Australian iron ore mining firm Flinders Mines Limited has announced plans to raise approximately A$16m ($11.83m) under a non-renounceable offering of approximately 290 million fully paid ordinary shares priced at A$0.55 ($0.40) each.

Eligible shareholders will receive one new ordinary share for every existing 11 ordinary shares.

The offer value is at approximately 22% discount to the 30-day volume-weighted average price up to 13 April 2017 of Flinders Mines’ share price on ASX.

Famur has announced plans to issue approximately 43.67 million ordinary bearer Series D shares and 29,293,500 ordinary bearer Series E shares through a private placement.

Based in Poland, the company is a manufacturer of equipment and machines for the mining industry.

See Also:

Fortescue Metals Group has announced that it has raised $750m through issuing senior unsecured notes maturing in 2024 with a 5.125% coupon rate, in addition to $750m raised through issue of senior unsecured notes maturing in 2022.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

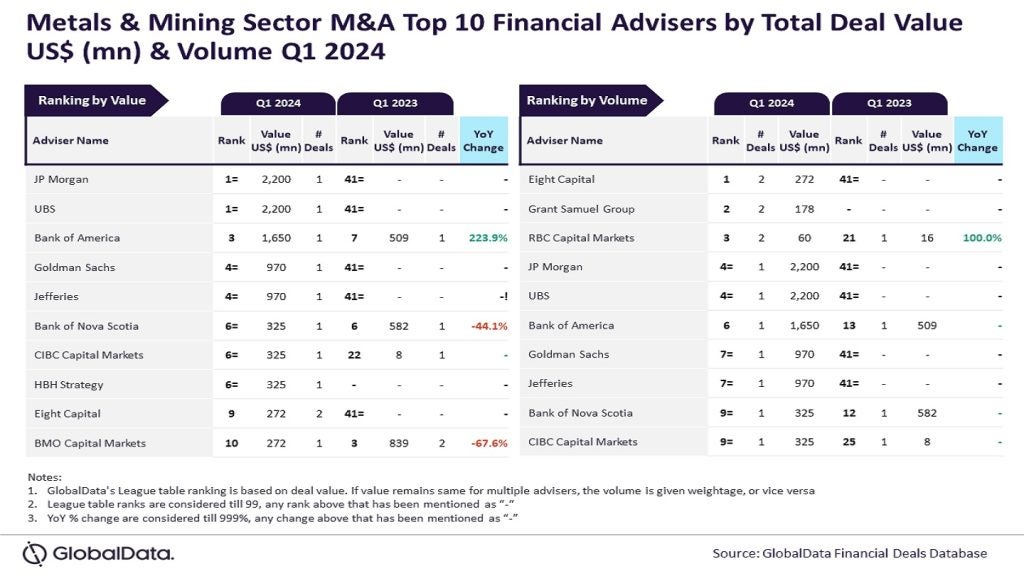

By GlobalDataEuroclear Bank and Clearstream Banking acted as depository, while Credit Suisse Group, Deutsche Bank, JPMorgan Chase & Co, and Morgan Stanley were engaged as the book-runners for the issue.

Fortescue Metals Group is an iron ore mining company based in Australia.

US-based coal mines operator Contura Energy has announced the filing of preliminary prospectus with the Securities and Exchange Commission to raise approximately $100m by issuing common shares in an initial public offering (IPO).

The company has given a 30-day option to the underwriters to purchase additional shares to cover over-allotments, if any.

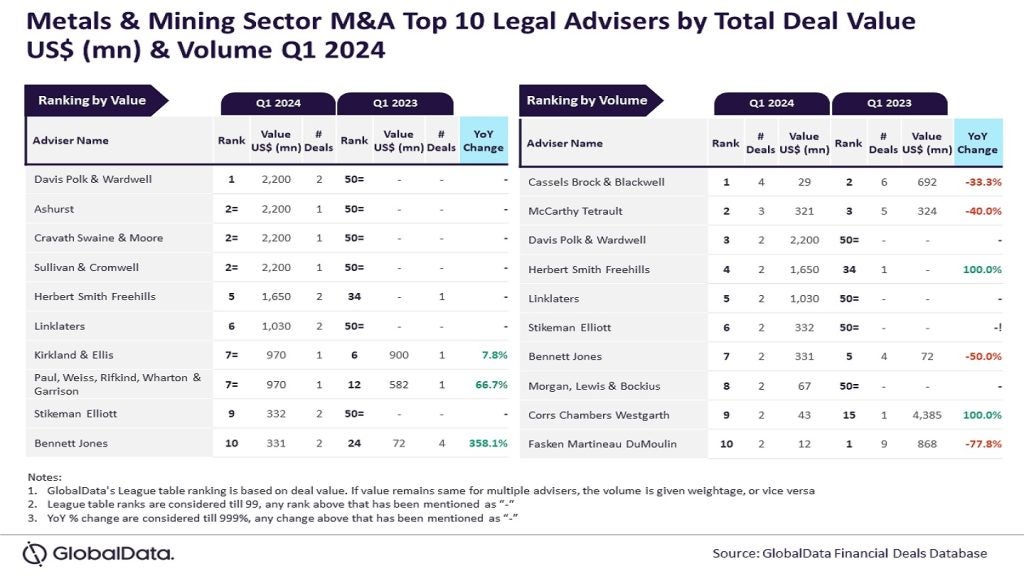

Citigroup Global Markets is engaged as the joint underwriter and book-runner, while Davis Polk & Wardwell is the legal advisor for the transaction.

Ship Ocean has announced the acquisition of the Jelai IUP copper-gold project located in Indonesia from Asiamet Resources for $800,000.

Asiamet is a Canada-based exploration and development company that specialises in copper-gold deposits.