In recent months, the Carmichael project has seen some unexpected moves from both those for and against it, including a newly-passed bill banning ‘alarmist green groups’ from opposing proposals, and a naked protest selfie posted online by high profile Australian model Robyn Lawley, to highlight the harm the mine could do.

Aside of the potential environmental impacts, there have been other issues raised too – if somewhat less dramatically – including the economic viability of the project, not least because the very Asian markets for coal which this initiative intends to feed, are themselves showing signs of change. With construction scheduled to begin in 2015, and first coal anticipated in August 2017, despite both state and national government approval, the debate surrounding this project seems unlikely to be about to quieten down.

Massive project

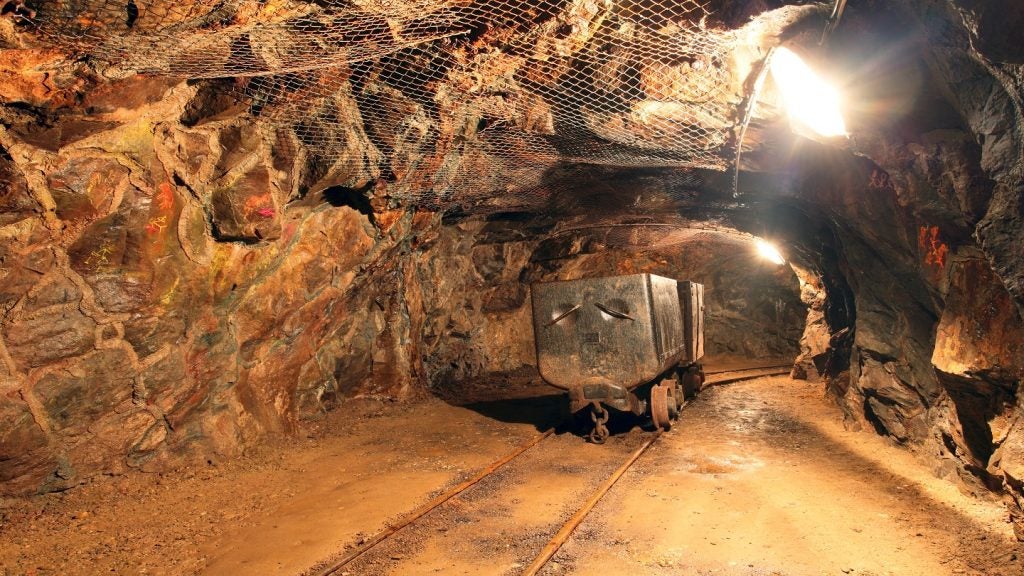

The proposal itself is as big as the storm it has provoked. As befits a A$16.5bn project that will result in the construction of the largest thermal coal mine in Australia – and one of the biggest in the world – everything about it is on a truly massive scale. Six open-cut and five underground pits, each with a peak production capacity of 10Mtpa, are planned to mine the estimated ten billion tonnes of JORC-compliant thermal coal resource beneath the 200 square-km site, along with associated storage and processing facilities and a fully equipped workers’ village.

An equally vast infrastructure programme is also planned to support the new mine project, encompassing nearly 400km of standard gauge rail track, with an operational capacity of up to 100 Mtpa and a major new export terminal at Abbot Point on the coast. Once completed, 4,000m trains of 220 wagons will carry around 23,500 tonnes of coal apiece from central Queensland to the sea.

See Also:

Economic promise

The project will feature a 60 million tonnes per annum (Mtpa) green field coal mine and a 189km railway line .

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe promised economic benefits are huge too. If it all goes according to plan, the finished mine’s annual production will be some six times greater than the next largest facility currently operating in the neighbouring Bowen Basin, run for at least twice as long, and boost the State’s coal output by more than 20%.

According to project sponsors Indian mining company Adani, over its planned 60 year lifespan, the combined mine, rail and port scheme will provide employment for over 10,000 – directly and indirectly – and generate some A$22bn in taxes and royalties in half that time. Moreover, since the Galilee Basin is effectively the last great undeveloped coal resource within the State, they say that the new infrastructure planned could help the entire area realise its potential as the largest producer in the region.

Environmental risk

The size of the project is unprecedented, but then, its opponents argue, so too are the environmental risks. There will be significant impacts, they say, to the terrestrial species and habitats at the mine site and along the rail corridor, to regional groundwater and to the marine environment around the port development, as well as the carbon consequences associated with burning so much coal.

According to Greenpeace Australia, preparing the site for the mine – which will itself be seven times the size of Sydney harbour – will rip up 20,000 hectares of native bushland and displace one of the largest known populations of endangered black throated finches. In addition, once completed, mining operations will draw an annual twelve billion litres of water from the region’s rivers and aquifers, dropping the water table even as far as 10km away from the mine by over a metre.

The planned terminal lies alongside the Caley Valley Wetlands, home to more than 40,000 water-birds and an important beach for nesting turtles. Three million cubic metres of seabed is to be dredged to construct it, and then, perhaps most controversially of all, dumped within the Great Barrier Reef Marine Park.

Growing opposition

For many, all of this environmental disturbance and damage, simply to achieve the eventual release of the equivalent of four times the fossil fuel emissions of New Zealand, is just too high a price to pay – no matter how great the economic promise.

The mood, it seems, is changing in Australia. There is growing local resistance to large-scale coal mines, coal seam gas projects and fracking, typified by the rise of organisations such as the Lock The Gate Alliance, a country-wide coalition of people united to protect local land, water and communities from what they see as unsafe or inappropriate fossil fuel projects.

It appears that the voice of these grass-roots groups is getting steadily louder.

Public outcry

When the Carmichael project gained its original consent at the end of July, it came with 36 environmental conditions attached – undoubtedly a nod to the strength of opposition the proposed development had provoked. However, while the threat to the Great Barrier Reef was considered during the approval process, it was not deemed to warrant specific conditions being imposed.

A huge public outcry and little more than a month later, the sea dumping plan was abandoned, as Campbell Newman, Queensland’s Premier, announced that alternative arrangements to dispose of the dredge spoil on land were being investigated. But despite much subsequent speculation in the media, details of the new scheme were not quick to emerge, and suggested timeframes for the revised application came and went.

Fast-forward to 25 September, and the Mackay Conservation Group successfully argued in Brisbane’s Federal Court for more time to mount a legal challenge to the dredging, extending their original end-of-October date to allow them to examine any alternative proposal that were forthcoming. Barely a week later, the government came under fire again, as reports began to emerge that the cost of the new dumping arrangements were not to be met by the project’s owners, but paid for with Australian tax dollars instead.

Senator Larissa Waters, environment spokesperson for the Australian Greens spoke for many when she branded the idea "an absolute disgrace."

Chinese commerce has publicly endorsed international supply chain due diligence recommendations for companies working abroad.

Dwindling demand

She also highlighted another issue which could have serious implications for the project, and others like it – the global demand for coal is dwindling.

India’s new prime minister is set on a course of significantly increasing renewable energy, and China aims to slash coal use to improve air quality, with consumption perhaps peaking as soon as 2016, according to Institute for Energy Economics and Financial Analysis (IEEFA) estimates. In addition, Beijing’s proposed anti-pollution measures seek to ban the burning of coal with an ash content higher than 16% in many of the country’s major cities, where most of the imported material is used; the raw ash content of Galilee basin coal is typically almost double that.

It inevitably leaves huge uncertainty hanging over the export market, and has led many, including Tim Buckley, IEEFA’s director of Energy Finance Studies, Australasia, to ask if the Carmichael project can possibly be commercially viable.

With rumours that Adani is now seeking to sell off the Abbots Point terminal, a legal challenge in the offing and Campbell Newman’s administration under formal investigation by the Australian Senate, it seems there will be more controversy to come before that question will finally be answered.

.gif)