Located in the Pilbara region of Western Australia, the Corunna Down iron mine is 100% owned by Australian iron ore company Atlas Iron. The mine is situated close to the company’s operating mine Mt Webber and the future McPhee project.

The prefeasibility study (PFS) of Corunna Downs was completed in November 2016, while its definitive feasibility study (DFS) was released in December 2016.

Atlas Iron announced in February 2017 that it was moving forward with the development of Corunna Downs project.

The mine is expected to produce four million tonnes (Mt) of iron ore initially. The life of the mine is expected to be between five and six years, with potential for future expansion as the current ore reserve considers only the above-water table resource.

The first shipment of ore from Corunna Down is scheduled for Q1 2018.

Corunna Down iron ore mine geology and mineralisation

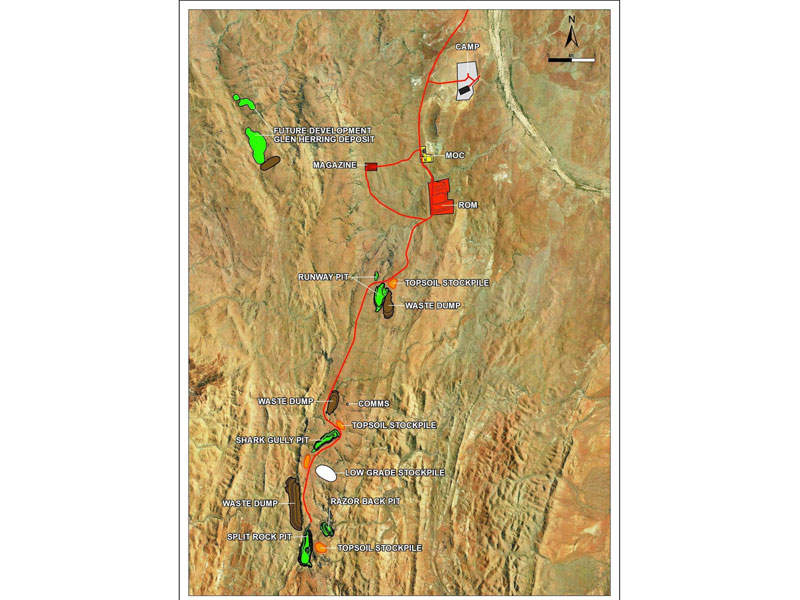

Corunna Downs currently hosts five prospects namely split rock, runway, razorback, shark gully and glen herring. The PFS, however, considered mineral resources of the first three prospects alone.

All the three prospects are hosted by the cleaverville formation and are located in the kelly greenstone belt, which is bound by the Corunna Downs and Shaw granitoid complexes. The prospects feature successive macrobands of goethite-hematite rich, high-grade, iron ore zones.

Reserves at Corrunna Downs

As of December 2015, the mine is estimated to contain indicated and inferred mineral resources of 65.4Mt grading 57.2% iron (Fe), including 42.1Mt of indicated and 23.3Mt of inferred resources. The ore reserves at the mine are estimated to be 21.1Mt grading 57% iron.

Of the total resource, the runway prospect contains 11.4Mt grading 57.3% Fe, shark gully contains 9.2Mt grading 57.6% Fe, split rock prospect contains 25.4Mt grading 57.1% Fe, razorback contains 5.9Mt grading 57.1% Fe and glen herring prospect contains 13.5Mt grading 57.3% Fe.

Mining and processing at Atlas Iron’s mine

Corunna Downs will be a conventional open-pit operation using drill and blast, and truck and excavator load and haul methods. It will include four open-pits, the mining of which will be outsourced to a mining contractor who will operate under the supervision of Atlas Iron.

The runway prospect will be mined first due to its proximity to the run-of-mine (ROM) pad and low strip ratio. Shark gully will be the second, followed by split rock, which is the biggest of all the pits and would be a major source of ore supply over the life of the mine.

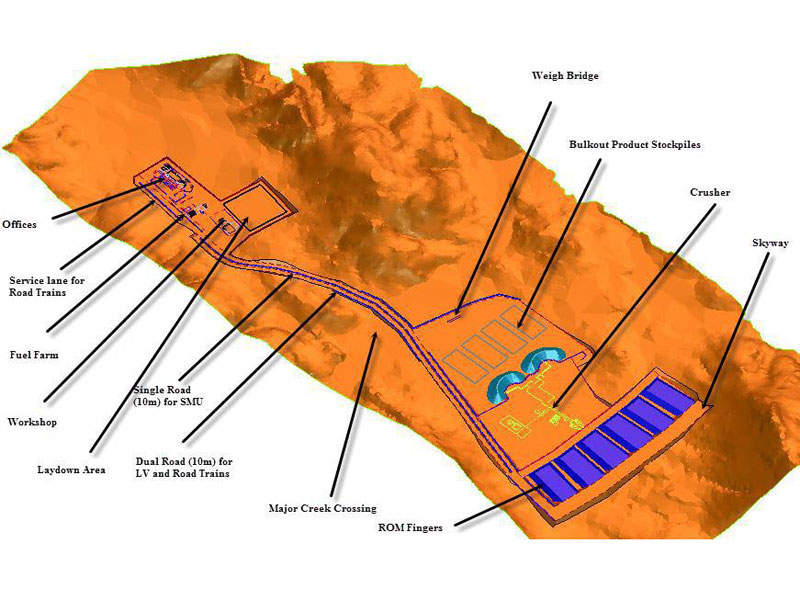

The mined ore will be transported to the ROM pad, where it will be blended to the crusher.

The project envisages the development of a semi-mobile, dry crush and screen plant for processing the mined ore. With a minimum capacity to process 4Mtpa of lump and fines, the plant, along with the ROM pad and product yard, will be located at the base of the Corunna Range.

To be built, owned and operated by a private contractor, the processing plant will use standard dry crushing and screening processes to process the ore.

The finished product from the plant will be stockpiled and hauled by road to the Utah stockyard at Port Hedland in the Pilbara region.

Corunna Downs iron ore mine infrastructure

The mine site can be accessed through an unsealed hillside marble bar road and a13km-long access road. An upgraded 22km-long public road is also available to access the mine. The project site also features a 152-man camp facility and road train haulage of 237km to Port Hedland.

Other infrastructure to be developed includes access ramps, ROM pad, crusher area, stockpile area, processing plant, stockpiling and load-out yard, waste dumps, mine operation centre, contractor’s laydown yard, explosives storage, and accommodation camp.

Financing

The project is estimated to require an initial capital expenditure ranging between A$47m ($34.05m) and A$53m ($38.4m), for an initial annual production of 4Mt of iron ore.

The investment will be funded from the company’s operating cash flow following proposed amendments to its Term Loan B facility.