The Premier gold project (PGP) is an underground mine being developed in British Columbia (BC), Canada, by mineral development company Ascot Resources (Ascot). The mine comprises five deposits namely Premier, Silver Coin, Big Missouri, Dilworth, and Martha Ellen.

The PGP comprises the development of the Premier, Silver Coin and Big Missouri deposits. It is being developed along with the Red Mountain gold project, which is located 15km north-east of Stewart, BC.

A feasibility study for the development of the Premier and Red Mountain gold projects was released in April 2020.

The initial capital expenditure on the two projects together is C$176m ($141.35m), while the life of mine is estimated to be eight years.

Portal construction commenced in April 2022 while underground ramp development started in May. Some of the construction works had to be paused due to financing issues.

Gold production from the project, which was earlier scheduled to begin in the first quarter (Q1) of 2023, is expected to commence between late 2023 and early 2024.

Location and geology of the Premier Gold Project

PGP is located at the southern tip of the Golden Triangle, 25km from Stewart, near the border with Alaska.

The property is situated to the east of the Westcoast Crystalline Complex, close to the western edge of the Triassic to Jurassic Bowser Basic.

Most of the deposits within the property are hosted by volcanic rocks of the Jurassic-era Hazelton Group, which are composed of a thick package of homogeneous andesitic tuffs, lapilli tuffs, and flows of the Unuk River Formation.

Intrusive rocks such as dikes of Premier porphyry are found in abundance in the area.

Mineralisation and reserves of the PGP

Gold and silver mineralisation at the property occurs in quartz breccias, quartz veins, and stockwork within areas of quartz-sericite-pyrite alteration.

Gold occurs as silver-rich electrum, whereas base metals are found in galena and sphalerite. Silver occurs in argentite, electrum, and freibergite minerals, as well as in its native form.

The mineralisation type is categorised as intermediate sulfidation epithermal category, based on the mineral assemblage.

The proven and probable reserves of the Premium gold project are estimated at 3.63 million tonnes (Mt), grading 5.45g/t of gold and 19.11g/t of silver.

Mining at the Premier gold project

Initial mining is expected to take place at the Silver Coin and Big Missouri deposits, followed by ore mining at the Premier deposit.

Silver Coin and Big Missouri are proposed to be interconnected and will operate using shared infrastructure, whereas Premier and the main zones at Red Mountain are planned to be operated independently.

The longitudinal long-hole retreat method is proposed to be used to recover 78% of the ore at Silver Coin while 19% of the ore will be removed from the flatter zones through inclined undercut long-hole method.

The project will employ room and pillar method to extract 81% of the ore at the Big Missouri deposit. Approximately 14% of the ore will be extracted by cut and fill methods.

The Premier deposit is primarily planned to be mined using long-hole (70%) and inclined undercut long-hole (19%). A minor portion of the ore will be extracted using room and pillar and cut and fill methods.

All the deposits are planned to be accessed through side-hill portal access using new ramps and the refurbishment of existing underground infrastructure.

The mining fleet is expected to include 10t LHDs, a 30t mine trucks, double-boom jumbos, explosives trucks, a motor grader, scissor lifts, bolters, and production drills.

Processing details at PGP

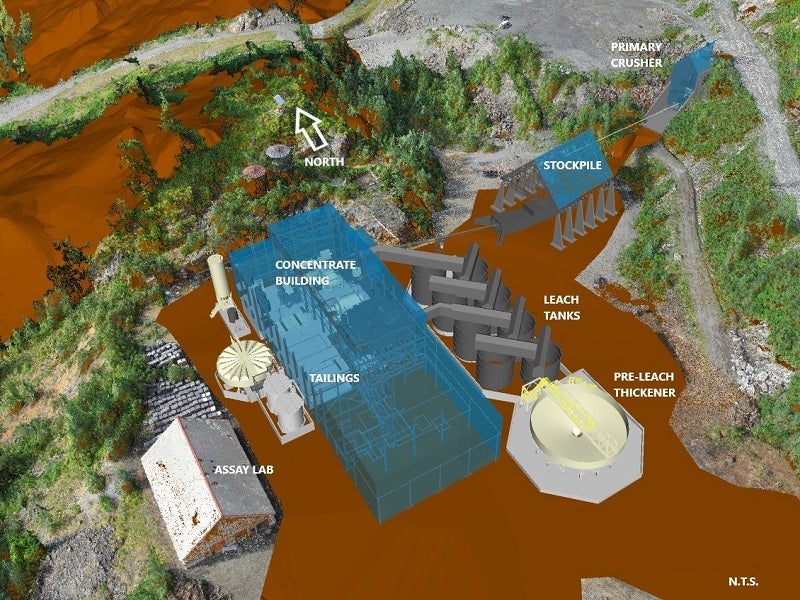

The existing milling facility along with the mine and surface infrastructure at the project site has been under care and maintenance since 2001. The mill is being refurbished to support the production plan.

The processing plant will be fed with ore from the Silver Coin and Big Missouri underground deposits in the first two years. It will be added with modifications such as a fine-grinding circuit and pre-leach thickening stage to be able to accommodate ore from JW, Marc, and AV deposits of Red Mountain in the fourth quarter of year two of the operations.

The mill facility will have a nominal plant treatment rate of 2,500tpd and an availability rate of 92%. It is anticipated to be fed with ore from Premier and Red Mountain on a campaigning basis, which will see ore processing from the Premier project deposits for two weeks, following by ore processing from Red Mountain for the subsequent two weeks.

Run-of-mine (ROM) ore from either of the PGP and Red Mountain stockpiles will be fed to the primary jaw crusher through a reciprocating plate feeder.

The crushed ore will be transferred to a coarse ore stockpile (COS) through a refurbished product conveyor.

Two new apron feeders will be used to reclaim coarse ore from the stockpile. The material will be sent to the semi-autogenous grinding (SAG) and ball mills. The ball mills will be arranged in a closed circuit with hydrocyclones.

The SAG and ball mills circuit will reduce the material size to 80µm. A portion of ores from the discharge from the ball mill will be pumped to a centrifugal gravity concentrator during ore processing at PGP.

The gravity concentrate containing coarse gold will be discharged into an intensive leach reactor (ILR) to undergo cyanidation for the recovery of precious metals.

A conventional carbon-in-leach (CIL) circuit will be used to cyanide leach the hydrocyclone overflow with P80 of 80m during processing of PGP ores.

The recovered gold and silver will undergo elution in a pressure Zadra-style elution circuit, followed by electrowinning to produce silver/gold dore. The recovered gold from the ILR will undergo electrowinning separately.

A sulphur dioxide (SO₂)/air cyanide destruction circuit will be used to detoxify the leached tailings. The PGP processing will involve thickening of the detoxified tailings before being pumped to a tailings storage facility (TSF).

Infrastructure at the Premier gold project

The Premier project site can be accessed through the gravel-surfaced two-way Granduc Mining Road from Stewart.

Fresh water needs of the project are expected to be met from the neighbouring Cascade Creek.

A 25kV powerline from Stewart currently supplies power to the PGP Site. A new substation is planned to be built next to the processing facility and connected to the 31MW power plant partially owned by Long Lake Hydro. The project site will receive power from a 138kV power line between the Long Lake line and the new substation.

Financing Canada’s PGP

Ascot closed a $105m finance package for the construction of the PGP and repayment of convertible notes in December 2020.

The package included a $80m senior credit facility with Sprott Private Resource Lending II (Sprott). The remaining $25m was secured in the form of a convertible facility provided by Beedie Investments and Sprott.

Ascot drew down $20m of the senior credit facility. It, however, could not secure an agreement for the satisfaction of the drawdown conditions for the remaining $60m tranche.

The company is looking for alternate financing sources for the construction of the project.

Contractors involved

The renovations to PGP’s tailings storage were undertaken by Arthon and Belvedere Place Contracting (BPC). The improvements included raising the fuse plug and upgrading the main dam face, spillway, seepage monitoring pond, and settling ponds at the mining water treatment plant.

Kode Contracting was engaged to provide crushing services for the Canadian mining project.

Sacre-Davey Engineering (SDE), an engineering consultant based in Canada, led the feasibility study for the Premier and Red Mountain gold project. The company was responsible for the overall coordination, infrastructure, and economic evaluation of the project.

InnovExplo and Mine Paste were engaged to conduct mining and geotechnical study while Sedgman Canada, a member of CIMIC Group, carried out testing related to metallurgy and processing.

SRK Consulting (Canada) contributed to the feasibility study by providing consulting services related to the water treatment plant.

Global consulting firm Knight Piésold received a contract for the tailings and water management part of the feasibility study.

Paul Hughes Consulting was appointed to conduct site geotechnical studies while McElhanney was hired for access roads.

Prime Engineering provided advice on the cost estimate for the 138kV transmission line and the new substation. Falkirk Environmental Consultants, Marsland Environmental Associates, and EcoLogic Consultants were responsible for environmental studies.

Palmer Environmental Consulting Group conducted geochemistry, hydrology and water quality modelling.

Bird Resource Consulting Corp. (BRCC) prepared the resource estimates of the Premier gold project.

The road design and cost estimate were provided by Onsite Engineering while Adapt Mountain Safety Services (formerly the Avalanche Risk Management Division of Soucie Construction) provided recommendations and operating cost estimates for the avalanche control programme.