The Arcadia lithium project located near Harare, Zimbabwe, is considered to be one of the world’s biggest hard rock lithium resources.

Prospect Resources fully owns the lithium project through its subsidiary, Prospect Lithium Zimbabwe (PLZ).

The pre-feasibility study (PFS) of the project was completed in June 2017. The ground-breaking ceremony for the Arcadia lithium project was held in December 2018. The mine produced an average of 212ktpa of spodumene and 216ktpa of petalite in 2019.

In December 2019, Prospect released an updated definitive feasibility study (DFS) based on the proposed 2.4 million tonnes per annum (Mtpa) mining and processing operation. A direct optimised feasibility study (Direct OFS) was later released in December 2021 to cement the previous studies and optimise the mine design with updated reserves and a capital investment of $192.46m.

Prospect Resources signed a binding agreement in December 2021 for the sale of an 87% interest in Arcadia to a subsidiary of Zhejiang Huayou Cobalt (Huayou), for an upfront cash consideration of approximately $377.8m. The sale was completed in April 2022.

Arcadia lithium project location

The Arcadia project is located 38km east of Harare and lies in the high veld near the Arcturus gold mine. The deposit is made up of Winston, Takashi, Green Mamba, Bing, Tourit, and the Oribi Li-Be claims, which were operated before the early 1970s.

The project area extends over 14km² and comprises historical lithium and beryl workings within an existing agricultural area partially surrounded by hills.

Arcadia lithium project geology and mineralisation

The lithology of the Arcadia lithium project includes greenstone rock units of the Arcturus formation, a part of the Harare Greenstone Belt (HGB). The greenstone belt is a complex refolded synformal structure, cropping out as two major limbs, including an east-west trending Arcturus Limb and a north-south trending Passaford Limb.

The lithological units found at the belt include meta-basalts, banded iron formations, meta-andesites, serpentinites, dolerites, and lithium-bearing pegmatites.

The deposit is hosted within a series of stacked, subparallel petalite-spodumene-bearing pegmatites, intruding the HGB. The drilling results identified pegmatites with an average thickness of 15m and extending up to 3.5km along the strike.

Most of the economic lithium mineralisation found at Arcadia comprises petalite and spodumene. The crystallisation of petalite is expected to have occurred prior or co-genetically with primary spodumene.

Secondary mineralisation is believed to have occurred through the conversion of primary petalite and spodumene to spodumene, quartz intergrowth, and eucryptite.

The presence of significant caesium concentrations of more than 40ppm from soils around the pegmatite-bearing Shabaash lepidolite was demonstrated by the satellite bodies at the Arcadia mine.

The identified caesium exists within pollucite, a rare caesium mineral of high value that forms in pegmatite structures of extremely differentiated lithium-caesium-tantalum (LCT).

Arcadia lithium project reserves

The proven and probable reserves at Arcadia are estimated at 42.3Mt, grading 1.19% lithium oxide (Li₂O) and 121ppm tantalum pentoxide (Ta₂O₅) with a total Ta₂O₅ content of 11.3Mlb, as of October 2021.

Mining methods of the Arcadia Lithium Project

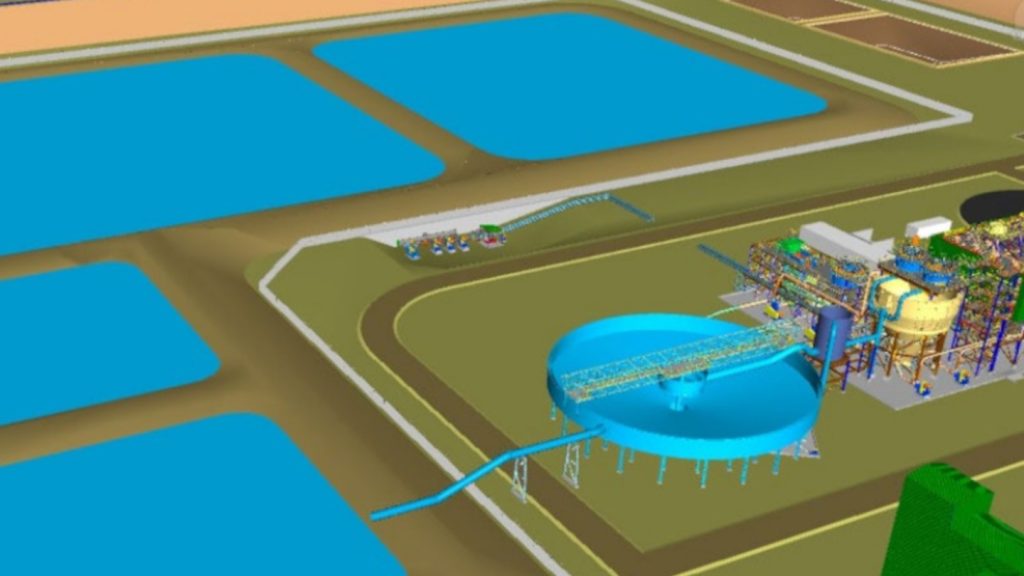

The Arcadia deposit will be mined as a conventional truck and shovel open pit operation via contract mining. Mining operations are planned to be carried out in two pits comprising a main pit and a satellite pit located northeast of the main pit.

As part of the first phase of operations, the main pit will be mined in four phases, which include two smaller starter pits within the main pit.

Mining operations are expected to be carried out using track-mounted diesel hydraulic backhoe excavators to load ore and waste into dump trucks. Ore gradings of 1% Li₂O or more will be transported to the run-of-mine (ROM) pad and stockpiled for reclamation by a front-end loader. The lower-grade ore will be stockpiled and used as a blender with high-grade ore.

The run-of-mine (ROM) ore will undergo two-stage crushing followed by a high-pressure grinding roll (HPGR) to achieve the desired 5mm crushed product.

Ore processing of the lithium project

The Arcadia pilot plant was commissioned in June 2021 to produce high-purity petalite concentrate. It consisted of a single-stage dense media separation (DMS) with a 200hmm cyclone.

The ROM ore will undergo two-stage crushing at the processing plant followed by a high-pressure grinding roll (HPGR) to achieve the desired -5mm crush size. The crushed product with a bottom cut-off size (BCOS) of 0.6mm will be transferred to a DMS circuit.

The crushed ore product, after gravity recovery, will also report to the flotation circuit for spodumene recovery. Wet high-intensity magnetic separation (WHIMS) will be used to remove magnetic particulates and prepare flotation feed, followed by mica flotation of the non-magnetic fraction. The resultant mica concentrate will be stored for potential sale.

Tantalite recovery will be done via a dedicated spiral circuit within the flotation tailings stream. Rough tantalite will be upgraded to a saleable product with approximately 25% Ta2O5 content with conventional gravity concentration and magnetic separation methods.

Offtake of lithium from Arcadia site

Prospect Resources entered a conditional placement and off-take agreement with Sinomine Resource Exploration (Sinomine) in November 2017 for the off-take of spodumene and petalite concentrates produced at Arcadia.

Sinomine will invest A$10m ($7.67m) in Prospect Resources under share placement at A$0.05 a share while Prospect will sell 390,000t of spodumene concentrate (grading 6% Li₂O) and 1.10Mt of petalite concentrate (grading 4% Li₂O) over a seven-year period as part of the agreement.

The agreement also entitles Prospect to construct a lithium carbonate plant and divert half of the petalite concentrate produced at Arcadia to the facility for producing and supplying lithium carbonate to Sinomine.

The parties also agreed to a facility agreement, as part of which Sinomine will fully finance the construction of the mine and infrastructure on a build-and-transfer basis.

In November 2020, Prospect signed an off-take agreement with Sibelco for petalite production from the Arcadia lithium project.

The agreement includes the annual supply of high-quality ultra-low iron petalite concentrate of up to 100,000dmt over a seven-year period.

Infrastructure facilities at Arcadia project

The mine can be accessed from Harare either from the main A2 Harare to Mozambique highway or the main A3 Harare to Mutare highway.

Power supply requirements will be met from the ZETDC 132kV Atlanta substation, located approximately 9.5km from the mine site. A dedicated 33kV, 20MW supply agreement has been secured by PLZ from the substation. A new 33kV line will feed a local substation to be built near the plant.

Run-off and raw water bores within the project mining lease area will be utilised to supply site water requirements. The Chinyika dam is situated less than 4km away from Arcadia and has also been considered for the supply of water. Potable water supply will be produced from on-site boreholes.

Contractors involved

Engineering consulting business Lycopodium prepared the Direct OFS and was involved with process plant design and review, plant capital and operating cost estimates.

CSA Global, a mining and geological consulting company, provided the ore reserve, and mine planning while economic solutions consultancy firm Practara was engaged for the geotechnical services of the Direct OFS.

The environmental assessment for the Direct OFS was provided by SRK Consulting while research and consultancy group Wood Mackenzie provided price forecasting.

BioMetallurgical Zimbabwe (BMZ), a mining and engineering company, prepared the PFS for the Arcadia project, while engineering firmHatch was engaged to prepare an additional PFS.

Digital Mining Services, The MSA Group, McDhui Mining Services, Practara, FT Geolabs, Nagrom, Blonton Management Consultants, Envirosmart Consultancy, LogiProc, and Consulmet were also involved in the preparation of the PFS.

As agreed with Sinomine, Prospect Resources engaged the Beijing General Research Institute of Mining & Metallurgy (BGRIMM) for drafting the DFS report for the project.

The block model evaluation was carried out by CSA Global in November 2019. CSA Global built a mine production life plan using MineSched software.