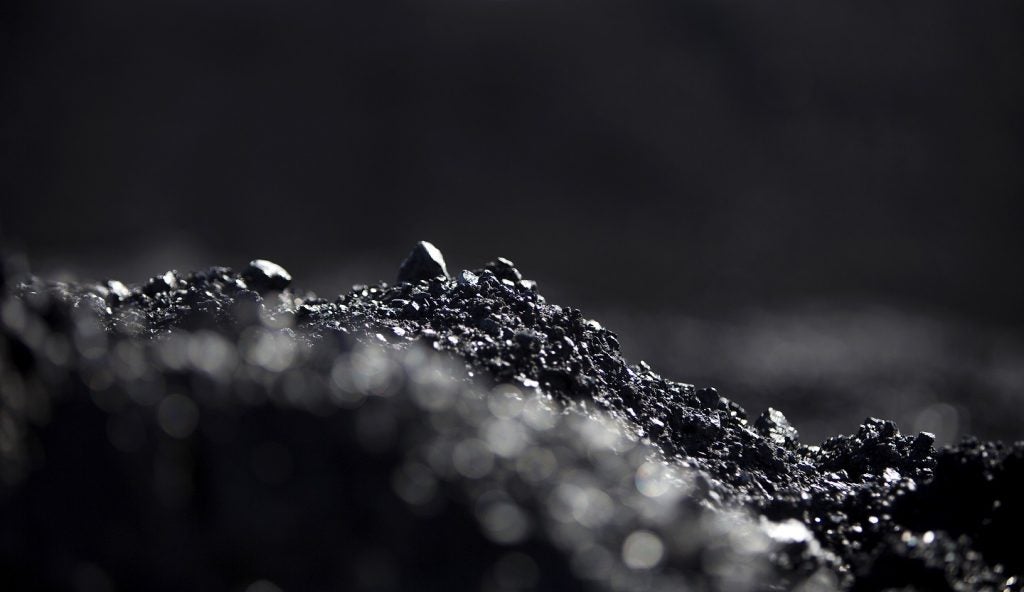

East Ayrshire is the graveyard of Scotland’s once thriving open cast coal mining industry. Within its borders are 22 open cast mines in need of restoration, each a casualty of the collapse of the country’s two largest mining operators. Last April, Scottish Coal, borne out of the privatisation of British Coal in 1997, was placed into liquidation by KPMG against a backdrop of falling prices and rising costs. Just one month later, ATH Resources succumbed to the same symptoms.

Since the passing of the two firms, there has been a partial resurrection. Hargreaves, a mining firm from south of the border in Durham, bought up a number of the assets from Scottish Coal, including mines in East Ayrshire, with the hope that the scale and diversity of its operations within the energy sector can provide a firmer footing for Scotland’s coal deposits.

But now, new life is on the cards with the firm seeking to break ground and establish a new mine on the Cauldhall moor in Midlothian.

The mine, from which Hargreaves proposes to extract ten million tonnes of coal over ten years, has been granted conditional consent by Midlothian Council on the common promise of up to 230 new full-time jobs and further stimulation of the local supply chain. The main condition of consent, and one of the prime objections of the locals fighting against it, lies within the financial package that is intended to ensure that irrespective of success, the mine site is restored as was.

See Also:

New Zealand coal mining company Solid Energy has developed a new method of using biosolids to rehabilitate old mining sites.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe importance of getting the bonds right is illustrated by the blighted landscapes of East Ayrshire and other areas that were hit when the two firms went under. As in those instances, the restoration arrangements were found to be spectacularly inadequate.

The potted history of inadequate restoration guarantees

In the aftermath of the collapse of Scottish Coal and ATH, East Ayrshire Council chief executive Fiona Lees announced that to fully restore the 22 mines would cost £161m but that restoration bonds amounted to just £28.6m. Councils in South Lanarkshire and Galloway also weighed in with shortfalls of £34m and £15m respectively.

While Lees had not been made aware of the potential for problems in restoration bonds, a report raising concerns had been made available to East Ayrshire Council. In 2006, Rod Smith, a consultant with decades of experience within the sector, had sent a copy of a paper he had written on the issue to all of the councils involved in open cast mines.

To Smith, who sent another copy of his paper directly to Lees after she made the announcement, the shortfall came as no surprise. "Anybody who was in any senior management position in the industry, who had anything to do with bonds and so on, knew full well that it wasn’t a question of whether they’d have enough, it was how big the deficit was going to be," Smith says. "It was just known that they were totally underinsured."

In his paper, Smith attributed the inadequacy of the bond arrangements to four factors, which were also featured in a report last year by Jim Mackinnon, former chief planning officer of the Scottish Government. The first was that the original plans for the mines were at best unreasonably optimistic and at worst downright unworkable, owing to their design being based more around getting planning permission than an actual work plan. The second failing, which also allowed the first to have greater impact, was a lack of effective monitoring of the operations to ensure they matched up with the agreed plan. Thirdly, that bond values were based too heavily on information supplied by the operator and finally, that these values were not routinely reviewed to ensure they were still adequate.

While legal action to try and hold the liquidators of Scottish Coal accountable for restoration costs is ongoing, the prospect of East Ayrshire accumulating the full £161m from those responsible for the mines, or those that have taken on their responsibilities, is slim to none. Therefore, it will likely fall on the communities around the mines to carry the environmental burden of unrestored mines, or the financial burden of making up the shortfall.

Geospatial data is the bedrock of mining, and geographic information systems (GIS) are making this data clearer and more detailed.

An unrivalled legacy of environmental dereliction

Upon publishing his report, Mackinnon concluded that the combined failings of the coal companies and the councils had left a legacy of "environmental dereliction which is probably unrivalled anywhere in Scotland". That legacy and those derelict mines fuel the Stop Caudhall Opencast campaign, whose supporters fear that history may repeat itself if Hargreaves is given consent to develop a mine on the moor.

Malcom Spaven, one of the campaign leaders, believes that were things to go wrong roughly half-way through the project, the chances of any bond negotiated between the council and Hargreaves would be slim. "If they had to pull out at that stage, the cost of restoring the site would be enormous," he ways.

"So in the course of negotiating the restoration scheme with council and finding a financial institution prepared to provide a bond, to fund that worst case the amount required could be in the region of £30-£35m. To put that in perspective, the highest bond amounts on any open cast mine in Scotland have typically been around £5m."

While the campaign has vowed to continue fighting the development, Hargreaves was granted conditional consent in November 2013 by Midlothian Council pending the agreement of a satisfactory restoration plan, community benefits package and employment guarantees for the local population.

Should these be agreed and Hargreaves succeed in extracting and selling the forecasted ten million tonnes of coal, alongside the continued health of its other business interests, then the restoration bond itself would be superfluous. But should the worst happen and Hargreaves, like Scottish Coal and ATH, go under, then the future of the Cauldhall Moor mine would depend entirely on how the costs calculated under the bond arrangements compare to reality.

Both Hargreaves and Midlothian Council have been clear that no development will take place unless both parties are satisfied that a secure and clear restoration plan is in place. But in order for it to work in practice, the council will have to ensure that the issues that dogged East Ayrshire – unrealistic work plans, lack of oversight, bonds based on developer information, and failure to routinely verify restoration bonds suitability – don’t rear their ugly heads once again.

.gif)