Hecla Mining has agreed to acquire all the outstanding shares of Klondex Mines for $462m.

Hecla and Klondex shareholders will own approximately 83.8% and 16.2% of Hecla’s outstanding common stock, respectively, following the acquisition.

Based in the US, the acquirer is engaged in silver exploration, while Klondex is a Canadian gold exploration company.

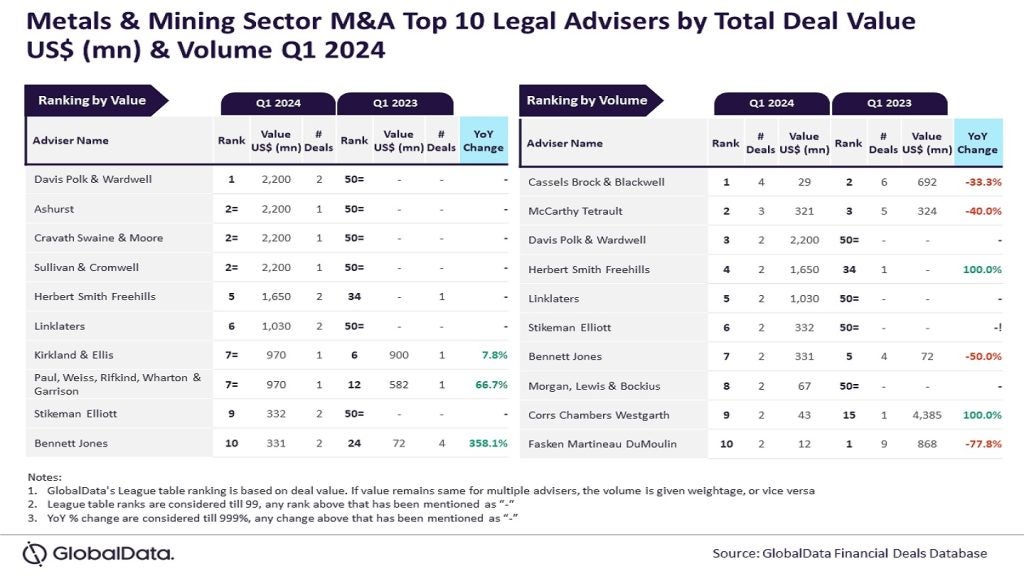

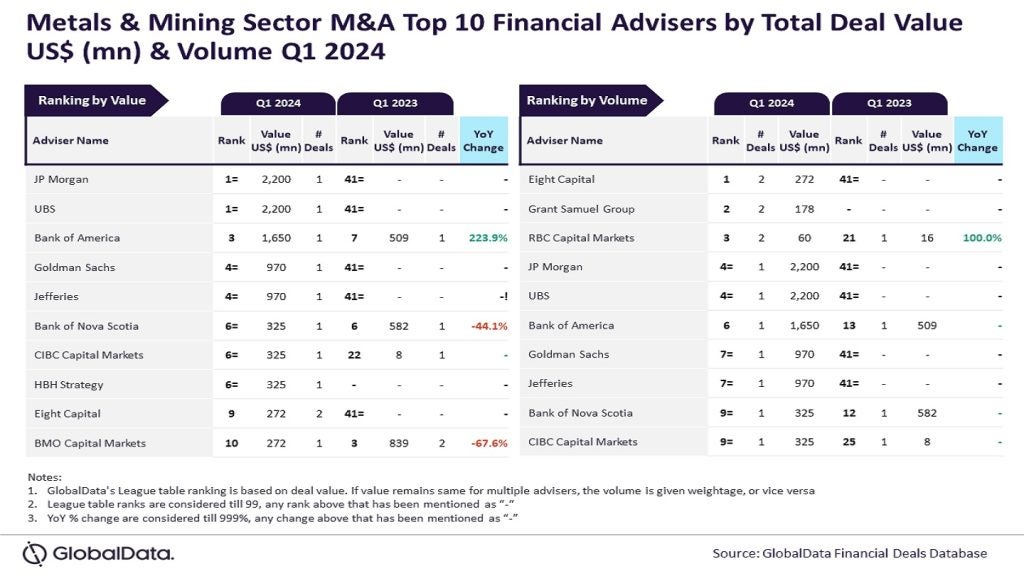

Hecla Mining has engaged CIBC World Markets and JPMorgan Chase & Co. as financial advisers for the transaction, while Cassels Brock & Blackwell and K&L Gates were engaged as legal advisers.

GMP Securities, Maxit Capital, and INFOR Financial Group are serving as financial advisers for Klondex, while Bennett Jones and Dorsey & Whitney are acting as legal advisers.

Alio Gold has agreed to acquire all the outstanding shares of Rye Patch Gold for C$128m ($97.68m) and form a combined company.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe shareholders of Alio Gold and Rye Patch will respectively hold 53% and 47% in the newly formed company.

Each common share of Rye Patch will be exchanged for 0.48 common shares of Alio Gold payable at C$1.57 ($1.19) a share, as part of the transaction.

Both the companies involved in the transaction are based in Canada and are engaged in gold mining.

Alio Gold has engaged RBC Capital Markets as financial adviser for the transaction, while Blake, Cassels and Graydon and Paul, Weiss, Rifkind, Wharton & Garrison were engaged as legal advisers.

Rye Patch Gold has engaged Capital West Partners as financial adviser, and Koffman Kalef and Dorsey & Whitney as legal advisers for the transaction.

Anaconda Mining plans to acquire all the issued and outstanding common shares of Maritime Resources for a consideration of 0.364 of a common share in exchange for each share of Maritime.

The acquirer company is engaged in gold mining, exploration and development, while the target company is engaged in mineral exploration and development and holds 100% of the Green Bay Property near Springdale, Newfoundland.

Both the companies involved in the transaction are based in Canada.

Anaconda has engaged PI Financial as financial adviser for the transaction, while Cassels Brock & Blackwell and Neal, Gerber & Eisenberg as legal advisers.

Norway-based company Natholmen has acquired Wega Mining from UK-based mining company Avocet Mining for $0.4m.

The target company is a gold exploration and development company based in Norway.

Avocet Mining has engaged Blytheweigh and J.P. Morgan Cazenove as the financial advisers for the transaction.