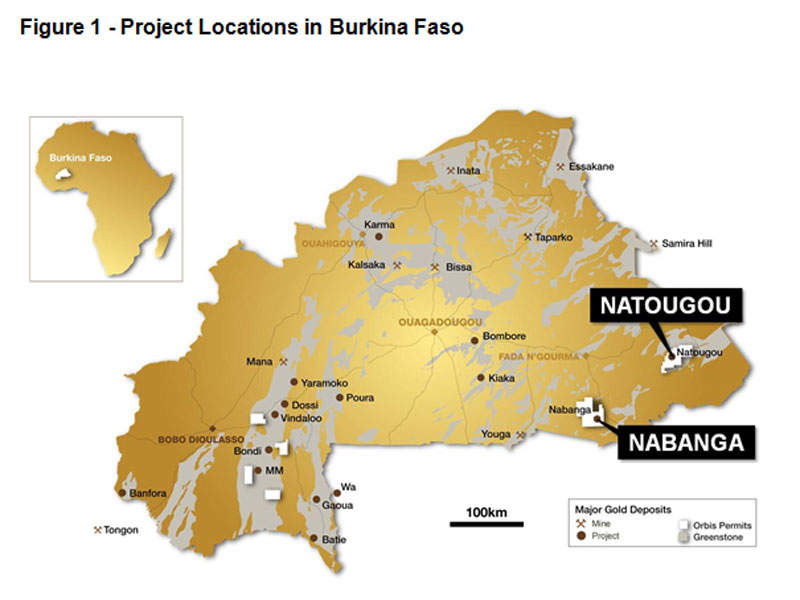

Located approximately 320km east of Ouagadougou, West Africa, the Natougou project is an advanced gold deposit in the Tapoa Permit Group.

Canadian mining company SEMAFO became the project owner by acquiring the Tapoa Permit Group from Orbis Gold, which was subsequently bought by the company in 2014.

A positive feasibility study (FS) for the project was completed in February 2016. The project received a mining permit from the Government of Burkina Faso in December 2016.

The mine will have an initial life of more than seven years and produce approximately 1.2Moz of gold over the same period. Initial capital expenditure is estimated to be $219m, including $42m in pre-stripping expenditure and $18m contingency.

First gold pour is expected in the second half of 2018, while full production is expected in 2019.

Geology and mineralisation

The Tapoa Permit Group is situated in West Africa’s Birimian Gold Province, which contains major gold deposits.

Mineralisation at the deposit is predominantly hosted in a flat-lying shear zone and comprises mafic to intermediate volcanic/intrusive stratigraphy. The Natougou deposit hosts 90% of the mineralisation in its fresh rock.

Mineral reserves at the African mine

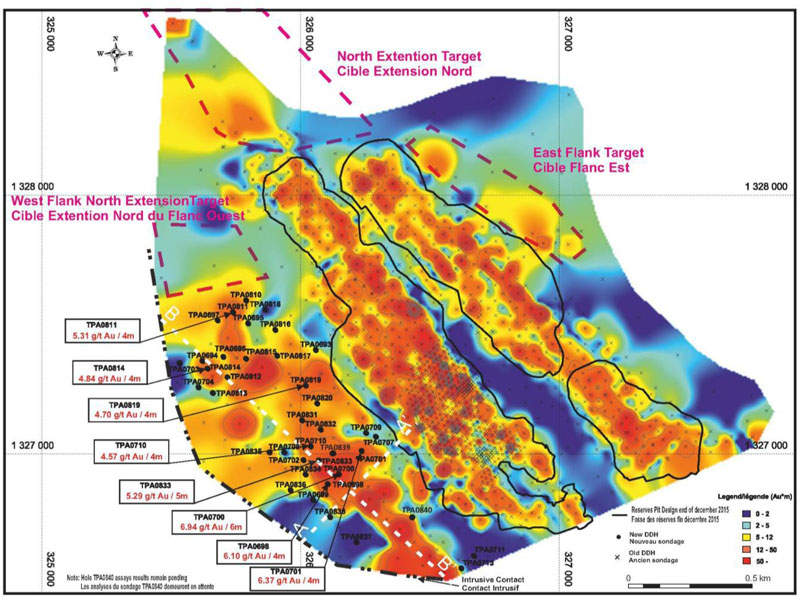

As of December 2015, the Natougou gold mine was estimated to host mineral reserves of 9.6Mt graded at 4.15g/t Au and containing 1.28Moz of gold.

Proven reserves were estimated at 1.6Mt graded at 6.5g/t Au and containing 0.33Moz of gold and probable reserves were estimated at 8Mt graded at 3.7g/t Au and containing 1.28Moz of gold.

Mining and processing at the Natougou gold mine

Conventional open-pit methods will be used to mine the project. Approximately 139Mt of material is projected to be mined throughout the life of the mine. Majority of the drilled and mined ore will be in the form of fresh rock and hence will be drilled and blasted before loading and processing.

The mined ore will be processed in an on-site processing plant having a processing capacity of 4,000t of ore a day.

The processing plant will comprise a conventional crushing and grinding circuit. Including a primary crusher and coarse ore storage bin, the crushing circuit will convey the crushed ore to the grinding circuit through a semi-autogenous grinding (SAG) mill, featuring a pebble crusher and a tower mill.

The grinding circuit will also feature a gravity circuit through which 30-50% of the gold will be recovered.

Main reagents to be used in the plant include cyanide, hydrated lime and oxygen. A gold recovery of 92.9% is expected from the plant, with average head grades of 4.15g/t.

Natougou gold project infrastructure

The mine can be accessed through an all-weather bitumen road, Nationale RN04, from Ouagadougou to Ougarou junction through Fada n’Gourma.

Power for the plant’s operations will be generated through a 15.4MW power plant, which will produce electricity using hybrid heavy fuel oil and light fuel oil generators.

Other infrastructure to support the processing plant’s operations include bulk fuel storage, tailings storage facility (TSF), reagents and consumables storage, maintenance and administration buildings, medical facilities, dining and kitchen rooms, offices and accommodation camps.

The TSF will be located 1.5km away from the processing plant and have a capacity to store 10Mt of tailings. The facility will be fully lined with high-density polyethylene (HDPE).

Water for the plant’s operations will be sourced from two creeks, located to the east and west of the processing plant, as well as from the sediment ponds located around the site. Another water supply dam is planned for construction to the north-east side of the plant.

Financing

SEMAFO received a $120m credit facility from the Macquarie Bank that will be used for the construction of the project. The facility will be repaid in two years in quarterly instalments of $15m, from Q1 2019 to Q4 2020.

Contractors involved

SEMAFO subsidiary Semafo Boungou (SMFB) awarded the mining services contract for the project to African Mining Services (AMS).

The infrastructure, capital and operating cost estimates were prepared by Lycopodium Minerals Canada, which was also responsible for metallurgy and process plant studies.

WSP Canada conducted the environmental studies, while the geology and mineral resource estimate was done by Snowden Mining Industry.

AMC Mining Consultants (Canada) was involved in mining and mine planning studies, while the geotechnical, tailings management, design and hydrology studies were conducted by Knight Piesold Consulting.