The Johnson Camp property is located 65 miles east of Tucson, Arizona, US and carries substantial proven reserves of copper ore.

Mining was commenced in the Johnson Camp mine by Cyprus Mines Corporation in the mid-1970s but ended ten years later due to low copper prices.

The asset is now 100% owned by Nord Resources. The property includes the Johnson Camp mine which is an existing open pit copper mine.

A feasibility study undertaken by Bilkerman Engineering & Technology Associates reported total proven and probable minable reserves of over 70 million tons of ore.

GEOLOGY AND RESERVES

The Johnson Camp mine is located along the east flank of the Little Dragoon Mountains in southeast Arizona. The Little Dragoon Mountains consist of a core of middle Precambrian granites and schists that are unconformably overlain by younger Precambrian metasediments and Paleozoic and Mesozoic sediments.

Total proven and probable minable reserves are 73.4 million tons of ore at an average total copper grade of 0.335% total copper (TCU), containing 492 million pounds of copper and over 374 million pounds of recoverable copper, minable at a strip ratio of 0.66 to 1.

MINING

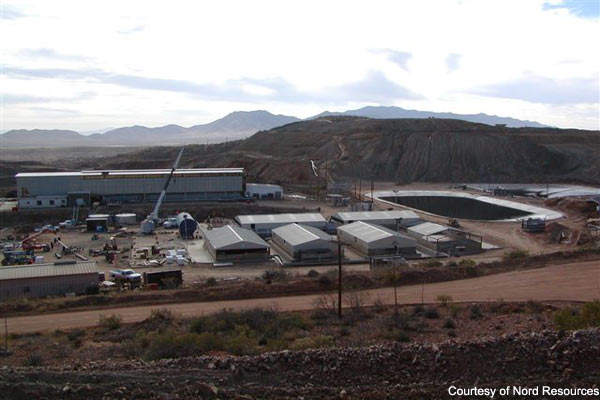

The property includes the Johnson Camp mine which is an existing open pit copper mine and production facility that uses the solvent extraction, electrowinning (SX-EW) process. The Johnson Camp mine includes two existing open pits, the Burro and Copper Chief bulk mining pits. Mining of the Johnson Camp Mine Project is by open-pit methods utilising mid-size earth-moving equipment.

Major facilities consist of two open pits; one waste rock dump, three peach pads; various solution ponds; two raffinate ponds; one solvent extraction ( SX ) plant; one electro winning ( EW ) plant; one tank farm; seven storm water collection ponds; several production and monitor wells.

ORE PROCESSING

Open pit mining is carried out by drilling and blasting defined ore zones, excavation, truck hauling to the pit from the crushing circuit – for crushing and agglomeration – and then overland transportation of the prepared ore via conveyor to the leach pads. The ore is then placed in layers and subjected to leaching using a dilute sulphuric acid solution.

Leached copper solution (pregnant leach solution PLS) flows to the leach pad base where it is collected and directed to flow into the PLS ponds. These solutions are transferred to the SX plant where they are processed through mixed settlers and mixed first with an organic solution to extract the copper from the PLS. They are then run across a strong sulphuric acid solution to extract the copper from the organic solution to make a rich copper-bearing electrolyte that is transferred to the EW plant for processing into cathode copper.

Copper barron raffinate solution from the SX plant returns to the raffinate ponds and is pumped back onto the leach pads for use in repeated leaching of new and existing and newly emplaced copper ores.

Make-up sulphuric acid is added to the raffinate as necessary to enhance recovery from the leach pads.

PRODUCTION AND COSTS

Based on current reserves the Johnson Camp is expected to produce 25 million pounds of copper cathodes annually over a mine life of 16 years. Nord Resources has produced copper from existing heaps at Johnson Camp mine on a limited basis without mining additional ore. The company is currently awaiting approval for additional capital.

Working capital is estimated at $683,000, to be repaid at the end of mine life. The financial projection assumes a salvage value of the mining, process and service equipment of $2,512,000. Mine closure costs have been estimated to total $1,850,000. A 1% marketing and delivery charge as applied to all copper sales.

THE FUTURE

In the past, the EW plant has produced copper of five 9s (99.999% copper) quality. The future operation will be at low current densities (22 to 23 amps per square foot) as compared to most operations and this should continue to ensure a high cathode quality.

The Nord updated feasibility study examined the throughput capacity of the proposed crushing and conveying circuit and concluded that the equipment was adequate to meet the production goals. BETA concurs with these findings.

Nord has already purchased the primary crushing station from the Newmont Gold Quarry operation for use at Johnson Camp. Nord says that planned modifications are sufficient to meet production targets.

Copper hit a record price of $8,820 in March 2008 and may well rise higher than that throughout the year adding impetus to all copper mining activities.