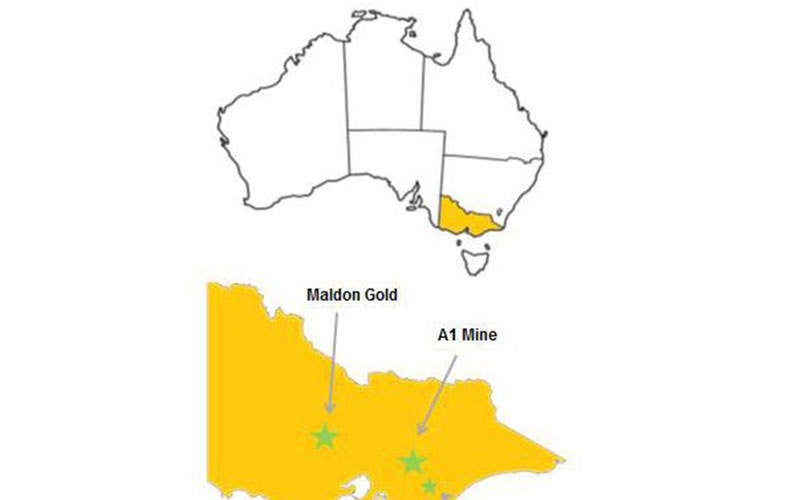

The A1 Gold Project is located within the MIN 5294 mining licence, in the Walhalla-Woods Point Goldfield area, approximately 120km east-northeast of Melbourne, Victoria, Australia. It is the second biggest gold producing mine in the area having historically produced more than 620,000oz of gold up to 1992.

The project is wholly owned by A1 Consolidated Gold, who is developing the project in stages. Stage one of the project aims at producing approximately 30,000oz of gold a year at a mining rate of 150,000t/y for an estimated period of three years. Stage two is expected to increase the project’s production life by an additional three years.

The scoping study for the Australian gold project was completed in September 2014 and was further updated in January 2015, and the mining contractor started the construction works in January 2016. First production from the project is scheduled to start in March 2016.

A1 gold project geology and reserves

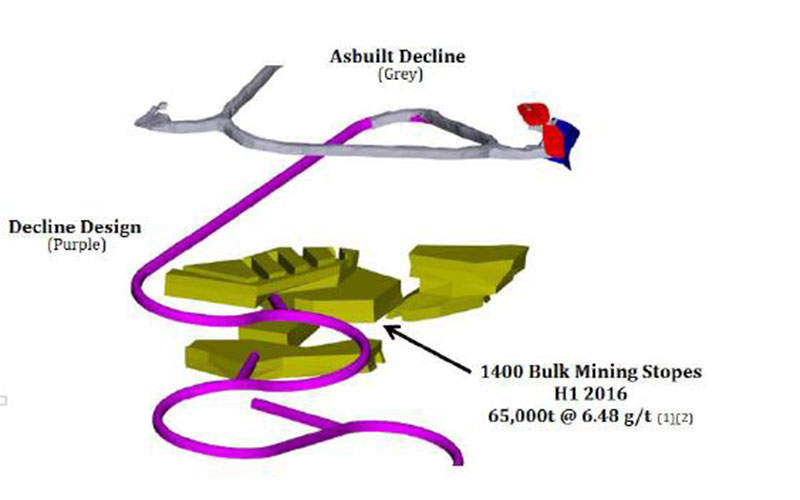

The A1 gold mine is generally referred to as a narrow vein gold deposit hosted with a diorite dyke bulge, approximately 150m-long, 45m-wide and 700m-deep, with the gold mineralisation hosted within shallow-dipping quartz veins, which occur as either stacked sets or as stockwork zones. The current project involves the development of a stockwork type of deposit named the 1400 Stockwork zone.

As of February 2013, the 1400 Stockwork zone was estimated to contain JORC-compliant indicated mineral resource of 250,000t grading 5.1g/t and containing 41,200oz of gold, and inferred mineral resource of 1.170Mt grading 6.4g/t and containing 240,000oz of gold.

Mining and processing at A1 Gold mine

The open stoping mining method has been selected for the project. A bottom-up mining sequence will be used for stopes that appear to be continuous for more than 20m vertically, whereas a top down sequence will be used for stopes that are offset between levels. For the bottom-up mining sequence, the open stopes will be filled with mine waste or mill sands to form a platform for mining.

The mined ore will be treated offsite at the Maldon gold processing facility, which was acquired from Octagonal Resources. The treatment plant is a fully permitted 150,000t/y facility and includes a primary crushing and grinding circuit and a leach gold recovery circuit.

A1 Gold will upgrade the facility and install a custom-designed gravity circuit to collect the coarse gold particles prior to leaching.

Infrastructure for A1 Consolidated Gold’s flagship project

The project benefits from the presence of existing surface infrastructure, including an administration office, first aid facility, telephone, internet and mine-radio system, drill core and sample preparation facility, and a heavy equipment workshop with fuel and oil storage facilities at the mine site.

Power for the mine will be supplied from the 22kV state power grid. The site also has an existing 500kVA transformer, a 100 mega-litre licence for underground water, which is sufficient for all planned future mining operations, and an approval for a 120,000m³ of water storage on the surface.

The processing plant site is also connected to the state grid, and has existing infrastructure including access roads, a process water supply pipeline, an administration office, a first aid facility, a workshop, and a tailings storage facility.

Contractors involved with the Australian gold mine

Pybar Mining Services was awarded a two-year underground mining service contract for the project in December 2015. The project’s scoping study was compiled by Mining One, whereas the mineral resource was estimated by CSA Global.