The Norilsk mining centre lies in the Russian High Arctic, about 2800km north east of Moscopgw. The world’s leading nickel and palladium producer, and a significant supplier of copper, the operations support a community of some 300,000. Direct employment is around 80,000, with plans to halve this within ten years.

The Norilsk deposits were discovered during the 1920s, with nickel production starting during the Second World War. Underground mining began in the 1950s.

The operating company was privatised by the Russian government in 1995, and is now controlled by Unexim Bank.

The company also controls the Severonkel and Perchenganikel nickel mines on the Kola Peninsula, south of Murmansk, and has a significant investment holding in Stillwater Mining Co., operator of the Stillwater platinum mine in the US.

GEOLOGY AND RESERVES

The copper-nickel-Platinum Group Metal (PGM) deposits at Norilsk lie at a depth of between 500m and 1,500m beneath a series of flood basalts and sediments. The massive sulphide orebodies are hosted within the Talnakh intrusive complex. Ores can be high-nickel or high-copper in grade, some of the direct-smelting copper ores containing up to 32% copper. PGMs include platinum, palladium and rhodium.

The most recent reserve estimates (as of the end of 2004) show proven and probable ore reserves totalling 478.7Mt, containing 6.27Mt of nickel, 9.37Mt of copper, 62.2Moz of palladium and 16Moz of platinum. Reserves are reportedly sufficient to support 50 years’ output at current rates.

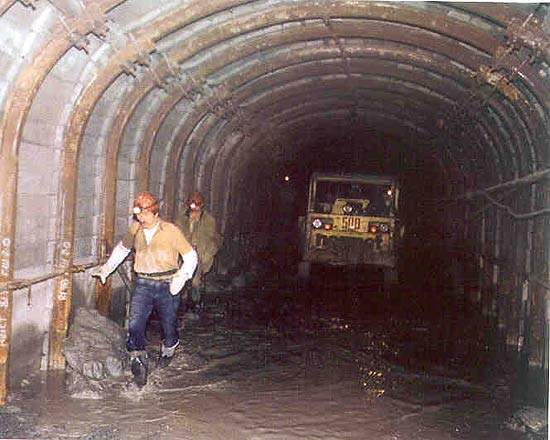

UNDERGROUND MINING

Norilsk uses a sub-level caving mining method, the completed stopes then being backfilled for support. Stopes are mined 120m long, 8m wide and 10m thick using mechanised drilling and ore loading equipment that has predominantly been supplied by Atlas Copco. The company had sold approaching 400 units, including drilling jumbos, load-haul-dump machines and raise borers, by early 2001. Other suppliers include Boart Longyear (drilling equipment) and Putzmeister (backfill pumps).

Output is obtained from five underground mines, the principal currently being the Oktyabrskiy, Komsomolskiy and Taymirskiy units, which account for about 60%, 15% and 10% of annual Russian PGM production respectively. Oktyabrskiy produces about 70% of the operation’s copper and 55% of its nickel.

The Skalistiy mine came on stream in the late 1990s at a cost of around $600m, and Glubokiy mine is now under development – these two units alone have reserves of some 70Mt of ore. Norilsk Nickel also operates the Kayerkanskiy opencast coal mine, some 30km from the city, to supply power station fuel; the operation uses two Liebherr R992 hydraulic excavators and a fleet of Belaz 40t and 70t-capacity haul trucks.

ORE PROCESSING

Norilsk Nickel’s Siberian operations include two ore concentrators, capable of treating 11Mt/y of ore, and three smelters with a combined capacity of 350,000t of copper and 160,000t of nickel. Sulphide ores are first pre-concentrated using heavy-medium separation, then treated by flotation to recover copper and nickel concentrates for smelter feed.

Capacity at the Nadezhda metallurgical complex, which uses Outokumpu flash smelting technology, is being increased, while the Medny copper smelter is also being upgraded to 400,000t/y. PGM concentrates are refined at the Krasnoyarsk metallurgical complex and at the Prioksky plant near Moscow.

PRODUCTION

Between its various operations, Norilsk accounts for about 90% of Russia’s nickel, 55% of its copper and virtually all of its PGMs. Only recently has the company begun to publish official figures for its output of nickel and copper, with the possibility that it may begin to release platinum-group metal production figures some time in 2005. Over 90% of its sales are to foreign customers.

The complex achieved its maximum output of around 250,000t of nickel in 1989. Its production in 2006 was 244,000t of nickel, plus 425,000t of copper, 3.16Moz of palladium and 752,000oz of platinum (not including its share of production from Stillwater).

INVESTMENT

Norilsk currently spends $50m annually on new equipment, as part of its announced ten-year, $3,000m investment programme. Plans include concentrating its mining operations into fewer units, and upgrading its ore processing and smelting facilities.

In early 2005, the company was soliciting bids for a new 2,054m-deep ventilation shaft for its Skalisty mine, as a precursor to developing ore reserves on the 1,064m and 2,052m levels.

The company has also won a $500m World Bank loan to assist in resettling up to 50,000 Norilsk residents in other, less-expensive parts of Russia, and in early 2007 submitted a plan to the city of Norilsk over social and economic development in the community over the next 20 years.