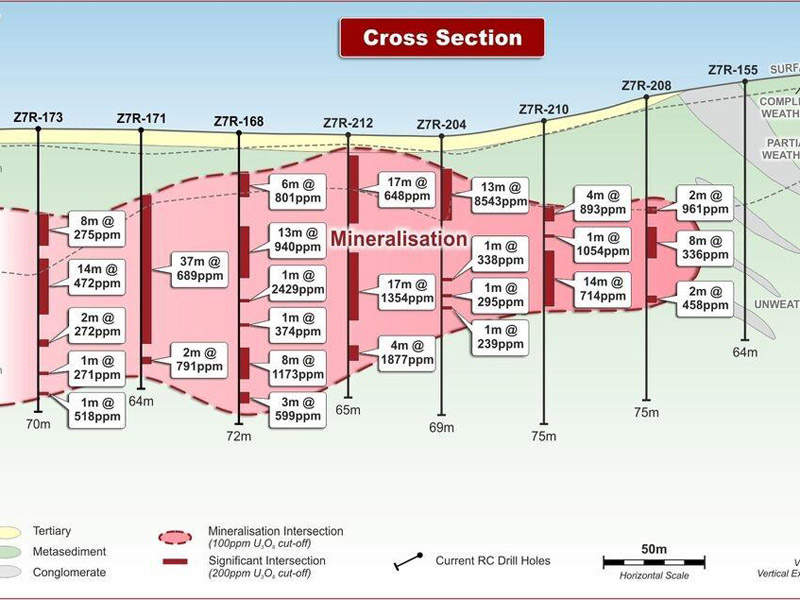

Salamanca Uranium Project geology and mineralisation

The deposits are vein-type uranium deposits hosted in fine-grained meta-sedimentary sequences, adjacent to granitic intrusives. The mineralisation at Zona 7 and Retortillo is held within a stockwork of veins and associated with the presence of sulphides within the partially weathered zone and fresh rock.

The mineralisation at Alameda occurs in a complex network of dipping brittle structures, such as veins, faults, fractures and along-bedding contacts. The mineralised zones commonly have sharp boundaries, which separate the mineralised structures from the poorly-mineralised host rock.

Reserves at Berkeley Energia’s flagship project

As of 2016, proven and probable reserves of the uranium project were estimated at 60.7Mt at a cut-off grade of 408ppm Triuranium octoxide (U3O8), containing 54.6Mlb of U3O8.

Mining and processing ore deposits

The deposits are proposed to be mined using conventional open-pit and transfer mining methods, integrating hydraulic excavators, haul trucks, and drill and blast operations. The transfer mining method will enable the open-pits to be continuously backfilled, reducing waste dump volumes and waste re-handling.

The project will involve the initial mining of Retortillo, which will be replaced by Zona 7 in the second year, while Alameda will start production in the third year. Mining at Retortillo will resume in the ninth year, following the depletion of the high-grade ore at Zona 7. The low-grade ore from Zona 7 will be processed in the last one and half years of production.

A centralised processing plant will be located at the Retortillo site. The proposed process flowsheet for the project includes crushing, screening, agglomeration, stacking and heap leaching using on-off leach pads, uranium recovery and purification by solvent extraction, ammonium diuranate precipitation, and calcination.

Located 10km from the process plant, the Zona 7 site will incorporate just a primary crusher, whereas the Alameda site, located roughly 35km from Retortilo, will share the uranium recovery and purification facility of the main processing plant.

Infrastructure at the Spanish uranium mine

The project benefits from the existence of access roads, which would require deviation and upgrades, and its close proximity to the Santander Port.

Accommodation facilities will not be required onsite due to the project’s close proximity to local towns and villages. The sulphuric acid required for the agglomeration of the crushed ore will be sourced locally.

The electricity required for the project is being sourced from the neighbouring Spanish National Distribution Grid, with the Alameda deposit site connected via a 13km-long, 45kV powerline, whereas the required water is being sourced from boreholes and rainwater harvesting facilities at the site.

Financing

Berkeley Energia invested €70m ($77.9m) in the Salamanca project as of October 2017. It is investing an additional €250m ($279m) to support the project construction.

Oman Investment Fund signed an agreement in October 2017 to provide a $120m sovereign wealth fund of the Sultanate of Oman agreed in the project.

Off-take agreements

Berkeley Energia signed a five-year off-take agreement with Interalloys Trading in September 2016 for the sale of 2Mlb of uranium concentrate from the project. The agreement has an option to extend the volume to 3Mlb.

Key players involved with the world-class uranium project

Senet compiled the PFS with inputs from SRK for the mine design, Knight Piésold for the mine design, URS for environmental management, Duro Felguera for the project cost estimates, as well as other consultants, including Golder Associates, Mintek, ANSTO, Randolph Scheffel, Jenike & Johanson, FRASA / INGEMISA, Iberdrola, March JLT, and OHL.

The DFS was prepared by MDM Engineering, in collaboration with Iberdrola and OHL. The contract for re-routing an existing electrical line was awarded to Iberdrola, while the contractor for the realignment of the existing road to the Retortillo deposit is Excavaciones y Transportes Cerezo.